Chrysler 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

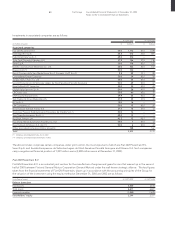

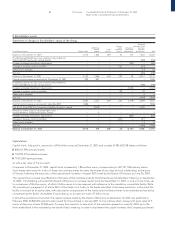

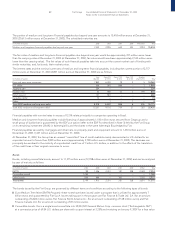

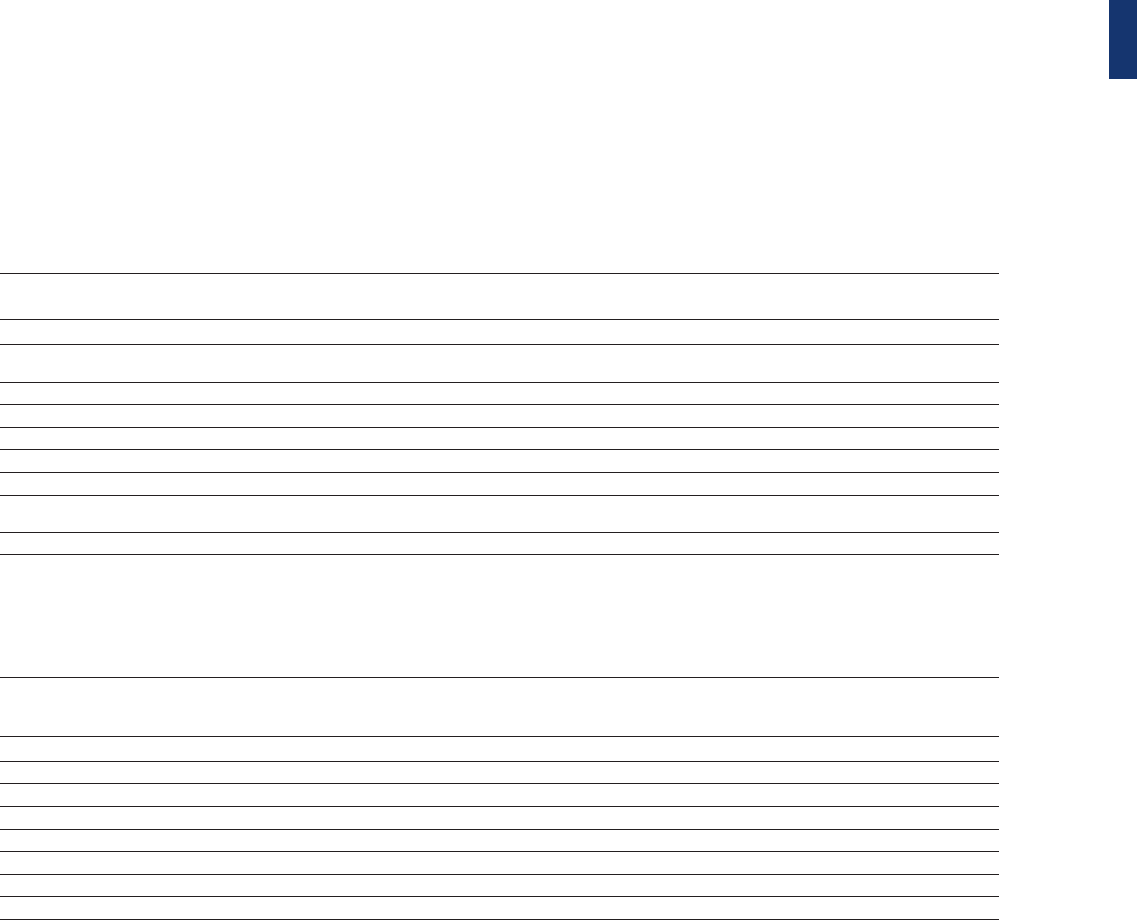

Reconciliation to Stockholders’ equity and Net loss of the Parent company Fiat S.p.A.

Stockholders’ Net Stockholders’ Net

equity at Result equity at Result

(in millions of euros) 12/31/2003 2003 12/31/2002 2002

Statutory financial statements of Fiat S.p.A. 5,415 (2,359) 5,934 (2,053)

Elimination of the carrying values of consolidated investments and the related

dividend income recorded in the statutory financial statements of Fiat S.p.A. (7,143)(254) (7,909) (175)

Elimination of writedowns against consolidated investments recorded by Fiat S.p.A. – 2,371 – 2,844

Equity and results of operations of consolidated companies 8,598 (1,634) 9,799 (4,704)

Consolidation adjustments:

Elimination of intra-Group dividends –(92) – (836)

Elimination of intra-Group profit and losses from sales of investments –25 – 766

Elimination of intra-Group profit and losses in inventories,

investments, property, plant and equipment and other adjustments (77)43 (183) 210

Consolidated financial statements 6,793 (1,900) 7,641 (3,948)

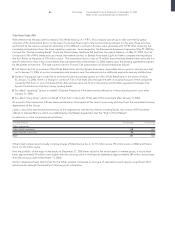

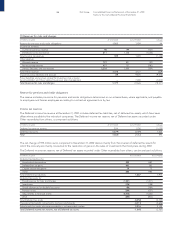

Minority interest

The minority interest in stockholders’ equity of 701 million euros (1,038 million euros at December 31, 2002) refers mainly to the

following companies consolidated on a line-by-line basis:

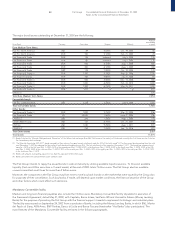

At 12/31/2003 At 12/31/2002

(% held by (% held by

minority minority

stockholders) stockholders)

Italian companies:

Ferrari S.p.A. 44.0 44.0

Teksid S.p.A. 19.5 33.5

IPI S.p.A. –34.1

Foreign companies:

Fiat Auto Holdings B.V. 10.0 20.0

Iveco Ford Truck Ltd. –15.2

CNH Global N.V. 14.9 14.7

The reduction in the minority interest percentage ownership in Fiat Auto Holdings B.V. is due to the recapitalization of 5 billion euros

resolved by the Stockholders’ Meeting of Fiat Auto Holdings B.V. held April 23, 2003 and subscribed to by Fiat Partecipazioni S.p.A.

(the direct parent company of Fiat Auto Holdings B.V.) for 3 billion euros, whereas General Motors has not as yet subscribed to its

share of the capital increase, as described in Note 14.

In accordance with the accounting policies described previously, the losses pertaining to General Motors, the minority stockholder

in Fiat Auto Holding B.V. (Automobile Sector), were allocated to General Motors up to the value of its share of capital stock, and the

excess, or deficit, that arose starting from the third quarter of 2002, was charged to the Group (204 million euros in 2003 and 296

million euros in 2002).