Chrysler 2003 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

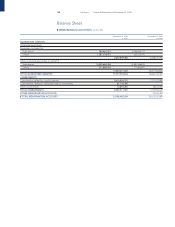

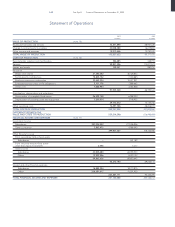

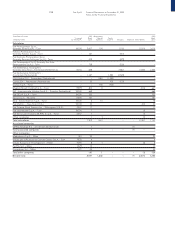

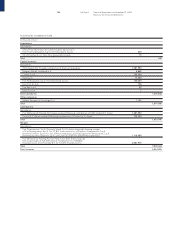

157 Fiat S.p.A. Financial Statements at December 31, 2003

Notes to the Financial Statements

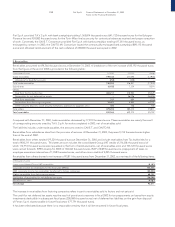

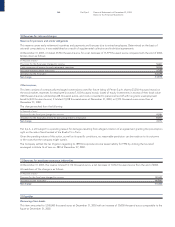

In particular, decreases include:

(in thousands of euros)

Disposals

Subsidiaries

0.06% of the preference shares of Toro Assicurazioni S.p.A. to DeAgostini Invest S.A. 420

Associated companies

20% of GPWC Holdings B.V. to Ferrari S.p.A. 500

Total 920

Contributions

Subsidiaries

shares of CNH Global N.V. contributed to Fiat Netherlands Holding N.V. 1,381,990

shares of Comau S.p.A. contributed to Comau B.V. 100,000

Total 1,481,990

Mergers

Subsidiaries

Cancellation of shares following merger in Fiat Partecipazioni S.p.A. (formerly Sicind S.p.A.)

of Fiat Partecipazioni S.p.A. (727,821 thousand euros), of FiatAvio Partecipazioni S.p.A.

(formerly FiatAvio S.p.A.) (161,109 thousand euros) and of Fiat Gestione Partecipazioni S.p.A.

(formerly Business Solutions S.p.A. until June 30, 2003) (229,559 thousand euros) 1,118,489

Cancellation of shares following merger in Fiat Netherlands Holding N.V.

(formerly Iveco N.V.) of Fiat Netherlands Holding N.V. (2,548,603 thousand euros)

and of Comau B.V. (133,372 thousand euros) 2,681,975

Total 3,800,464

Writedowns of carrying value

Subsidiaries

Fiat Partecipazioni S.p.A. (mainly due to the negative performance of the Automobile Sector) 1,210,084

Fiat Netherlands Holding N.V. (due to the losses of the Iveco and CNH subsidiaries) 1,000,425

Magneti Marelli Holding S.p.A. 144,221

Fiat USA Inc. 9,747

Isvor Fiat S.c.p.A. 268

Fiat International S.p.A. 1,279

Fiat Se.p.In. S.c.p.A. 569

Fiat Revi S.c.r.l. 41

Total subsidiaries 2,366,634

Other companies

Istituto Europeo di Oncologia S.r.l. 2,939

Total 2,369,573

Total decreases 7,652,947

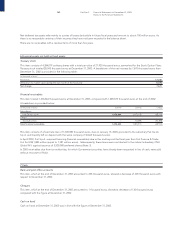

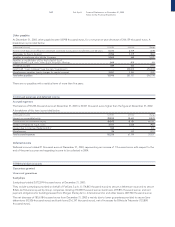

The table at the end of these Notes to the Financial Statements contains a list of equity investments and the additional information

required under Article 2427 of the Italian Civil Code and the supplemental data recommended by CONSOB, including changes in

quantity and value of subsidiaries and associated companies and, for publicly traded companies, a comparison between the book

value and the market value.

As required by Article 2426, Section 3, of the Italian Civil Code, we wish to emphasize that certain investments are carried at an

amount that exceeds the value of the corresponding portion of the underlying stockholders’ equity in the latest approved financial

statements, after deducting dividends and after the adjustments required for consolidation purposes.

In particular, the values of the investments in Magneti Marelli Holding S.p.A., Fiat Partecipazioni S.p.A., Ferrari S.p.A., and Fiat

Finance North America Inc. that are reported on the balance sheet of Fiat S.p.A. are higher that the corresponding shares of

stockholders’ equity in the companies (123 million euros, 271 million euros, 55 million euros, and 3 million euros, respectively)

because these investments have objectively higher inherent values than what is documented by accounting records.

The higher values for the investment in Magneti Marelli Holding S.p.A. are confirmed by the external appraisal performed at the

end of 2002 when the Company was formed; those for Fiat Partecipazioni S.p.A. by the contractually agreed gain on the indirect

investment in Italenergia Bis S.p.A. that can be realized at the beginning of 2005 upon exercise of the put option for sale to EDF;

those for Ferrari S.p.A. by the current values recently realized upon sale of 34% of the investment to Mediobanca in 2002 (see Note

14 hereunder for an updated disclosure of the mutual commitments assumed at that time).