Chrysler 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

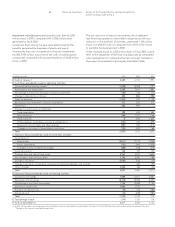

36 Report on Operations Process of Transition to International Accounting

Standards (IAS/IFRS)

instruments will derive from that classification and, accordingly,

in certain cases could be substantially different from the

present basis.

In accordance with these standards, derivative financial

instruments are also financial assets and liabilities which must

be recorded in the balance sheet, in contrast to that set forth

by Italian accounting principles, which provide that they should

be recorded in the memorandum accounts, except in certain

circumstances in which they should be recorded in the balance

sheet.

The overall effect of the adoption of these standards could

vary depending on the way in which they are introduced into

European law and the likelihood of additional changes being

made by the IASB. However, at present it is expected that

potentially significant effects on gross indebtedness may derive

from the different accounting treatment of receivables and bills

discounting transactions, in particular those with recourse and

securitization.

Employee benefits

IAS 19 sets out the method of accounting for employee benefits

and, accordingly, the Group dedicated a specific working group

to the analysis of labor legislation, in Italy and abroad, in order

to identify any differences with current principles. In particular,

with regard to post-employment defined benefit programs,

IAS 19 requires that the obligation accrued to the balance

sheet date be projected into the future, in order to estimate

the amount to be paid upon termination of employment,

and subsequently the present value should be determined

in accordance with a specific actuarial method (“Project Unit

Credit Method”). As a consequence of the adoption of the

above-mentioned accounting standard, the employee severance

indemnity (TFR) recorded in the financial statements of Italian

subsidiaries must be recalculated.

Reserves for risks and charges

In accordance with IAS 37, reserves for risks and charges are

only recorded when there is a present obligation, as a result

of a past event, which may be legal, contractual or derive from

the company’s declarations or actions which result in valid

expectations by the parties involved (constructive obligations).

Certain reserves which are at present recorded, in accordance

with the Italian laws in force, may not satisfy all of the conditions

provided by IAS for their recognition. Furthermore, in accordance

with IAS 37 accruals are recorded at the value represented by

the best estimate of the amount that the company would pay

to settle the obligation and, where the effect of the time value

of money is material, the estimated cost should be discounted

to present value, a technique not contemplated by current

Italian laws.

Consolidated financial statements

In the first financial statements prepared in accordance with

IAS/IFRS, at the transition date, the principles of consolidation

set forth in IAS 27 will be applied. These principles differ from

those presently set forth by Italian law particularly in respect of

the consolidation of subsidiaries that carry out dissimilar activities.