Chrysler 2003 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

169 Fiat S.p.A. Financial Statements at December 31, 2003

Notes to the Financial Statements

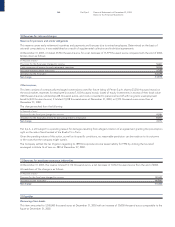

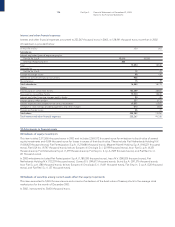

Commitments for derivative financial instruments

These totaled 61,730 thousand euros at December 31, 2003, reflecting an increase by the same amount with respect to December 31,

2002, and refer to the equity swap on Fiat shares.

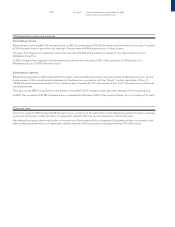

In 2003, the Board of Directors approved a resolution granting Giuseppe Morchio options to purchase 13,338,076 ordinary Fiat shares

at a price of 5.623 euros per share. These options, which are exercisable between March 27, 2004 and March 27, 2010, constitute the

only variable compensation awarded to Mr. Morchio for his services as Chief Executive Officer. In each of the first five years, Mr.

Morchio will earn the right to purchase up to 20% of the total number of available shares. Two-thirds of the options that will vest

on March 27 of each year from 2005 to 2008 will be exercisable only if certain predetermined profitability targets are reached during

the reference period. The risk that Fiat’s stock price will significantly rise above the exercise price of the options has been hedged

through the allocation of 3,338,076 treasury shares and, for the remaining 10,000,000 shares, by executing a total return equity swap

contract with a reference price of 6.173 euros per share. The swap matures on August 31, 2004. Under current accounting principles,

hedge-accounting rules cannot be applied to equity swaps, even when they are executed for hedging purposes, because these

swaps constitute negotiable financial derivatives. As a result, in keeping with a conservative approach, if over the life of the contract

the performance of the Fiat stock is favorable, the instrument’s positive fair value will not be recognized in earnings. Conversely, if

its performance is unfavorable, the instrument’s negative fair value will be recognized as a financial expense. At December 31, 2003,

the abovementioned equity swap had a negative fair value 906 thousand euros, which was recognized in the statement of income.

Other commitments

This item, which totaled 12,853 thousand euros at December 31, 2003 (16,431 thousand euros at December 31, 2002), represents

the residuary amount of the commitment, undertaken by Fiat on the occasion of its centennial under a resolution adopted by

the Stockholders’ Meeting on June 22, 1998, to defray, over a ten-year period, the costs incurred to provide courses for a

Degree in Automotive Engineering and pay for the renovation of the respective building. The decrease of 3,578 thousand

euros from December 31, 2002 reflects the outlays incurred in the year to renovate the building and teach the courses.

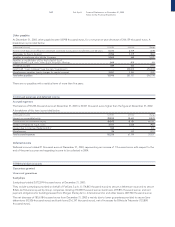

A summary is presented below of the rights arising from the purchase of 34% of the capital stock of Ferrari S.p.A. for 775 million

euros by Mediobanca S.p.A., within the framework of a consortium set up for the acquisition and placement of the Ferrari shares.

Fiat realized a gain of 671 million euros on this sale, net of selling expenses. The sales contract sets out the following principal

elements:

❚Mediobanca assumed the responsibility of sole Global Coordinator in charge of coordinating and leading the consortium.

❚Mediobanca can not sell its Ferrari shares to another group in the automobile industry as long as the Fiat Group maintains a 51%

controlling interest in Ferrari. Barring certain specific assumptions, the Fiat Group can not reduce its investment in Ferrari below

51% until the end, depending on the case, of the third or fourth year subsequent to signing the contract.

❚Fiat holds a call option that allows it to repurchase the Ferrari shares at any time before June 30, 2006 (the original date of June 30,

2005 was extended by one year during the course of 2003), except during the five months subsequent to the presentation of an

IPO application to the competent authorities. The option exercise price is equal to the original price at which the shares were sold

plus interest during the period based on the BOT yield plus 4%.

❚Mediobanca, moreover, does not hold any put option to resell the purchased Ferrari shares to Fiat, even in the event that the

IPO does not occur or is not completed.

❚Fiat may share, in declining percentages, in any gain realized by Mediobanca and the other members of the consortium in the

event of an IPO.

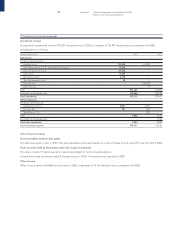

As part of the sale of Piemongest S.p.A. to Iupiter S.r.l., Fiat S.p.A. guaranteed performance of the obligations envisaged under

that transaction.

It should be noted that, while Renault has a 19.52% interest in Teksid S.p.A., Fiat S.p.A. and Renault have agreed that this may

be resold to Fiat S.p.A., should there be a material change in the conditions upon which the original agreement was based.

Other memorandum accounts

Company assets held by third parties

There were no company assets held by third parties at December 31, 2003.