Chrysler 2003 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

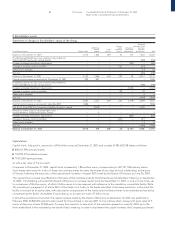

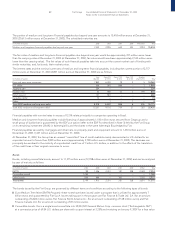

of 2,229 million U.S. dollars, equivalent to 1,765 million euros. The subscribers to the Exchangeable GM bond will have the right

to ask for early redemption of the bond in cash at its face value with payment on July 9, 2004. The investors may exercise this right

during the period which starts 30 business days prior to July 9, 2004 and ends 15 business days prior to July 9, 2004. With reference

to the risk, implicit in the bond, of an increase in the General Motors share price above 69.54 U.S. dollars, a Total Return Equity

Swap agreement was put into place as described in Note 14.

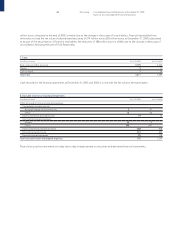

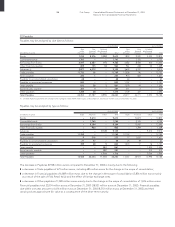

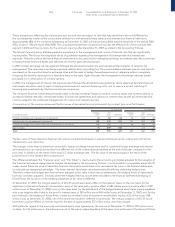

❚Other bonds: these refer to the following issues:

– Bonds issued by Fiat Finance & Trade Ltd. S.A. with coupon interest at 3.75% and maturing March 31, 2004 for an amount

of 1,000 million euros and an amount outstanding of 936 million euros.

– Bonds issued by Fiat Finance & Trade Ltd. S.A. with coupon interest at 1.5% and maturing June 27, 2005 for an amount

of 40 billion Japanese yen, equal to 296 million euros.

– Bonds issued by Case New Holland Inc. (“CNH Inc.”) with coupon interest at 9.25% and maturing August 1, 2011 for an amount

of 1,050 million U.S. dollars, equivalent to 831 million euros; the bond indenture contains a series of financial covenants that are

common in the American high yield bond market.

– Bonds issued by Case LLC. and Case Credit Corp. for a total amount outstanding of 624 million U.S. dollars, equivalent to 494

million euros.

The prospectuses, the offering circular or their abstracts relating to the aforementioned principal bond issues are available on the

Group’s website at www.fiatgroup.com under “Shareholders and Investors – Financial Publications”.

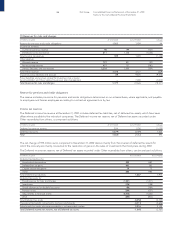

The majority of the bonds issued by the Group contain commitments (“covenant”) by the issuer and in some cases by Fiat, as the

guarantor, that, in international practice, are common for bond issues of this type when the issuers are in the same industrial segment

in which the Group operates, such as, in particular: (the so-called negative pledge clause which requires that the benefit of any real

present or future guarantees given as collateral on the assets of the issuer and/or Fiat, on other bonds and other credit instruments

should be extended to these bonds, to the same degree, (ii) the so-called pari passu clause, on the basis of which obligations cannot

be undertaken which are senior to the bonds issued, (iii) the obligation of providing periodical disclosure, (iv) for some of the bond

issues, the so-called cross-default clauses whereby the bonds become immediately due and payable when certain defaults arise in

respect of other financial instruments issued by the Group and (v) other clauses generally present in issues of this type.

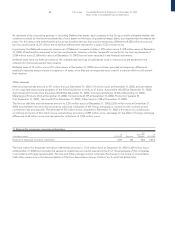

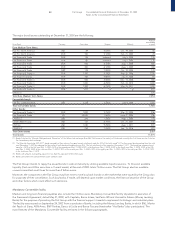

The bonds issued by Case New Holland Inc. (“CNH Inc.”) with coupon interest at 9.25% and maturing on August 1, 2011 for an

amount of 1,050 million U.S. dollars, equivalent to 831 million euros, contain, moreover, financial covenants common to the high yield

American bond market which place restrictions, among other things, on the possibility of the issuer and certain companies of the

CNH group to secure new debt, pay dividends or buy-back treasury stock, realize certain investments, conclude transactions with

associated companies, give collateral on its assets, conclude sale and leaseback transactions, sell certain fixed assets or merge with

other companies and financial covenants which impose a maximum limit on further indebtedness by the CNH group companies

which can not exceed a specific ratio of cash flows to dividend payments and financial expenses. Such covenants are subject to

various exceptions and limitations and, in particular, some of these would no longer be binding should the bonds be assigned

an investment grade rating by Standard & Poor’s Rating Services and/or Moody’s Investors Service.