Chrysler 2003 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

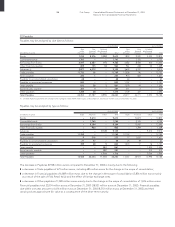

9 Stockholders’ equity

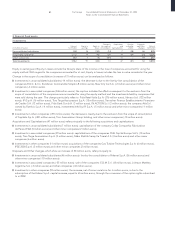

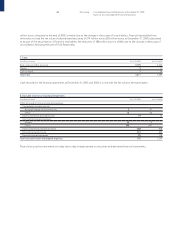

Statement of changes in Stockholders’ equity of the Group

Retained

Treasury earnings, Other

Additional stock Cumulative reserves,

paid-in Legal valuation translation Net loss

(in millions of euros) Capital stock capital reserve reserve adjustments for the year Total

Balance at December 31, 2000 2,753 1,636 659 50 370 7,852 13,320

Dividends paid (0.620 euros per ordinary and preference

share and 0.775 euros per savings share) –––––(352) (352)

Foreign exchange translation adjustments ––––(342) – (342)

Change in treasury stock in portfolio – – – 232 – (232) –

Other minor changes –––––(11) (11)

Net loss –––––(445) (445)

Balance at December 31, 2001 2,753 1,636 659 282 28 6,812 12,170

Capital stock increase as resolved on December 10, 2001 329 691 – – – – 1,020

Dividends paid (0.310 euros per ordinary and preference

share and 0.465 euros per savings share) –––––(198) (198)

Foreign exchange translation adjustments ––––(1,407) – (1,407)

Change in treasury stock in portfolio – – – (29) – 29 –

Other minor changes –––––44

Net loss –––––(3,948) (3,948)

Balance at December 31, 2002 3,082 2,327 659 253 (1,379) 2,699 7,641

Capital stock increase as resolved on June 26, 2003 1.836 –––––1.836

Fiat S.p.A. fiscal 2002 loss covered by Additional paid-in capital – (2,053) – – – 2,053 –

Allocation of the value of unopted rights sold

on the market to Additional paid-in capital – 5 – – – – 5

Foreign exchange translation adjustments ––––(802) – (802)

Change in treasury stock in portfolio – – – (221) – 221 –

Other minor changes –––––1313

Net loss –––––(1,900) (1,900)

Balance at December 31, 2003 4,918 279 659 32 (2,181)3,086 6,793

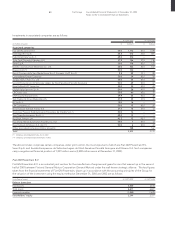

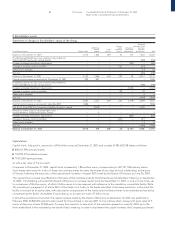

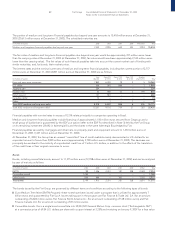

Capital stock

Capital stock, fully paid-in, amounts to 4,918 million euros at December 31, 2003 and consists of 983,622,708 shares as follows:

❚800,417,598 ordinary shares;

❚103,292,310 preference shares;

❚79,912,800 savings shares;

all with a par value of 5 euros each.

Compared to December 31, 2002, capital stock increased by 1,836 million euros, corresponding to 367,197,108 ordinary shares.

Such shares were issued in a ratio of three new ordinary shares for every five shares of any class of stock outstanding, at the price

of 5 euros, following the execution of the capital stock increase in August 2003 voted by the Board of Directors on June 26, 2003.

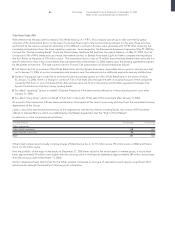

The capital stock increase was effected on the basis of the mandate given by the Extraordinary Stockholders’ Meeting on September

12, 2002. This Meeting authorized the Board of Directors to increase capital stock, by September 11, 2007, in one or more times, up

to a maximum of 8 billion euros, of which 3 billion euros is to be reserved, with reference to the mandatory convertible facility (Note

12), according to paragraph 7 of article 2441 of the Italian Civil Code, to the banks identified in the same resolution, in the event the

facility is not paid at an earlier date, with subscription and payment of the newly issued ordinary shares to be achieved exclusively by

compensating the Banks’ receivables for principal up to a maximum total of 3 billion euros.

It should be pointed out that when the capital increase voted by the Board of Directors on December 10, 2001 was perfected in

February 2002, 65,820,600 warrants were issued for the purchase in January 2007 of one ordinary share, always with a par value of 5

euros, at the price of euro 29.448 each, for every four warrants. In execution of the resolution passed on June 26, 2003, up to the

limits established in the mandate by the stockholders’ meeting, in order to implement the capital increase, the Company purchased