Chrysler 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

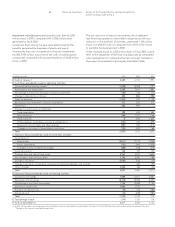

24 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A

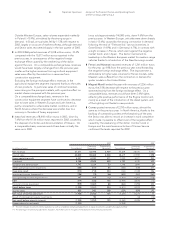

negative balance resulting from disposals. The figure for 2003

is broken down as follows:

❚Balance of net gains/losses on disposals, totaling a positive

1,747 million euros, composed primarily of the gains from

the disposals of FiatAvio S.p.A. (1,258 million euros net of

transaction costs), the Toro Assicurazioni Group (390 million

euros net of transaction costs), the retail financing activities

of Fiat Auto in Brazil (103 million euros), and the company

IPI (15 million euros). The principal loss is represented by

that incurred upon disposal of Fraikin (-24 million euros),

in addition to the loss of 210 million euros that had been

booked at the end of 2002.

❚Restructuring expenses of 658 million euros; these expenses

are represented by the costs incurred or determined

according to plans for personnel laid off with long-term

unemployment benefits, severance incentives, and writedown

of property, plant and equipment and intangible fixed assets

according to the Relaunch Plan presented at the end of June

2003. Restructuring expenses include expenses and provisions

that refer mainly to Fiat Auto (259 million euros), CNH (142

million euros), Comau (98 million euros) and Magneti Marelli

(50 million euros).

❚A total of -215 million euros in other extraordinary writedowns

of activities, stemming from evolution in the market outlook

of certain businesses, particularly in regard to the depreciation

of property, plant, and equipment at Fiat Auto.

❚A total of -501 million euros in extraordinary provisions to

reserves for future risks and charges, other expenses and

prior period expenses, net of other non-operating income

and prior period income. These include expenses and

provisions connected to the contract for the sale of the

Electronic Systems activities of Magneti Marelli which was

carried out in the past fiscal year, damages stemming from

the flood at the Termoli plant, and residual commitments

connected to investments in the telecommunications field.

❚Prior-period tax liabilities of 26 million euros.

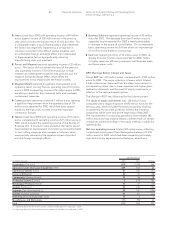

In 2002, the balance of non-operating income and expenses

included restructuring expenses mainly stemming from the

industrial restructuring plan of Fiat Auto and its effects on other

Group Sectors; writedowns of assets carried out on the basis of

changed market outlooks and consequent new business plans,

and extraordinary provisions to reserves for future risks and

charges. Furthermore, certain disposals had caused losses,

such as the sale of the investment in General Motors at market

prices, disposals of the Teksid Aluminum Business Unit, the

Electronic Systems Business Unit of Magneti Marelli, and

adjustment of the book value of the Iveco Fraikin Business

at its presumable disposal value. These losses were partially

offset by the gains stemming mainly from the sales of 34%

of Ferrari, 14% of Italenergia Bis, the AfterMarket activity

of Magneti Marelli, and the investment in Europ Assistance.

Result for the Fiscal Year

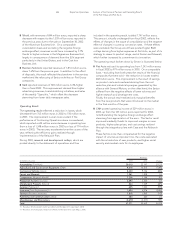

The Group’s loss before taxes was 1,298 million euros,

compared with a loss of 4,817 million euros in fiscal 2002;

this result reflected the previously mentioned net improvement

in EBIT.

Net financial expenses totaled 979 million euros in

2003, compared with 862 million euros in 2002. When

the performance of continuing operations alone is considered,

the balance of net financial expenses in 2003 showed an

improvement of 27 million euros with respect to the same

period in 2002. This is mainly attributable to the lower average

indebtedness for the period and reduction in the level of

interest rates in Europe and the United States, which were

partially offset by the greater impact in 2003 of foreign

exchange losses and an increase in bank commissions.

Fiscal 2002 was also favorably influenced by the positive

effects stemming from hedging of interest rate risks.

Net income taxes for the year totaled 650 million euros,

compared with a credit of 554 million euros in 2002. The

income taxes due for fiscal 2003 include: 125 million euros

(141 million euros in 2002) for IRAP, the regional tax on

production activities in Italy; 31 million euros (192 million euros

in 2002) for other current taxes; and deferred tax liabilities of

494 million euros (887 million euros in deferred tax assets in

2002). The income taxes for 2003 include utilization of tax

prepayments previously set aside in view of the realization of

capital gains on the disposal of the Toro Assicurazioni Group

and FiatAvio S.p.A., which were subsequently realized.

The consolidated net loss before minority interest was 1,948

million euros, down sharply from the loss of 4,263 million euros

in 2002.

The Group’s interest in net loss was 1,900 million euros,

compared with a loss of 3,948 million euros in fiscal 2002.

As a result of the Group’s interest in net loss, there was a

net loss per share of 2.412 euros, compared with a net loss

per share of 6.66 euros in 2002.