Neiman Marcus 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

his employment agreement; (ii) Mr. Skinner’s (A) willful misconduct or (B) gross negligence, in each case that is materially injurious to the Company or any

of our affiliates; (iii) Mr. Skinner’s willful breach of his fiduciary duty or duty of loyalty to the Company or any of our affiliates; or (iv) Mr. Skinner’s

commission of any felony or other serious crime involving moral turpitude.

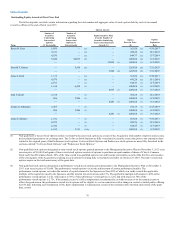

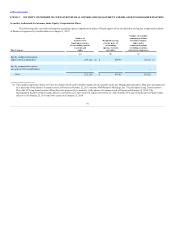

Option Agreement with Mr. Skinner

In connection with the Acquisition, Mr. Skinner was previously awarded 5,827 time-vested non-qualified stock options and 5,827 performance-

vested non-qualified stock options, in each case, pursuant to the Management Incentive Plan. All 5,827 performance-vested non-qualified stock options and

2,331 time-vested non-qualified stock options were cancelled by the Compensation Committee in connection with Mr. Skinner's move to Vice Chairman.

The remaining unvested 2,331 time-vested non-qualified stock options will vest on the earlier to occur of (i) February 1, 2016, subject to Mr. Skinner's

continued employment through such date and (ii) Mr. Skinner's termination of employment by us without "cause." If Mr. Skinner's employment terminates as

a result of his retirement, he will be able to exercise the vested portion of his time-vested non-qualified stock options for one year following such termination

of employment.

Confidentiality, Non-Competition and Termination Benefits Agreements

Messrs. Koryl and Schulman are each a party to a confidentiality, non-competition and termination benefits agreement that will provide for

severance benefits if the employment of the affected individual is terminated by the Company other than in the event of death, “total disability,” termination

for “cause” or the executive's resignation for “good reason.” These agreements provide for a severance payment equal to one and one-half annual base salary

payable over an eighteen-month period, and reimbursement for monthly COBRA premiums for the same period. Each confidentiality, non-competition and

termination benefits agreement contains restrictive covenants, including 18-month non-competition and non-solicitation covenants, as a condition to receipt

of any payments payable thereunder.

For purposes of Messrs. Koryl and Schulman’s confidentiality, non-competition and termination benefits agreements, ‘‘cause’’ is generally defined

as: (i) a breach of duty by the executive in the course of his employment involving fraud, acts of dishonesty, disloyalty, or moral turpitude; (ii) conduct that

is materially detrimental to the Company, monetarily or otherwise, or reflects unfavorably on the Company or the executive to such an extent that the

Company’s best interests reasonably require the termination of the executive’s employment; (iii) the executive’s violation of his obligations under the

agreement or at law; (iv) the executive’s failure to comply with or enforce Company policies concerning equal employment opportunity, including engaging

in sexually or otherwise harassing conduct; (v) the executive’s repeated insubordination or failure to comply with or enforce other personnel policies of the

Company or our affiliates; (vi) the executive’s failure to devote his full working time and best efforts to the performance of his responsibilities to the

Company or our affiliates; or (vii) the executive’s conviction of or entry of a plea agreement or consent decree or similar arrangement with respect to a felony,

other serious criminal offense, or any violation of federal or state securities laws.

For purposes of Messrs. Koryl and Schulman’s confidentiality, non-competition and termination benefits agreements, ‘‘good reason’’ is generally

defined as any of the following without the executive’s prior consent: (i) a material diminution in the executive’s base compensation; (ii) a material

diminution in the executive’s authority, duties, or responsibilities; (iii) a material diminution in the authority, duties, or responsibilities of the officer to

whom the executive is required to report; (iv) a material diminution in the budget over which the executive retains authority; (v) a material change in the

geographic location at which the executive must perform services; and (vi) any other action or inaction that constitutes a material breach by the Company of

the agreement.

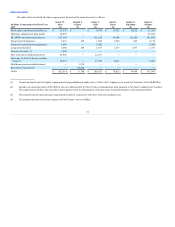

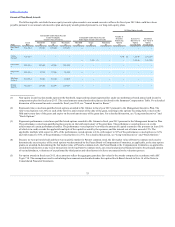

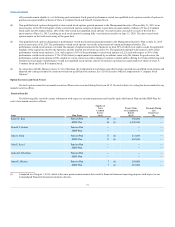

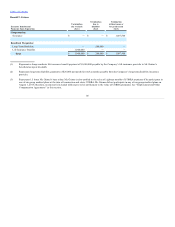

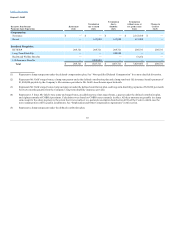

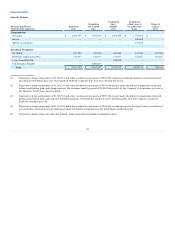

The tables below show certain potential payments that would have been made to the named executive officers if his or her employment had

terminated on August 1, 2015 under various scenarios, including a change of control. Because the payments to be made to a named executive officer depend

on several factors, the actual amounts to be paid out upon a named executive officer’s termination of employment can only be determined at the time of an

executive’s separation from us. See "Employment and Other Compensation Agreements" for a more detailed discussion of the restrictive covenants that are

conditions to the receipt of the severance payments.

84