Chrysler 2003 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

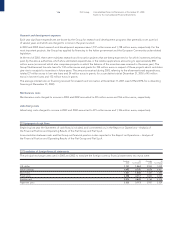

Personnel costs amount to 6,688 million euros in 2003, a decrease of 11.5% compared to 2002, mostly due to the effects of the

change in the scope of consolidation. On a comparable consolidation basis, the decrease would be 5%. Personnel costs are equal

to 14.1% of revenues (13.6% in 2002). Personnel costs as a percentage of revenues, on a comparable consolidation basis, would be

14.5% (14.3% in 2002).

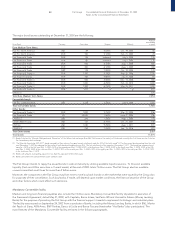

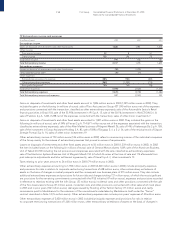

An analysis of the average number of employees by category is provided as follows:

2003 2002 2001

Companies Companies Companies Companies Companies Companies

consolidated consolidated consolidated consolidated consolidated consolidated

on a by the on a by the on a by the

line-by-line proportional line-by-line proportional line-by-line proportional

basis method Total basis method Total basis method Total

Average number of employees

Managers 2,948 – 2,948 3,483 2 3,485 3,500 39 3,539

White-collar 60,407 – 60,407 67,487 114 67,601 69,299 1,823 71,122

Blue-collar 110,887 – 110,887 118,999 320 119,319 135,945 3,566 139,511

Total 174,242 – 174,242 189,969 436 190,405 208,744 5,428 214,172

The average number of employees in 2003 is equal to 174,242, a decrease of 16,163 employees compared to 2002. That reduction

is partly due to employees who left the Group, also in connection with employee reduction plans, and partly to the change in the

scope of consolidation mainly as a result of the sale of FiatAvio S.p.A., the Toro Assicurazioni Group, the Fraikin activities and the

retail financing activities of the Automobile Sector.

In 2003, there are no companies accounted for using the proportional method owing to the accounting of Naveco by the equity

method (in 2002 this company was consolidated by the proportional method) and the deconsolidation of the companies held by

FiatAvio S.p.A.

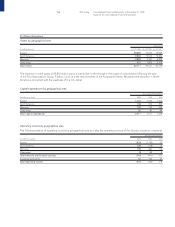

Provisions for risks

Provisions for risks of 1,163 million euros in 2003 (1,138 million euros in 2002) relate to the vehicle warranty reserve for 490 million

euros in 2003 (435 million euros in 2002), mainly in the Automotive Sectors, and to other reserves connected with industrial risks

for 673 million euros (703 million euros in 2002).

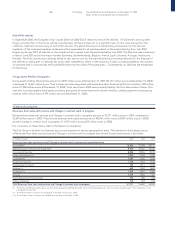

Other operating costs

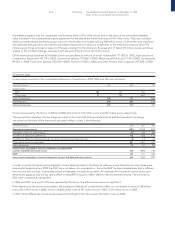

(in millions of euros) 2003 2002 2001

Losses on sale of fixed assets 47 86 137

Prior period expenses 226 297 198

Indirect and other taxes 147 229 260

Sundry expenses 608 692 714

Total Other operating costs 1,028 1,304 1,309

Insurance claims and other insurance costs

Insurance claims and other insurance costs amount to 1,367 million euros in 2003 (4,045 million euros in 2002). The decrease from

2002 is due to the sale of the Toro Assicurazioni Group.

17 Financial income and expenses

Investment income

(in millions of euros) 2003 2002 2001

Dividends 12 103 102

Tax credit on dividends 522 112

Gains on sale of investments held in current assets 531 50

Total Investment income 22 156 264