Chrysler 2003 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73 Fiat Group Consolidated Financial Statements at December 31, 2003

FORM AND CONTENT OF THE CONSOLIDATED FINANCIAL

STATEMENTS

The 2003 consolidated financial statements have been

prepared in accordance with the rules contained in Italian

Legislative Decree No. 127 dated April 9, 1991, which fulfilled

the Fourth and Seventh EC Directives. The significant events

which occurred after the end of the fiscal year described in the

Report of Operations are an integral part of the notes to the

consolidated financial statements.

The consolidated financial statements include the financial

statements of Fiat S.p.A., the Parent Company, and of all Italian

and foreign subsidiaries that constitute the Fiat Group (“Fiat”

or “The Group”), in which Fiat S.p.A. holds directly or indirectly

more than 50% of the voting capital and/or has de facto control

over operations. The companies in which the Parent Company

holds, directly or indirectly, control jointly with other partners,

are normally accounted for using the equity method. The same

is true for the associated companies in which the Group

exercises a significant influence.

Certain insignificant subsidiaries, including those acquired for

resale, which total less than 0.3% in 2003 (0.5% in 2002 and 0.6%

in 2001) of total consolidated revenues and for which it is not

practicable to obtain the necessary information on a timely

basis without disproportionate expense, have been excluded

from consolidation. This exclusion does not affect the assertion

that the consolidated financial statements are a true and fair

representation of the financial position and results of operations

of the Group. Furthermore, the subsidiary BUC – Banca Unione

di Credito, as allowed by law, has been excluded from the

scope of consolidation inasmuch as it has non-homogeneous

operations and is accounted for using the equity method.

The composition of the Fiat Group underwent several

significant changes in 2003 that are discussed in detail in

the following section “Major divestitures during the year”.

PRINCIPLES OF CONSOLIDATION AND SIGNIFICANT

ACCOUNTING POLICIES

The consolidated financial statements have been prepared

from the statutory financial statements of the Group’s single

companies or consolidated Sectors approved by the Boards

of Directors and adjusted, where necessary, by the directors

of the companies to conform with Group accounting principles

and to eliminate tax-driven adjustments. The Group’s accounting

principles respect the requirements set forth by Legislative

Decree No. 127 of April 9, 1991, interpreted and supplemented

by the Italian accounting principles issued by the National

Boards of Dottori Commercialisti and of Ragionieri and, where

there are none and not at variance, by those laid down by the

International Accounting Standards Board (I.A.S.B.).

As regards the transition to International Accounting Standards

“International Financial Reporting Standards IFRS” issued by

Notes to the Consolidated Financial Statements

at December 31, 2003

the I.A.S.B., reference should be made to the specific section

in the Report on Operations.

In order to obtain a true and fair representation of the financial

position and results of operations of the Group, taking into

account their functional integration, the financial companies

that provide services to the industrial Sectors and the insurance

companies have been consolidated on a line-by-line basis.

As a result, adjustments to the balance sheet and statement

of operations format have been made in applying Article 32

of Legislative Decree No. 127/91, which provides for changes to

be made to obtain a more clear, true and correct representation

of the financial position and results of operations.

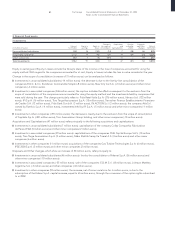

Principles of consolidation

Assets and liabilities, and revenues and expenses, of

subsidiaries consolidated on a line-by-line basis are included

in the consolidated financial statements, regardless of the

percentage of ownership. Carrying values of investments are

eliminated against the subsidiaries’ related stockholders’ equity.

The portion of stockholders’ equity and results of operations

attributed to minority interests are disclosed separately. When

losses pertaining to minority interests exceed the value of their

share of the relevant capital stock, the excess, or deficit, is

charged to the Group, unless the minority stockholders are

expressly committed to reimbursing the losses, in which case

the excess is recorded as an asset in the consolidated financial

statements. If no such commitment is in place, should income

be realized in the future, the minority interests’ share of that

income will be attributed to the Group, up to the amount

necessary to recover the losses previously attributed to the

Group.

Differences arising from the elimination of investments

(since 1994) against the related stockholders’ equity of

the investment at the date of acquisition are allocated to the

assets and liabilities of the company being consolidated, up

to the limit of their current value. The residual value, if positive,

is capitalized as an asset, “Differences on consolidation”,

and is amortized on the straight-line basis over the estimated

period of recoverability. Negative residual amounts are recorded

as a component of stockholders’ equity, “Consolidation reserve”

(or as a liability, “Consolidation reserve for future risks and

charges”, when due to a forecast of unfavorable economic

results).

Intercompany profits and losses are eliminated net of related

tax effects, together with all intercompany receivables, payables,

revenues and expenses arising on transactions within the Group.

Exceptions are the gross margins on intercompany sales of plant

and equipment produced and sold at prices in line with market

conditions, in which case such eliminations would be effectively

irrelevant and not cost-beneficial.

Also subject to elimination are guarantees, commitments and

risks relating to companies included in the scope of

consolidation.