Neiman Marcus 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

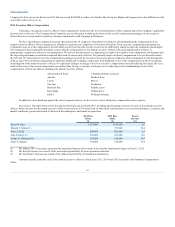

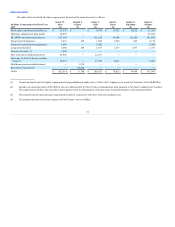

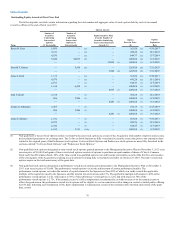

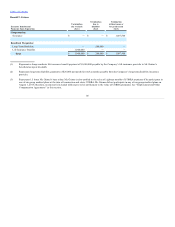

The following table sets forth certain information regarding the total number and aggregate value of stock options held by each of our named

executive officers at the end of fiscal year 2015.

Karen W. Katz

5,699

—

(1) —

363.08

(1) 9/30/2017

9,211

—

(1) —

450.26

(1) 10/1/2018

4,556

—

(1) —

644.37

(1) 11/7/2019

5,020

20,079

(2) —

1,000.00

(2) 11/5/2023

—

—

25,099

(3) 1,000.00

(3) 11/5/2023

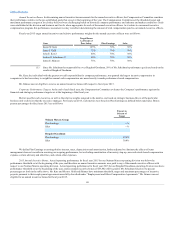

Donald T. Grimes

—

5,500

(4) —

1,205.00

(4) 7/21/2025

—

—

5,500

(5) 1,205.00

(5) 7/21/2025

James J. Gold

1,375

—

(1) —

363.08

(1) 9/30/2017

4,979

—

(1) —

450.26

(1) 10/1/2018

2,671

—

(1) —

644.37

(1) 11/7/2019

1,614

6,454

(2) —

1,000.00

(2) 11/5/2023

—

—

8,067

(3) 1,000.00

(3) 11/5/2023

John E. Koryl

5,164

—

(1) —

450.26

(1) 10/1/2018

896

3,586

(2) —

1,000.00

(2) 11/5/2023

—

—

4,483

(3) 1,000.00

(3) 11/5/2023

Joshua G. Schulman

3,407

—

(1)

576.59

(1) 5/25/2019

896

3,586

(2)

1,000.00

(2) 11/5/2023

—

—

4,483

(3) 1,000.00

(3) 11/5/2023

James E. Skinner

1,551

—

(1) —

363.08

(1) 9/30/2017

4,979

—

(1) —

450.26

(1) 10/1/2018

2,042

—

(1) —

644.37

(1) 11/7/2019

1,165

2,331

(2)(6) —

1,000.00

(2) 11/5/2023

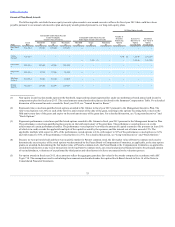

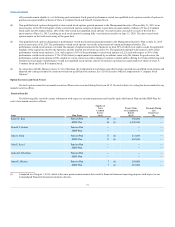

(1) Non‑qualified Co‑Invest Stock Options rolled over from Predecessor stock options as a result of the Acquisition with number of options and exercise

prices adjusted pursuant to an exchange ratio. The Co‑Invest Stock Options are fully vested and exercisable at any time prior to the expiration dates

related to the original grant of the Predecessor stock options. Co‑Invest Stock Options and Predecessor stock options are more fully described in the

sections entitled “Co‑Invest Stock Options” and “Predecessor Stock Options.”

(2) Non‑qualified stock options designated as time‑vested stock options granted pursuant to the Management Incentive Plan on November 5, 2013 at an

exercise price of $1,000. Each grant of time‑vested stock options consists of options to purchase an equal number of shares of Class A Common

Stock and Class B Common Stock. 20% of the time‑vested non‑qualified options vest and become exercisable on each of the first five anniversaries

of the closing date of the Acquisition, resulting in such options becoming fully vested and exercisable on October 25, 2018. The time‑vested stock

options expire on the tenth anniversary of the grant date.

(3) Non‑qualified stock options designated as performance‑vested stock options granted pursuant to the Management Incentive Plan on November 5,

2013 at an exercise price of $1,000. The performance‑vested options vest on the achievement of certain performance hurdles. The

performance‑vested options vest when the amount of capital returned to the Sponsors (at least 50% of which is in cash) exceeds the applicable

multiple of the capital invested by the Sponsors, and the internal rate of return exceeds 15%. The applicable multiple with respect to 40% of the

performance‑vested options is 2.0x, with respect to 30% of the performance‑vested options is 2.25x and with respect to 30% of the

performance‑vested options is 2.75x. If the named executive’s officer employment is terminated by us without cause or by the named executive

officer for good reason, the performance-vested stock options will be eligible to vest in connection with a change in control or initial public offering

for 180 days following such termination. If Ms. Katz's employment is terminated as a result of her retirement after the third anniversary of the grant

date, certain

76