Chrysler 2003 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

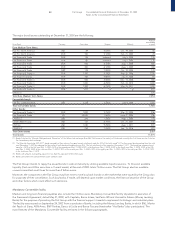

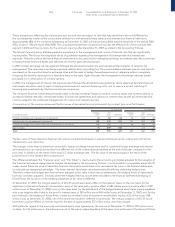

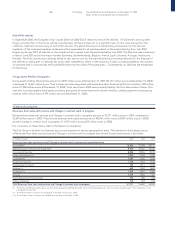

105 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

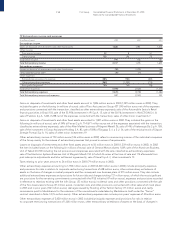

S.p.A. in turn assigned the design and construction of these works to the CAV.E.T. and CAV.TO.MI consortiums. In order to guarantee

the contractual advances and the proper execution of the works, Fiat S.p.A. granted bank suretyships to T.A.V. S.p.A. totaling 1,566

million euros. Similarly, as called for by the contract, the CAV.E.T. and CAV.TO.MI consortiums granted bank suretyships to Fiat S.p.A.

for 617 million euros and 889 million euros, respectively. Consequently, the guarantees granted are substantially covered by the

guarantees received.

Other commitments and important contractual rights

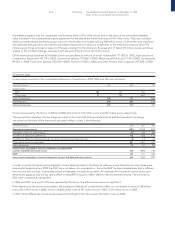

Relations with General Motors

Although they are not included in the memorandum accounts, the following comments are intended to summarize the options

held by the Fiat Group deriving from the relationships with General Motors. On the basis of the Agreement (“Master Agreement”)

signed on March 13, 2000, by which 20% of the Automobile Sector was sold to General Motors, the Fiat Group had reserved itself

a Put option at fair market value with General Motors on its remaining investment in Fiat Auto Holdings B.V. (80% in 2000, now 90%

following the capital increase later described), exercisable during the period between January 24, 2004 and July 24, 2009. General

Motors has claimed that the sale of certain financial activities by Fiat Auto and the recapitalization of Fiat Auto Holdings, put into

place by Fiat, violate the Master Agreement and, as a result, the Put option. Fiat maintains that the two transactions are entirely

legitimate and do not violate the Master Agreement nor other rights held by General Motors. Fiat considers the Put binding

and exercisable according to the clauses of the Master Agreement. On October 26, 2003, Fiat and General Motors announced

agreements regarding the strategic alliance in progress. A first agreement (“Amendment”) pushes back the period in which the

Put option can be exercised by one year. The new period in which the Put option can be exercised goes from January 24, 2005

to July 24, 2010. The second agreement (“Standstill Agreement”) precludes the parties from bringing legal action regarding the

Master Agreement until December 15, 2004, preserving their respective rights.

As for the aforementioned recapitalization of Fiat Auto Holdings, the Stockholders’ Meeting of this company held on April 23, 2003

resolved a recapitalization plan for 5 billion euros offering its stockholders the possibility of paying for their share of the capital

increase over a period of 18 months. Fiat, during the year, subscribed to the recapitalization for 3 billion euros, whereas General

Motors has not yet subscribed to its share of the capital increase and stated that at this time it does not plan to participate.

Consequently, the current percentage ownership of Fiat in Fiat Auto Holdings rose to 90%. For purposes of completing the

disclosure, it should be pointed out that the Master Agreement (Section 8.07) calls for certain residual options in favor of General

Motors in the event of a change in the control of Fiat following the purchase of more than 50% of Fiat’s voting rights by another party

or several parties in concert among each other. In this very remote eventuality, General Motors would have the right to demand that

Fiat exercise the Put option on Fiat’s investment in Fiat Auto Holdings, if the change in control was hostile, or, even if it was not

hostile, to sell its investment in Fiat Auto Holdings to Fiat at a price equal to fair market value or, up to July 24, 2004, at 2.4 billion

U.S. dollars, if higher. Such eventuality is considered extremely unlikely partly in view of the onerous obligations that would be

placed upon the acquirer of control on the basis of the laws on takeover bids.

Lastly, it should be pointed out that Fiat and General Motors have stated that discussions are underway to redefine the structure of

the strategic alliance so that the parties might continue their industrial cooperation in constructive terms and settle unresolved issues.

At the present time, it is not possible to determine what if any effects the discussions could have on the assets and liabilities reflected

in the consolidated financial statements.

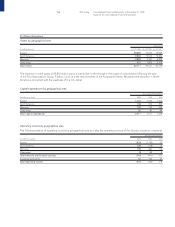

Ferrari

A summary is presented below of the rights arising from the purchase of 34% of the capital stock of Ferrari S.p.A. for 775 million

euros by Mediobanca S.p.A., within the framework of a consortium set up for the acquisition and placement of the Ferrari shares. Fiat

realized a gain of 671 million euros on this sale, net of selling expenses. The sale contract sets out the following principal elements:

❚Mediobanca assumed the responsibility of sole Global Coordinator in charge of coordinating and leading the consortium.

❚Mediobanca cannot sell its Ferrari shares to another group in the automobile industry as long as the Fiat Group maintains a 51%

controlling interest in Ferrari. Barring certain specific assumptions, the Fiat Group can not reduce its investment in Ferrari below

51% until the end, depending on the case, of the third or fourth year subsequent to signing the contract.

❚Fiat holds a call option that allows it to repurchase the Ferrari shares at any time before June 30, 2006 (the original date of June 30,

2005 was extended by one year during the course of 2003, by virtue of the payment of a premium of 16 million euros), except

during the five months subsequent to the presentation of an IPO application to the competent authorities. The option exercise

price is equal to the original price at which the shares were sold plus interest during the period based on the BOT yield plus 4%.

❚Mediobanca, moreover, does not hold any put option to resell the purchased Ferrari shares to Fiat, even in the event that the IPO

does not occur or is not completed.