Chrysler 2003 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

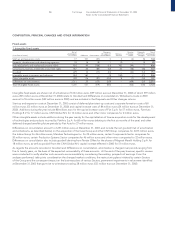

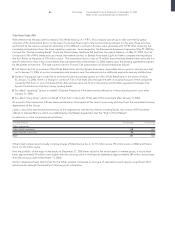

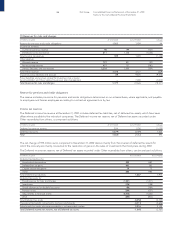

Investments where the investment risk is borne by policyholders and those related to pension plan management

(in millions of euros) At 12/31/2003 At 12/31/2002 Change

Investments where the investment risk is borne by policyholders

and those related to pension plan management –6,930 (6,930)

Investments for the benefit of life insurance policyholders, where the policyholders bear the risk, and pension plan assets, at

December 31, 2002 referred to the Toro Assicurazioni Group.

Current assets

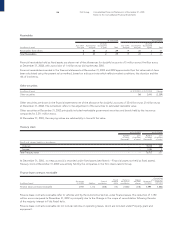

4 Inventories

At 12/31/2003 At 12/31/2002

(in millions of euros) Gross Allowance Net Gross Allowance Net

Raw materials and supplies 1,306 (207)1,099 1,382 (134) 1,248

Work in progress and semifinished products 966 (22)944 1,102 (20) 1,082

Contract work in progress 4,077 – 4,077 5,293 – 5,293

Finished goods and merchandise 4,482 (430)4,052 4,279 (449) 3,830

Advances to suppliers 5,188 – 5,188 3,824 – 3,824

Total Inventories 16,019 (659)15,360 15,880 (603) 15,277

Advance payments on contract work in progress (8,448)–(8,448) (8,227) – (8,227)

Net inventories 7,571 (659)6,912 7,653 (603) 7,050

Movements in the inventory allowance accounts during the year were as follows:

Foreign Change in

At Use and exchange the scope of At

(in millions of euros) 12/31/2002 provisions effects consolidation 12/31/2003

Allowance for inventory writedowns 603 93 (9) (28) 659

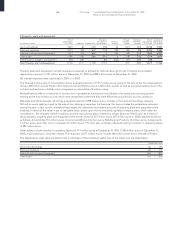

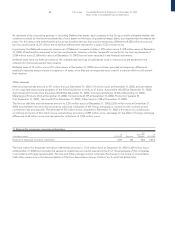

Inventories of 15,360 million euros at December 31, 2003 (15,277 million euros at December 31, 2002) increased by 83 million euros

compared to the prior year. Advance payments received from customers against contract work in progress amount to 8,448 million

euros (8,227 million euros at December 31, 2002) and are recorded in Payables (Note 12). Inventories, net of such advance payments

received from customers, amount to 6,912 million euros (7,050 million euros at December 31, 2002). Advances to suppliers principally

regard the amounts paid by the Fiat S.p.A. to the consortiums involved in the T.A.V. project. Contract work in progress decreased

mainly as a result of the Change in the scope of consolidation.

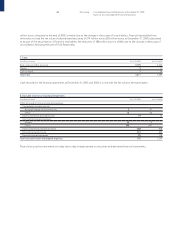

5 Receivables

An analysis of receivables by due date is as follows:

At 12/31/2003 At 12/31/2002

Due Due Of which Due Due Of which

within beyond due beyond within beyond due beyond

(in millions of euros) one year one year 5 years Total one year one year 5 years Total

Trade receivables 3,733 25 3 3,758 5,248 60 4 5,308

Receivables from unconsolidated subsidiaries 73 3 – 76 54 – – 54

Receivables from associated companies 764 – – 764 472 – – 472

Other receivables from:

Employees 33 2 – 35 36 3 – 39

Tax authorities 1,413 137 – 1,550 1,639 146 – 1,785

Social security agencies 14––1422 – – 22

Others 1,808 1,508 9 3,316 2,120 2,834 8 4,954

Total Other receivables 3,268 1,647 9 4,915 3,817 2,983 8 6,800

Total Receivables 7,838 1,675 12 9,513 9,591 3,043 12 12,634