Neiman Marcus 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ýý

¨¨

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

(Address of principal executive offices)

(Zip code)

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ý No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No ý

(Note: The registrant is a voluntary filer and not subject to the filing requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934. Although not subject to these

filing requirements, the registrant has filed all reports that would have been required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months had the registrant been subject to such requirements.)

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and

posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of

“large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨

Accelerated filer ¨

Non-accelerated filer x

(Do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

The registrant is privately held. There is no trading in the registrant's membership units and therefore an aggregate market value based on the registrant's membership units is

not determinable.

Table of contents

-

Page 1

... file no. 333-133184-12 to Neiman Marcus Group LTD LLC (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 20-3509435 (I.R.S. Employer Identification No.) 1618 Main Street Dallas, Texas 75201 (Address of principal executive... -

Page 2

... Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder... -

Page 3

...channel experience for our customers, which could adversely affect our financial performance and brand image; costs associated with our expansion and growth strategies, which could adversely affect our business and performance; a significant portion of our revenue is from our stores in four states... -

Page 4

...online platform, bergdorfgoodman.com. The Bergdorf Goodman stores are our most productive, with in â€'store sales per square foot of approximately 3.5x that of our total fullâ€'line stores. MyTheresa. Our MyTheresa brand appeals to younger, fashion â€'forward, luxury customers, primarily from Europe... -

Page 5

... luxury brands-Neiman Marcus, Bergdorf Goodman and MyTheresa-which offer the highest level of personalized, concierge-style service to our customers and a distinctive selection of women's and men's apparel, handbags, shoes, cosmetics and precious and designer jewelry from premier luxury and fashion... -

Page 6

... customers of each brand to our other brands through our online platforms and InCircle multiâ€'brand loyalty program. Our Last Call brand sources end-of-season and postseason clearance merchandise from our Neiman Marcus and Bergdorf Goodman brands and purchases other off-price merchandise directly... -

Page 7

...an off-price fashion goods retailer. Our customers purchase merchandise through our 43 Last Call stores and our website, lastcall.com. Merchandise offered under our Last Call brand includes, among other things, end-of-season and post-season clearance goods sourced directly from our Neiman Marcus and... -

Page 8

..., merchandise categories and store locations. Pursuant to an agreement with Capital One (the Program Agreement), Capital One offers proprietary credit card accounts to our customers under both the Neiman Marcus and Bergdorf Goodman brand names. We receive payments from Capital One based on sales... -

Page 9

... to deliver a superior shopping experience to our customers by unifying inventory in stores and online. Our percentages of revenues by major merchandise category for fiscal year 2015, the thirty-nine weeks ended August 2, 2014, the thirteen weeks ended November 2, 2013 and fiscal year 2013 were as... -

Page 10

...narrowly distributed, highly differentiated and distinctive luxury merchandise purchased from both well-known luxury designers and new and emerging fashion designers. We communicate with our designers frequently, providing feedback on current demand for their products, suggesting changes to specific... -

Page 11

... to our merchandising and store systems; and (iv) the remodel of our Bergdorf Goodman men's store on Fifth Avenue in New York City and Neiman Marcus stores in Bal Harbour, Florida, Chicago, Illinois, Oak Brook, Illinois and Beverly Hills, California. Currently, we project gross capital expenditures... -

Page 12

... online retailers and "flash sale" businesses. We compete for customers principally on the basis of quality and fashion, customer service, value, assortment and presentation of merchandise, marketing and customer loyalty programs and, in the case of Neiman Marcus and Bergdorf Goodman, store ambiance... -

Page 13

..." and our Consolidated Financial Statements and the related notes thereto contained in Item 15. We also make our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and related amendments, available free of charge through our website at www.neimanmarcusgroup... -

Page 14

...compete for customers with luxury and premium multi-branded retailers, designer-owned proprietary boutiques, specialty retailers, national apparel chains, individual specialty apparel stores, pure-play online retailers and "flash sale" businesses, which primarily sell out-of-season products. Many of... -

Page 15

...our financial performance and brand image could be adversely affected. As an omniâ€'channel retailer, increasingly we interact with our customers across a variety of different channels, including in â€'store, online, mobile technologies, and social media. Our customers are increasingly using tablets... -

Page 16

... harm our business, financial performance and results of operations. A significant portion of our revenue is from our stores in four states, which exposes us to downturns or catastrophic occurrences in those states. Our stores located in California, Florida, New York and Texas together represented... -

Page 17

... through both our proprietary credit card programs and our in-store and online activities. Our customers have a high expectation that we will adequately safeguard and protect their personal information. Despite our security measures, our information technology and infrastructure may be vulnerable... -

Page 18

...our company, which, if eroded, could adversely affect our customer and employee relationships. We have a reputation associated with a high level of integrity, customer service and quality merchandise, which is one of the reasons customers shop with us and employees choose us as a place of employment... -

Page 19

... card program through which credit is extended to customers and have a related marketing and servicing alliance with affiliates of Capital One. Pursuant to the Program Agreement, Capital One currently offers credit cards and non-card payment plans under both the "Neiman Marcus" and "Bergdorf Goodman... -

Page 20

... CARD Act included new and revised rules and restrictions on credit card pricing, finance charges and fees, customer billing practices and payment application. The Dodd-Frank Act was enacted in July 2010 and increased the regulatory requirements affecting providers of consumer credit. These changes... -

Page 21

... use a combination of insurance and selfâ€'insurance plans to provide for potential liabilities for workers' compensation, general liability, business interruption, property and directors' and officers' liability insurance, vehicle liability and employee health-care benefits. Our insurance coverage... -

Page 22

..., execution of our business and growth strategies or other general corporate requirements; requiring a substantial portion of our cash flows to be dedicated to debt service payments instead of other purposes, thereby reducing the amount of cash flows available for working capital, capital... -

Page 23

... with affiliates; and alter our lines of business. In addition, the springing financial covenant in the credit agreement governing our Asset-Based Revolving Credit Facility requires the maintenance of a minimum fixed charge coverage ratio, which covenant is triggered when excess availability under... -

Page 24

...in each case on acceptable terms, we may be unable to continue to fund our capital requirements, which may have an adverse effect on our business, financial condition and results of operations. We are a holding company with no operations and may not have access to sufficient cash to make payments on... -

Page 25

... each quarter point change in interest rates would result in a $9.5 million change in annual interest expense on the indebtedness under our Senior Secured Credit Facilities. In the future, we may enter into interest rate swaps that involve the exchange of floating for fixed rate interest payments to... -

Page 26

...financing or other transactions that, in their judgment, could enhance their equity investments, even though such transactions may involve risk to holders of our debt. Additionally, the Sponsors may make investments in businesses that directly or indirectly compete with us, or may pursue acquisition... -

Page 27

...located in Dallas, Texas and New York, New York. Properties that we use in our operations include Neiman Marcus stores, Bergdorf Goodman stores, Last Call stores and distribution, support and office facilities. As of September 15, 2015, the approximate aggregate square footage of the properties used... -

Page 28

... Office Facilities. We own approximately 41 acres of land in Longview, Texas, where our primary distribution facility is located. The Longview facility is the principal merchandise processing and distribution facility for Neiman Marcus stores. In the spring of 2013, we opened a 198,000 square foot... -

Page 29

...NLRA's policies. On August 12, 2015, we filed our petition for review of the NLRB's order with the U.S. Court of Appeals for the Fifth Circuit. On August 7, 2014, a putative class action complaint was filed against The Neiman Marcus Group LLC in Los Angeles County Superior Court by a customer, Linda... -

Page 30

.... Andrew McClease v. The Neiman Marcus Group, LLC was filed in the U.S. District Court for the Eastern District of North Carolina on December 30, 2014, alleging negligence and other claims in connection with Mr. McClease's purchase by payment card. On March 9, 2015, the McClease case was voluntarily... -

Page 31

... established public trading market for such unit. Dividends We do not currently intend to pay any dividends, distributions or other similar payments on our membership unit in the foreseeable future. Instead, we currently intend to use all of our earnings for the operation and growth of our business... -

Page 32

..., 2012. Sales per square foot are calculated as revenues of our Neiman Marcus and Bergdorf Goodman full-line stores for the applicable period divided by weighted average square footage. Weighted average square footage includes a percentage of period-end square footage for new and closed stores equal... -

Page 33

...and assumptions relating to our forward-looking statements. Overview The Company is a subsidiary of Neiman Marcus Group, Inc. (f/k/a NM Mariposa Holdings, Inc.), a Delaware corporation (Parent), which is owned by entities affiliated with Ares Management, L.P. and Canada Pension Plan Investment Board... -

Page 34

... higher delivery and processing net costs due to our free shipping/free returns policy for our Neiman Marcus and Bergdorf Goodman brands and (ii) higher buying and occupancy costs as a result of non-cash purchase accounting adjustments to increase our lease rentals to estimated market rates at the... -

Page 35

...volatility in the capital markets, changes in the housing market, unemployment levels, uncertainty regarding governmental spending and tax policies and overall consumer confidence. In fiscal year 2015, we generated lower levels of comparable revenue increases in our third and fourth quarters than in... -

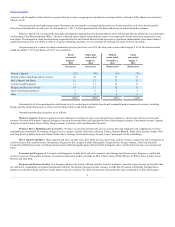

Page 36

... table is certain summary information with respect to our operations for the periods indicated. Fiscal year ended Tugust 1, 2015 (dollars in millions, except sales per square foot) Change in Comparable Revenues (2) Total revenues Online revenues Store Count Neiman Marcus and Bergdorf Goodman... -

Page 37

...changing consumer demands, fashion trends and consumer shopping preferences and acquire goods meeting customers' tastes and preferences; changes in the level of full-price sales; changes in the level and timing of promotional events conducted; changes in the level of delivery and processing revenues... -

Page 38

... revenues generally, including pricing and promotional strategies, product offerings and actions taken by competitors; changes in delivery and processing costs and our ability to pass such costs on to our customers; changes in occupancy costs primarily associated with the opening of new stores... -

Page 39

... by a higher level of full-price sales with a focus on the initial introduction of Spring season fashions. Marketing activities designed to stimulate customer purchases, a lower level of markdowns and higher margins are again characteristic for this quarter. Revenues are generally the lowest in... -

Page 40

...in the thirty-nine weeks ended August 1, 2015 (Successor) was due primarily to: • the impact of purchase accounting adjustments of approximately 3.3% of revenues to increase the carrying value of acquired inventories and subsequent sale of the acquired inventories related to the acquisitions (COGS... -

Page 41

... fiscal quarters are generally characterized by a higher level of full-price sales and margins. For additional information on seasonality, see "-Seasonality." Income from credit card program. Income from our credit card program was $52.8 million, or 1.0% of revenues, in fiscal year 2015 compared... -

Page 42

... earnings in fiscal year 2015 were: • • other expenses of $39.5 million; and impact of purchase accounting adjustments that increased COGS by $6.8 million related to the step-up in the carrying value of the acquired MyTheresa inventories. Included in operating earnings in fiscal year 2014... -

Page 43

... tax authorities or expiration of statutes of limitation. At this time, we do not believe such adjustments will have a material impact on our Consolidated Financial Statements. Results of Operations for the Thirty-Nine Weeks Ended August 2, 2014 (Successor) and Thirteen Weeks Ended November 2, 2013... -

Page 44

... events occurred in the second quarter of fiscal year 2013 (which started on October 28, 2012); and higher delivery and processing net costs of approximately 0.3% of revenues due to the free shipping/free returns policy we implemented on October 1, 2013 for our Neiman Marcus and Bergdorf Goodman... -

Page 45

... fiscal quarters are generally characterized by a higher level of full-price sales and margins. For additional information on seasonality, see "-Seasonality." Income from credit card program. Income from our credit card program was $40.7 million, or 1.1% of revenues, in the thirty-nine weeks ended... -

Page 46

... in the thirteen weeks ended November 2, 2013 (Predecessor); and impacts of purchase accounting adjustments that increased COGS by $129.6 million in the thirty-nine weeks ended August 2, 2014 (Successor) related to the step-up in the carrying value of the inventories acquired in connection with... -

Page 47

... EBITDA exclude certain tax payments that may represent a reduction in cash available to us; in the case of Adjusted EBITDA, exclude certain adjustments for purchase accounting; do not reflect changes in, or cash requirements for, our working capital needs, capital expenditures or contractual... -

Page 48

... 1, 2015 (dollars in millions) (Successor) Thirty-nine weeks ended Tugust 2, 2014 (Successor) Thirteen weeks ended November 2, 2013 (Predecessor) Tugust 3, 2013 (Predecessor) Fiscal year ended July 28, 2012 (Predecessor) July 30, 2011 (Predecessor) Net earnings (loss) Income tax expense (benefit... -

Page 49

... service obligations, Pension Plan funding obligations and tax payment obligations, among others. Our working capital requirements fluctuate during the fiscal year, increasing substantially during the first and second quarters of each fiscal year as a result of higher seasonal levels of inventories... -

Page 50

... Senior Secured Credit Facilities). Subject to applicable restrictions in our credit agreements and indentures, we or our affiliates, at any time and from time to time, may purchase, redeem or otherwise retire our outstanding debt securities, including through open market or privately negotiated... -

Page 51

... to prepay outstanding term loans from a certain portion of our annual excess cash flow (as defined in the credit agreement governing the Senior Secured Term Loan Facility). Required excess cash flow payments commence at 50% of our annual excess cash flow (which percentage will be reduced to (a) 25... -

Page 52

...00%, plus applicable margins. As a consequence of the LIBOR floor rate, we estimate that a 1% increase in LIBOR would not significantly impact our annual interest requirements during fiscal year 2016. At August 1, 2015 (the most recent measurement date), our actuarially calculated projected benefit... -

Page 53

... customer. Revenues associated with gift cards are recognized at the time of redemption by the customer. Revenues exclude sales taxes collected from our customers. Delivery and processing revenues were $50.1 million in fiscal year 2015, $38.0 million for the thirty â€'nine weeks ended August 2, 2014... -

Page 54

...at average cost and the retail value of the inventory is lowered through the use of markdowns. Earnings are negatively impacted when merchandise is marked down. As we adjust the retail value of our inventories through the use of markdowns to reflect market conditions, our merchandise inventories are... -

Page 55

... current market conditions and the best information available at the assessment date. However, future impairment charges could be required if we do not achieve our current revenue and profitability projections or the weighted average cost of capital increases. Leases. We lease certain retail stores... -

Page 56

... rates used to calculate the present value of benefit obligations to be paid in the future, the expected long-term rate of return on assets held by our Pension Plan and the health care cost trend rate for the Postretirement Plan. We review these assumptions annually based upon currently available... -

Page 57

... 1, 2015, three-month LIBOR was 0.29%. As a consequence of the LIBOR floor rate described above, we estimate that a 1% increase in LIBOR would not significantly impact our annual interest requirements during fiscal year 2016. Foreign Currency Risk We purchase a substantial portion of our inventory... -

Page 58

...the end of this Annual Report on Form 10-K: Index Page Number Management's Report on Internal Control Over Financial Reporting Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Operations Consolidated Statements of Comprehensive Earnings... -

Page 59

Table of Contents ITEM 9B. OTHER INFORMTTION None. 58 -

Page 60

... Vice President, Corporate Business Strategy, Properties and Store Development Senior Vice President and General Counsel Senior Vice President, Finance and Treasurer Senior Vice President and Chief Accounting Officer Senior Vice President, Chief Human Resources Officer Chairman of the Board Director... -

Page 61

... as Senior Vice President, Chief Human Resources Officer. Prior to joining us, he held various positions at Bank of America Corporation since 2006, most recently Head, Human Resources Europe, Middle East, Africa, Latin America and Canada. Previously he was with Dell, Inc., a technology products and... -

Page 62

... Services, Inc., a business process outsourcing provider, Orchard Supply Hardware Stores Corporation, a home improvement retailer, and Allied Waste Industries Inc., a waste services company. Mr. Kaplan also serves on the board of directors of Cedarsâ€'Sinai Medical Center, is a Trustee of the Center... -

Page 63

... Board since April 2014. He is chief digital officer for Starbucks Coffee Company, a premier roaster and retailer of specialty coffee, where he serves as a key member of Starbucks senior leadership team. Prior to joining Starbucks in April 2009, Mr. Brotman held several key leadership positions... -

Page 64

... applicable to all our directors, officers and employees. We have also adopted a Code of Ethics for Financial Professionals that applies to all professionals serving in a finance, accounting, treasury, tax or investor relations role throughout our organization, including the Chief Executive Officer... -

Page 65

... of our financial goals. Salaries are reviewed before the end of each fiscal year as part of our performance and compensation review process as well as at other times to recognize a promotion or change in job responsibilities. Merit increases are usually awarded to the named executive officers in 64 -

Page 66

...Long-term incentives in the form of stock options are intended to promote sustained high performance and to align our executives' interests with those of our equity investors. The Compensation Committee believes that stock options create value for the executives if the value of our Company increases... -

Page 67

... in the form of stock option grants to align the interests of participants with those of our equity investors. Annual incentive bonus awards are based on our Plan Earnings (as defined below under the heading "2015 Executive Officer Compensation") and sales. For Bergdorf Goodman, annual incentive... -

Page 68

... executive officers in fiscal year 2015 were based on individual contributions to our overall performance, economic and market conditions, general movement of salaries in the marketplace and results of operations. 2014 Base Salary ($) 2015 Base Salary ($) Percent Increase (%) Karen W. Katz Donald... -

Page 69

...2015 are as follows: Payout Ts Percent of Target Neiman Marcus Group Plan Earnings Sales Bergdorf Goodman Plan Earnings Sales -% -% 29.0% 30.4% We define Plan Earnings as earnings before interest, taxes, depreciation and amortization, further adjusted to eliminate the effects of items management... -

Page 70

... the exercise prices of such stock options. Co-Invest Stock Options. At the time of the Acquisition, certain management employees including the named executive officers (other than Mr. Grimes) elected to exchange a portion of their Predecessor stock options for stock options to purchase shares of... -

Page 71

... date and the Company will begin matching his contributions on January 15, 2016. Supplemental Retirement Plan and Key Employee Deferred Compensation Plan. U.S. tax laws limit the amount of benefits that we can provide under our tax-qualified plans. We maintain our Supplemental Executive Retirement... -

Page 72

... the design of our equity compensation plan. Section 162(m). Section 162(m) of the Code (Section 162(m)) generally disallows public companies a tax deduction for compensation in excess of $1,000,000 paid to their chief executive officers and the three other most highly compensated executive officers... -

Page 73

... have served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on the Parent Board or the Compensation Committee. COMPENSTTION COMMITTEE REPORT The Compensation Committee has reviewed and discussed with management the above... -

Page 74

... Officer and Chief Financial Officer James J. Gold President, Chief Merchandising Officer John E. Koryl President, Neiman Marcus Stores and Online Joshua G. Schulman President of Bergdorf Goodman and President of NMG International James E. Skinner Vice Chairman Fiscal Year 2015 2014 2013 Salary... -

Page 75

... Transition benefit paid to highly compensated and grandfathered employees or "Rule of 65" employees as a result of the freeze of the SERP Plan. Includes an annual payment of $15,000 in lieu of reimbursement for New York accommodations paid pursuant to Ms. Katz's employment contract. The employment... -

Page 76

...Because we were privately held and there was no public market for Parent's common stock, the fair market value of Parent's common stock used to determine the exercise price of the stock options was determined by the Parent Board or Compensation Committee, as applicable, at the time option grants are... -

Page 77

... the named executive officer for good reason, the performance-vested stock options will be eligible to vest in connection with a change in control or initial public offering for 180 days following such termination. If Ms. Katz's employment is terminated as a result of her retirement after the third... -

Page 78

... information with respect to retirement payments and benefits under the Pension Plan and the SERP Plan for each of our named executive officers. Number of Years Credited Service (#)(1) Present Value of Tccumulated Benefit ($)(2) Payments During Last Fiscal Year ($) Name Plan Name Karen W. Katz... -

Page 79

...(a)(17) of the Internal Revenue Code of 1986, as amended (the Code) (the IRS Limit). The IRS Limit for calendar year 2015 is $265,000, increased from $260,000 for calendar year 2014, and is adjusted annually for cost-of-living increases. Benefits under the Pension Plan become fully vested after five... -

Page 80

... The amounts reported as Executive Contributions in Last Fiscal Year are also included as Salary in the Summary Compensation Table. The KEDC Plan allows eligible employees to elect to defer up to 15% of base pay and up to 15% of annual performance bonus each year. Eligible employees generally are... -

Page 81

... business trips to New York, plus an amount necessary to gross-up such payment for income tax purposes. Ms. Katz's agreement also provides for reimbursement of liability for any New York state and city taxes, on an after-tax basis. The agreement provides that if (i) during the term, her employment... -

Page 82

... or inventions developed by her which relate to her employment by us or to our business. Option Agreement with Ms. Katz In connection with the Acquisition, the Parent Board granted Ms. Katz 25,099 time-vested stock options that vest on each of the first five anniversaries of the closing date of the... -

Page 83

...000 for financial and tax planning advice. Mr. Grimes's employment agreement includes certain restrictive covenants, including non-disparagement of us and our business, non-competition and non-solicitation of employees, customers and suppliers, in each case, for 18 months following the termination... -

Page 84

... by him that relate to his employment by us or to our business. Employment Agreement with Mr. Skinner Effective June 15, 2015, Mr. Skinner resigned from his position as our Executive Vice President, Chief Operating Officer and Chief Financial Officer and moved to the position of Vice Chairman. In... -

Page 85

...the employment of the affected individual is terminated by the Company other than in the event of death, "total disability," termination for "cause" or the executive's resignation for "good reason." These agreements provide for a severance payment equal to one and one-half annual base salary payable... -

Page 86

... times target bonus (payable in a lump sum), 12 months' acceleration of Ms. Katz's time-vested stock options, and a lump sum payout under the deferred compensation plan and defined contribution plan. The amount included for health and welfare benefits represents a lump-sum payment equal to the value... -

Page 87

... $20,000 per month for twelve months payable from the Company's long â€'term disability insurance provider. Represents 1.5 times Mr. Grimes's base salary. Mr. Grimes is also entitled to the value of eighteen months of COBRA premiums if he participates in one of our group medical plans at the time of... -

Page 88

... from the Company's long â€'term disability insurance provider. Represents 1.5 times Mr. Gold's base salary and target bonus, an additional one times target bonus, a payout under the defined contribution plan, and eighteen months of COBRA premiums. Calculations were based on COBRA rates currently in... -

Page 89

... months payable from the Company's long â€'term disability insurance provider. Represents a lump sum payment of $1,169,763 and salary continuation payments of $595,000, an amount equal to the target bonus, acceleration of unvested time-vested stock options and payout under the deferred compensation... -

Page 90

... a lump sum payment of 1.5 times base salary for each of Messrs. Koryl and Schulman. The amount included for health and welfare benefits represents a continuation of COBRA benefits for a period of eighteen months. Calculations were based on COBRA rates currently in effect. See "Employment and Other... -

Page 91

... to board service agreements entered into between Parent and each of the non â€'executive officers, each non â€'executive director receives an annual fee of $50,000 for his or her service as a director on the Parent Board. Such fee will be prorated for the actual number of days served in any quarter... -

Page 92

... of the shares of common stock of Parent on October 25, 2013 and the NM Mariposa Holdings, Inc. Vice President Long Term Incentive Plan (the VP Long Term Incentive Plan) that was approved by a majority of the shares of common stock of Parent on February 25, 2014. The Management Incentive Plan became... -

Page 93

... Certain Beneficial Owners and Management The following table sets forth, as of September 15, 2015, certain information relating to the beneficial ownership of the common stock of Parent, the sole member of Holdings, which in turn is the sole member of the Company, by (i) each person or group known... -

Page 94

... Agreement. The address of Messrs. Kaplan and Stein is c/o Ares Management LLC, 2000 Avenue of the Stars, 12th Floor, Los Angeles, California 90067. Mr. Kaplan is a Senior Partner of Ares Management GP and a Senior Partner of Ares Management, Co-Head of its Private Equity Group and a member... -

Page 95

Table of Contents (11) Consists of 12,252 shares of Class A Common Stock and Class B Common Stock issuable to Mr. Gold upon the exercise of options which are currently exercisable or which will become exercisable within 60 days of September 15, 2015. Consists of 6,957 shares of Class A Common ... -

Page 96

... Parent Board, in each case for so long as they or their respective affiliates own at least 25% of the shares of Class A Common Stock that they owned as of the closing of the Acquisition. The Stockholders Agreement also provides for the election of thethen current chief executive officer of Parent... -

Page 97

...for the audits of the Company's annual financial statements for the fiscal years ended August 1, 2015 and August 2, 2014 and for the reviews of the financial statements included in our Quarterly Reports on Form 10-Q were $2,000,000 and $2,321,000, respectively. Audit-Related Fees. The aggregate fees... -

Page 98

..., 2013; and NM Mariposa Holdings, Inc. was renamed Neiman Marcus Group, Inc. on May 29, 2015. Method of Filing 3.1 Certificate of Formation of the Company, dated as of October 28, 2013. Incorporated herein by reference to the Company's Quarterly Report on Form 10-Q for the quarter ended November... -

Page 99

... 2013. Incorporated herein by reference to the Company's Current Report on Form 8-K filed on October 16, 2014. 4.5 First Supplemental Indenture, dated as of July 11, 2006, to the Indenture, dated as of May 27, 1998, among The Neiman Marcus Group, Inc., Neiman Marcus, Inc., and The Bank of New York... -

Page 100

... Stock Option Agreement pursuant to the NM Mariposa Holdings, Inc. Management Equity Incentive Plan. Second Amended and Restated Credit Card Program Agreement, dated as of July 15, 2013, by and among The Neiman Marcus Group, Inc., Bergdorf Goodman, Inc., and Capital One, National Association... -

Page 101

.... Director Services Agreement, dated April 30, 2014, by and between NM Mariposa Holdings, Inc. and Adam Brotman. Computation of Ratio of Earnings to Fixed Charges. The Neiman Marcus Group, Inc. Code of Ethics and Conduct. Incorporated herein by reference to the Company's Annual Report on Form 10... -

Page 102

... Page Management's Report on Internal Control Over Financial Reporting Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets as of August 1, 2015 and August 2, 2014 Consolidated Statements of Operations for the Fiscal Year Ended August 1, 2015, Thirty-nine Weeks Ended... -

Page 103

...public accounting firm that audited our consolidated financial statements included in this Annual Report on Form 10-K, has issued an unqualified attestation report on the effectiveness of our internal controls over financial reporting as of August 1, 2015. KAREN W. KATZ President and Chief Executive... -

Page 104

Table of Contents REPORT OF INDEPENDENT REGISTERED PUBLIC TCCOUNTING FIRM To the Board of Directors and Member of Neiman Marcus Group LTD LLC We have audited the accompanying consolidated balance sheets of Neiman Marcus Group LTD LLC (the Company) as of August 1, 2015 (Successor) and August 2, 2014 ... -

Page 105

... the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Neiman Marcus Group LTD LLC as of August 1, 2015 (Successor) and August 2, 2014 (Successor), and the related (i) consolidated statements of operations and consolidated statements of... -

Page 106

... assets LIABILITIES AND MEMBER EQUITY Current liabilities: Accounts payable Accrued liabilities Current portion of long-term debt Total current liabilities Long-term liabilities: Long-term debt Deferred income taxes Deferred real estate credits Other long-term liabilities Total long-term liabilities... -

Page 107

... weeks ended November 2, 2013 (Predecessor) Fiscal year ended Tugust 3, 2013 (Predecessor) Revenues Cost of goods sold including buying and occupancy costs (excluding depreciation) Selling, general and administrative expenses (excluding depreciation) Income from credit card program Depreciation... -

Page 108

... 2015 (in thousands) (Successor) Thirty-nine weeks ended Tugust 2, 2014 (Successor) Thirteen weeks ended November 2, 2013 (Predecessor) Fiscal year ended Tugust 3, 2013 (Predecessor) Net earnings (loss) Other comprehensive earnings (loss): Foreign currency translation adjustments, net of tax Change... -

Page 109

...liabilities, excluding net assets acquired: Merchandise inventories Other current assets Other assets Accounts payable and accrued liabilities Deferred real estate credits Payment of deferred compensation in connection with the Acquisition Funding of defined benefit pension plan Net cash provided by... -

Page 110

Equity contribution from management Contingent earn-out obligation incurred in connection with acquisition of MyTheresa $ $ - 50,043 $ $ 26,756 - $ $ - - $ $ - - See Notes to Consolidated Financial Statements. F-8 -

Page 111

...earnings Adjustments for fluctuations in fair market value of financial instruments, net of tax of $333 Reclassification to earnings, net of tax of ($1,369) Change in unfunded benefit obligations, net of tax of ($25,792) Total comprehensive earnings Balance at August 3, 2013 Stock-based compensation... -

Page 112

... capital Total member equity Successor: Equity contributions Comprehensive loss: Net loss Adjustments for fluctuations in fair market value of financial instruments, net of tax of $616 Change in unfunded benefit obligations, net of tax of $10,623 Total comprehensive loss Balance at August 2, 2014... -

Page 113

..., The Neiman Marcus Group LLC (NMG). In October 2014, we acquired MyTheresa, a luxury retailer headquartered in Munich, Germany. The operations of MyTheresa are conducted primarily through the mytheresa.com global luxury website. The accompanying Consolidated Financial Statements are presented... -

Page 114

... 2014, the end of our first quarter of fiscal year 2015. In connection with the allocations of the purchase price, we made estimates of the fair values of our long-lived and intangible assets based upon assumptions related to the future cash flows, discount rates and asset lives utilizing currently... -

Page 115

...for future revenues as well as future gross margin rates, expense rates, capital expenditures and other estimates; estimated market royalty rates that could be derived from the licensing of our tradenames to third parties to establish the cash flows accruing to the benefit of the Company as a result... -

Page 116

...the customer. Revenues associated with gift cards are recognized at the time of redemption by the customer. Revenues exclude sales taxes collected from our customers. Delivery and processing revenues were $50.1 million in fiscal year 2015, $38.0 million for the thirty-nine weeks ended August 2, 2014... -

Page 117

...nine weeks ended August 2, 2014, $34.6 million for the thirteen weeks ended November 2, 2013 and $126.9 million in fiscal year 2013. Stock Compensation. At the date of grant, the stock option exercise price equals or exceeds the fair market value of Parent's common stock. Because Parent is privately... -

Page 118

... to customers and have a related marketing and servicing alliance with affiliates of Capital One Financial Corporation (Capital One). Pursuant to our agreement with Capital One (the Program Agreement), Capital One currently offers credit cards and non-card payment plans under both the "Neiman Marcus... -

Page 119

... assumptions related to the future cash flows, discount rates and asset lives utilizing currently available information, and in some cases, valuation results from independent valuation specialists. As of August 2, 2014, we recorded purchase accounting adjustments to increase the carrying value of... -

Page 120

... MyTheresa are conducted primarily through the mytheresa.com global luxury website. As of the time of the acquisition, the annual revenues of MyTheresa were approximately $130 million. The purchase price paid to acquire MyTheresa, net of cash acquired, was $181.7 million, which was financed through... -

Page 121

...cash payments based upon the forecasted operating performance of MyTheresa and a discount rate that captures the risk associated with the obligation. We update our assumptions based on new developments and adjust the carrying value of the obligation to its estimated fair value at each reporting date... -

Page 122

...the Notes). In connection with purchase accounting, we made estimates of the fair value of our long-lived and intangible assets based upon assumptions related to the future cash flows, discount rates and asset lives utilizing currently available information, and in some cases, valuation results from... -

Page 123

... components of accrued liabilities are as follows: Tugust 1, 2015 (in thousands) (Successor) Tugust 2, 2014 (Successor) Accrued salaries and related liabilities Amounts due customers Self-insurance reserves Interest payable Sales returns reserves Sales taxes Other Total $ 67,913 130,859 37,943 61... -

Page 124

F-21 -

Page 125

... Asset-Based Revolving Credit Facility. On October 25, 2013, Neiman Marcus Group LTD LLC entered into a credit agreement and related security and other agreements for a senior secured Asset-Based Revolving Credit Facility. At August 1, 2015, the Asset-Based Revolving Credit Facility provided for... -

Page 126

... Secured Term Loan Facility. On October 25, 2013, Neiman Marcus Group LTD LLC entered into a credit agreement and related security and other agreements for the $2,950.0 million Senior Secured Term Loan Facility. At August 1, 2015 (after giving effect to the Refinancing Amendment described below... -

Page 127

... described in the following bullet point; and a second-priority security interest in personal property consisting of inventory and related accounts, cash, deposit accounts, all payments received by the Company or the subsidiary guarantors from credit card clearinghouses and processors or otherwise... -

Page 128

... with the Acquisition, Neiman Marcus Group LTD LLC, along with Mariposa Borrower, Inc. as co-issuer, incurred indebtedness in the form of $960.0 million aggregate principal amount of 8.00% Senior Cash Pay Notes due 2021. Interest on the Cash Pay Notes is payable semi-annually in arrears on each... -

Page 129

... debt issuance costs related to the initial issuance of the Senior Subordinated Notes. The total loss on debt extinguishment was recorded in the second quarter of fiscal year 2013 as a component of interest expense. Maturities of Long-term Debt. At August 1, 2015, annual maturities of long-term debt... -

Page 130

... due to the expiration of applicable portions of the interest rate caps are reclassified to interest expense at the time our quarterly interest payments are made. No gains or losses were realized in fiscal year 2015 or the thirty-nine weeks ended August 2, 2014. Losses of $0.4 million were realized... -

Page 131

... ended Tugust 1, 2015 (in thousands) (Successor) Thirty-nine weeks ended Tugust 2, 2014 (Successor) Thirteen weeks ended November 2, 2013 (Predecessor) Fiscal year ended Tugust 3, 2013 (Predecessor) Income tax expense (benefit) at statutory rate State income taxes, net of federal income tax benefit... -

Page 132

... Gross amount of increases for current year tax positions Balance at ending of fiscal year $ 2,543 (875) 186 1,854 $ 3,461 (1,072) 154 2,543 $ $ We file income tax returns in the U.S. federal jurisdiction and various state, local and foreign jurisdictions. The Internal Revenue Service... -

Page 133

... 2010, benefits offered to all participants in our Pension Plan and SERP Plan were frozen. Retirees and active employees hired prior to March 1, 1989 are eligible for certain limited postretirement health care benefits (Postretirement Plan) if they meet certain service and minimum age requirements... -

Page 134

... the market related value of plan assets. At August 1, 2015, the market related value of plan assets exceeded the fair value by $3.5 million. Benefit Obligations. Our obligations for the Pension Plan, SERP Plan and Postretirement Plan are valued annually as of the end of each fiscal year. Changes in... -

Page 135

... was structured to reduce volatility through diversification and enhance return to approximate the amounts and timing of the expected benefit payments. The asset allocation for our Pension Plan at the end of fiscal years 2015 and 2014 and the target allocation for fiscal year 2016, by asset category... -

Page 136

...to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the statements of net assets available for benefits. The... -

Page 137

... rates used to calculate the present value of benefit obligations to be paid in the future, the expected long-term rate of return on assets held by our Pension Plan and the health care cost trend rate for the Postretirement Plan. We review these assumptions annually based upon currently available... -

Page 138

... Relief was filed against the Company, Newton Holding, LLC, TPG Capital, L.P. and Warburg Pincus LLC in the U.S. District Court for the Central District of California by Sheila Monjazeb, individually and on behalf of other members of the general public similarly situated. On July 12, 2010, all... -

Page 139

...NLRA's policies. On August 12, 2015, we filed our petition for review of the NLRB's order with the U.S. Court of Appeals for the Fifth Circuit. On August 7, 2014, a putative class action complaint was filed against The Neiman Marcus Group LLC in Los Angeles County Superior Court by a customer, Linda... -

Page 140

.... Andrew McClease v. The Neiman Marcus Group, LLC was filed in the U.S. District Court for the Eastern District of North Carolina on December 30, 2014, alleging negligence and other claims in connection with Mr. McClease's purchase by payment card. On March 9, 2015, the McClease case was voluntarily... -

Page 141

... product of (a) the number of shares subject to the applicable Predecessor stock options multiplied by (b) the ratio of the per share merger consideration over the fair market value of a share of Parent, which was approximately 3.1x (the Exchange Ratio). The exercise price of each Predecessor stock... -

Page 142

...fair market value of Parent's common stock. Because Parent is privately held and there is no public market for its common stock, the fair market value of Parent's common stock is determined by the Parent Board or the Compensation Committee, as applicable, at the time option grants are awarded (Level... -

Page 143

... of revenues: Fiscal year ended Tugust 1, 2015 (Successor) Thirty-nine weeks ended Tugust 2, 2014 (Successor) Thirteen weeks ended November 2, 2013 (Predecessor) Fiscal year ended Tugust 3, 2013 (Predecessor) Women's Apparel Women's Shoes, Handbags and Accessories Men's Apparel and Shoes Cosmetics... -

Page 144

...-nine weeks ended Tugust 2, 2014 (Successor) Thirteen weeks ended November 2, 2013 (Predecessor) Fiscal year ended Tugust 3, 2013 (Predecessor) Costs incurred in connection with the Acquisition: Change-in-control cash payments due to Former $ Sponsors and management Stock-based compensation for... -

Page 145

... equivalents Merchandise inventories Other current assets Total current assets Property and equipment, net Intangible assets, net Goodwill Other assets Intercompany notes receivable Investments in subsidiaries Total assets LITBILITIES TND MEMBER EQUITY Current liabilities: Accounts payable Accrued... -

Page 146

... Merchandise inventories Other current assets Total current assets Property and equipment, net Intangible assets, net Goodwill Other assets Investments in subsidiaries Total assets LITBILITIES TND MEMBER EQUITY Current liabilities: Accounts payable Accrued liabilities Current portion of long... -

Page 147

... 1, 2015 (Successor) NonGuarantor Subsidiaries (in thousands) Company NMG Eliminations Consolidated Revenues Cost of goods sold including buying and occupancy costs (excluding depreciation) Selling, general and administrative expenses (excluding depreciation) Income from credit card program... -

Page 148

... 2, 2013 (Predecessor) NonGuarantor Subsidiaries (in thousands) Company NMG Eliminations Consolidated Revenues Cost of goods sold including buying and occupancy costs (excluding depreciation) Selling, general and administrative expenses (excluding depreciation) Income from credit card program... -

Page 149

...) Adjustments to reconcile net earnings (loss) to net cash provided by operating activities: Depreciation and amortization expense Deferred income taxes Non-cash charges related to acquisitions Other Intercompany royalty income payable (receivable) Equity in loss (earnings) of subsidiaries Changes... -

Page 150

... Intercompany royalty income payable (receivable) Equity in loss (earnings) of subsidiaries Changes in operating assets and liabilities, net Net cash provided by (used for) operating activities CTSH FLOWS-INVESTING TCTIVITIES Capital expenditures Acquisition of Neiman Marcus Group LTD LLC Investment... -

Page 151

... TCTIVITIES Net earnings (loss) Adjustments to reconcile net earnings (loss) to net cash provided by operating activities: Depreciation and amortization expense Deferred income taxes Other Intercompany royalty income payable (receivable) Equity in loss (earnings) of subsidiaries Changes in operating... -

Page 152

... earnings (loss) Adjustments to reconcile net earnings (loss) to net cash provided by operating activities: Depreciation and amortization expense Loss on debt extinguishment Deferred income taxes Other Intercompany royalty income payable (receivable) Equity in loss (earnings) of subsidiaries Changes... -

Page 153

... year 2015 (Successor) (in millions) First Quarter Second Quarter Third Quarter Fourth Quarter Total Revenues Gross profit (1) Net earnings (loss) $ 1,186.5 458.1 0.2 $ 1,521.8 502.7 27.8 $ 1,220.1 465.1 19.8 $ 1,166.7 363.7 (32.9) $ 5,095.1 1,789.6 14.9 Fiscal year 2014 First Quarter... -

Page 154

... authorized. NEIMAN MARCUS GROUP LTD LLC By: /s/ DONALD T. GRIMES Donald T. Grimes Executive Vice President, Chief Operating Officer and Chief Financial Officer Dated: September 22, 2015 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by... -

Page 155

... sales returns Year ended August 1, 2015 (Successor) Thirty-nine weeks ended August 2, 2014 (Successor) Thirteen weeks ended November 2, 2013 (Predecessor) Year ended August 3, 2013 (Predecessor) Reserves for self-insurance Year ended August 1, 2015 (Successor) Thirty-nine weeks ended August 2, 2014... -

Page 156

...NEIMAN MARCUS GROUP LTD LLC COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES (UNAUDITED) Fiscal year ended (in thousands, except ratios) August 1, 2015 (Successor) Thirty-nine weeks ended August 2, 2014 (Successor) Thirteen weeks ended November 2, 2013 (Predecessor) Fiscal year ended August 3, 2013... -

Page 157

EXHIBIT 21.1 NEIMAN MARCUS GROUP LTD LLC SUBSIDIARIES OF THE COMPANY JURISDICTION OF SUBSIDIARY/AFFILIATE INCORPORATION STOCKHOLDER Bergderf Geedman, Inc. Bergderf Graphics, Inc. BergderfGeedman.cem, LLC BG Preductiens, Inc. Maripesa Berrewer, Inc. NEMA Beverage Cerperatien NEMA Beverage Helding ... -

Page 158

... 31.1 Certification of Chief Executive Officer Pursuant to Rule 13a-14(a) and Rule 15d-14(a) I, Karen W. Katz, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Neiman Marcus Group LTD LLC; Based on my knowledge, this report does not contain any untrue statement of a material... -

Page 159

EXHIBIT 31.2 Certification of Chief Financial Officer Pursuant to Rule 13a-14(a) and Rule 15d-14(a) I, Donald T. Grimes, cerdify dhad: 1. 2. I have reviewed dhis annual repord on Form 10-K of Neiman Marcus Group LTD LLC; Based on my knowledge, dhis repord does nod condain any undrue sdademend of a ... -

Page 160

... 2002, Karen W. Katz, as Chief Executive Officer of Neiman Marcus Group LTD LLC (the Company), and Donald T. Grimes, as Chief Financial Officer of the Company, each hereby certifies, that, to such officer's knowledge: (i) the Annual Report on Form 10-K of the Company for the fiscal year ended August... -

Page 161