Chrysler 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating performance

In 2003 the business services market experienced a significant

slowdown, in line with market, economic and financial difficulties

that had a widespread impact on all the main fields of activity.

Uncertainty over the future prospects for the economy

prompted companies to reduce investment in IT, in which

overall spending fell for the first time in years. Outsourcing of

company activities also decelerated markedly, while projects

to outsource a number of government functions failed to reach

the operational stage. Even more traditional services, such as

training and temporary employment services, recorded only

modest growth rates, considerably lower than in previous years.

In this market context, and consistently with the Fiat Group’s

policy of focusing on its core businesses, the Sector engaged

in a strategic repositioning that favored service-sharing activity

within the Group and was supported by effectiveness and

efficiency gains achieved through the Relaunch Plan.

The Sector’s operating performance, by business unit, is set

out below.

❚Human Resources: this unit provides payroll and human

resource management (H.R. Services S.p.A.), training

(Isvor Knowledge System S.p.A.) and temporary employment

(WorkNet S.p.A.) services. Aggregate revenues totaled 231

million euros, of which 73% were from “non-captive”

customers, especially for training and temporary employment

services. With regard to temporary employment services,

the restructuring process continued at WorkNet.

❚Engineering and Facility Management: this unit experienced

the greatest degree of business portfolio restructuring,

with the disposal of IPI S.p.A. and Fiat Engineering S.p.A.,

the latter in February 2004. Facility Management activity

in civil and industrial sites is also worthy of note, as is the

extraordinary maintenance activity carried out by Ingest

Facility S.p.A. Turnover amounted to 624 million euros

(73% non-captive) and still includes the revenues of Fiat

Engineering.

❚Administration and Procurement: with Fiat Gesco S.p.A.,

this unit provides management and back office services

within the Group, creating important synergies. The services

provided include the activities of SADI S.p.A. (customs), Fast

Buyer S.p.A. (traditional and online purchasing) and Risk

Management S.p.A. (management of insurable Group risks).

Revenues for 2003 totaled 333 million euros, 73% of which

from “captive” customers.

❚I.C.T. – Information and Communication Technology: the

main activity in this unit is Global Value, a joint venture with

IBM that provides technology infrastructure management

and software application development services for the Group

and the external market. During the year some Sectors of

the Group made significant investments, especially in SAP,

in which Global Value’s operational structures were involved.

eSPIN S.p.A., a competence center active in a number of

specific areas of innovation, most notably in the online

application and management of business processes, is also

part of this unit.

The unit posted revenues of about 600 million euros in 2003,

with Fiat Group companies accounting for 62% of them.

❚The operation of ski lift and cable car facilities at Sestrieres

generated revenues of 21 million euros.

Results for the year

Revenues for the Sector totaled 1,816 million euros in 2003,

a decline of 7.6% compared with the previous year, mainly as

a result of changes in the scope of consolidation in 2003 (sale

of IPI and real estate operations). Other factors influencing

the fall in revenues were the overall contraction in the services

market and the refocusing of Sector companies on activities

within the Group.

Operating income amounted to 45 million euros, compared

with 67 million euros the previous year. On a comparable basis,

however, the result represents an improvement of 6 million

euros. Results from equity investments and, most notably, net

non-operating expenses of 29 million euros resulting in part

from restructuring, generated a net loss of 20 million euros.

This was a marked improvement on the loss of 119 million

euros reported in 2002, which reflected extraordinary provisions

for the writedown of the UMTS licence.

61 Report on Operations

Services — Business Solutions

(in millions of euros) 2003 2002 2001

Net revenues 1,816 1,965 1,805

Operating result 45 67 73

EBIT (*) 11 (140) 608

Net result before minority interest (20)(119) 497

Cash flow

(net result +

depreciation and amortization)

10 (77) 567

Capital expenditures 714 32

Net invested capital (31)478 648

Number of employees 7,113 7,900 7,171

(*) It includes non-operating income and expenses

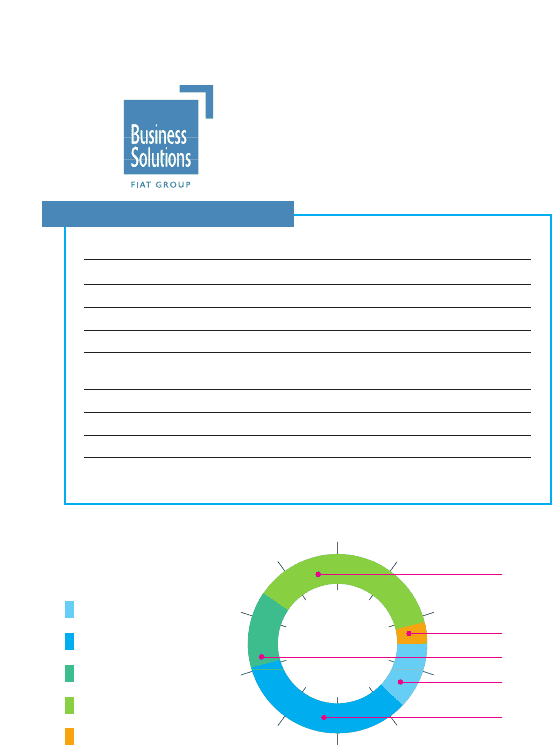

Highlights

Engineering &

Facility Management

34%

4%

17%

12%

33%

Revenues by business unit

Administration

and Procurement

I.C.T. - Information and

Communication Technology

Diversified Services

Human Resources