Chrysler 2003 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

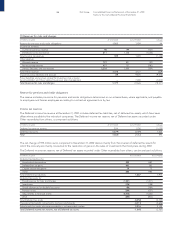

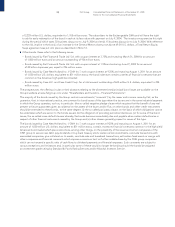

10 Reserves for risks and charges

(in millions of euros) At 12/31/2003 At 12/31/2002 Change

Reserve for pensions and similar obligations 1,503 1,459 44

Income tax reserves:

Current income tax reserve 98 199 (101)

Deferred income tax reserve 211 1,236 (1,025)

Total Income tax reserves 309 1,435 (1,126)

Other reserves:

Warranty reserve 791 841 (50)

Restructuring reserves 471 731 (260)

Various liabilities and risk reserves 2,216 2,555 (339)

Total Other reserves 3,478 4,127 (649)

Insurance policy liabilities and accruals 89 9,605 (9,516)

Policy liabilities and accruals where the investment risk is borne

by policyholders and those related to pension plan management –7,000 (7,000)

Total Reserves for risks and charges 5,379 23,626 (18,247)

Reserve for pensions and similar obligations

The reserve includes provisions for pensions and similar obligations determined on an actuarial basis, where applicable, and payable

to employees and former employees according to contractual agreements or by law.

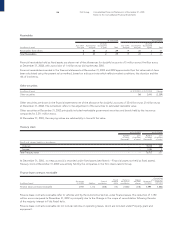

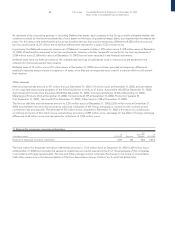

Income tax reserves

The Deferred income tax reserve at December 31, 2003 includes deferred tax liabilities, net of deferred tax assets, which have been

offset where possible by the individual companies. The Deferred income tax reserve, net of Deferred tax assets recorded under

Other receivables from others, is composed as follows:

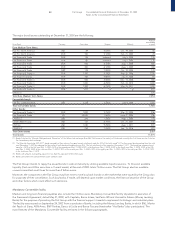

(in millions of euros) At 12/31/2003 At 12/31/2002 Change

Deferred income tax reserve 211 1,236 (1,025)

Deferred tax assets (1,879) (3,499) 1,620

Total (1,668) (2,263) 595

The net change of 595 million euros compared to December 31, 2002 derives mainly from the reversal of deferred tax assets for

which the recovery was mainly connected to the realization of gains on the sales of investments that took place during 2003.

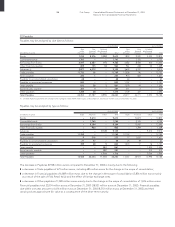

The Deferred income tax reserve, net of Deferred tax assets recorded under Other receivables from others, can be analyzed as follows:

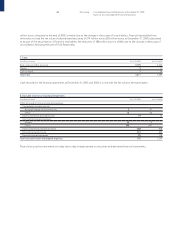

(in millions of euros) At 12/31/2003 At 12/31/2002

Deferred tax liabilities for:

Accelerated depreciation 492 682

Deferred tax on gains 493 382

Capital investment grants 18 13

Other 684 896

Total Deferred tax liabilities 1,687 1,973

Deferred tax assets for:

Taxed reserves for risks and charges (1,021) (1,301)

Inventories (126) (158)

Taxed allowances for doubtful accounts (86) (189)

Pension funds (289) (221)

Adjustments to financial assets (2,056) (1,062)

Other (680) (804)

Total Deferred tax assets (4,258) (3,735)

Theoretical tax benefit connected to tax loss carryforwards (4,313) (3,646)

Adjustments for assets whose recoverability is not reasonably certain 5,216 3,145

Total Deferred income tax reserve, net of Deferred tax assets (1,668) (2,263)