Neiman Marcus 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

on October 6, 2005. From such date until the Acquisition (as defined below) by our Sponsors (as defined below), the Company was a subsidiary of Newton

Holding, LLC.

On October 25, 2013, the Company merged with and into Mariposa Merger Sub LLC (Mariposa) pursuant to an Agreement and Plan of Merger,

dated September 9, 2013, by and among Neiman Marcus Group, Inc. (f/k/a NM Mariposa Holdings, Inc.) (Parent), Mariposa and the Company, with the

Company surviving the merger (the Acquisition). As a result of the Acquisition and the Conversion (as defined below), the Company is now a direct

subsidiary of Mariposa Intermediate Holdings LLC (Holdings), which in turn is a direct subsidiary of Parent. Parent is owned by entities affiliated with Ares

Management, L.P. and Canada Pension Plan Investment Board (together, the Sponsors) and certain co-investors. On October 28, 2013, the Company and

NMG (as defined below) each converted from a Delaware corporation to a Delaware limited liability company (the Conversion).

The Company's operations are conducted through its direct wholly owned subsidiary, The Neiman Marcus Group LLC (NMG).

The accompanying Consolidated Financial Statements are presented as "Predecessor" or "Successor" to indicate whether they relate to the period

preceding the Acquisition or the period succeeding the Acquisition, respectively. The Acquisition and the allocation of the purchase price were recorded for

accounting purposes as of November 2, 2013, the end of our first quarter of fiscal year 2014. In connection with the Acquisition, the Company incurred

substantial new indebtedness, in part in replacement of former indebtedness. See Item 7, "Management's Discussion and Analysis of Financial Condition and

Results of Operations - Liquidity and Capital Resources." In addition, the purchase price paid in connection with the Acquisition was allocated to state the

acquired assets and liabilities at fair value. The purchase accounting adjustments increased the carrying value of our property and equipment and inventory,

revalued our intangible assets related to our tradenames, customer lists and favorable lease commitments and revalued our long-term benefit plan obligations,

among other things. As a result, the Successor financial statements subsequent to the Acquisition are not necessarily comparable to the Predecessor financial

statements.

Our fiscal year ends on the Saturday closest to July 31. Like many other retailers, we follow a 4-5-4 reporting calendar, which means that each fiscal

quarter consists of thirteen weeks divided into periods of four weeks, five weeks and four weeks. This resulted in an extra week in fiscal year 2013 (the 53rd

week). All references to (i) fiscal year 2015 relate to the fifty-two weeks ended August 1, 2015, (ii) fiscal year 2014 relate to the fifty-two weeks ended

August 2, 2014, comprised of the thirty-nine weeks ended August 2, 2014 (Successor) and the thirteen weeks ended November 2, 2013 (Predecessor), and (iii)

fiscal year 2013 relate to the fifty-three weeks ended August 3, 2013. References to fiscal year 2012 and years preceding and fiscal year 2016 and years

thereafter relate to our fiscal years for such periods. Certain amounts presented in tables are subject to rounding adjustments and, as a result, the totals in such

tables may not sum.

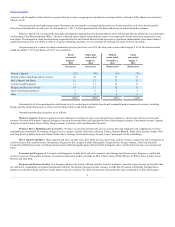

Our customers are educated, affluent and digitally connected. The average age of our customers is 51 and approximately 48% of our customers are

50 or younger. Approximately 79% of our customers are female, approximately 38% of our customers have an annual household income of over $200,000

and over 40% of our customers have a total household net worth greater than $1 million. Our customers are active on social media, and we engage them

through an active presence on Facebook, Twitter, Instagram and Pinterest, our primary social media platforms.

Our InCircle loyalty program is designed to cultivate long‑term relationships with our customers. This program includes marketing features, such as

private in‑store events, as well as the ability to accumulate points for qualifying purchases. Approximately 40% of our total revenues in fiscal year 2015 were

generated by our InCircle loyalty program members who achieved reward status. On a per customer basis, these customers spend approximately 10.5 times

more annually with us than our other customers.

We operate three primary luxury brands—Neiman Marcus, Bergdorf Goodman and MyTheresa—which offer the highest level of personalized,

concierge-style service to our customers and a distinctive selection of women’s and men’s apparel, handbags, shoes, cosmetics and precious and designer

jewelry from premier luxury and fashion designers to our loyal and affluent customers “anytime, anywhere, any device.” We also operate Last Call, an off-

price fashion brand catering to aspirational, price-sensitive yet fashion-minded customers, CUSP, a fashion brand catering to younger customers focused on

contemporary styles, and Horchow, a luxury home furnishings and accessories brand.

4