Chrysler 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35 Report on Operations

Following the coming into force of European Regulation No.

1606 dated July 2002, EU companies traded on EU regulated

markets are required to adopt IAS/IFRS in the preparation of

their 2005 consolidated financial statements.

Commencing with the first half of 2003, the Fiat Group set

up an IAS/IFRS implementation program with working groups

which operated first at a parent company level and then at

the level of principal operating companies. Reviews were

conducted of the IAS/IFRS in force and the principal changes

present in the proposals for the revision of those standards,

which to date have not been finalized.

As at the end of 2003:

❚the principal differences between the accounting principles

currently followed by the Fiat Group, in compliance with

the laws relating to financial statements interpreted and

integrated in accordance with Italian accounting principles,

and the applicable provisions of IAS/IFRS were identified;

❚an action plan was formulated that was aimed at identifying

the steps required to adapt the Group’s corporate processes

and information systems so as to render them capable of

supplying the information necessary for the preparation of the

Group’s 2005 consolidated financial statements in accordance

with IAS/IFRS, and to permit the processing of the information

related to 2004, to be presented for comparative purposes.

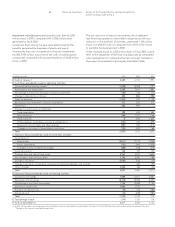

Based on the results of the work performed, the principal

differences that will have an effect on consolidated stockholders’

equity as at January 1, 2004, restated in accordance with the

new accounting standards, and on the future economic results

are set out below.

General principles

The adoption of the new body of accounting standards will

involve a reassessment not only of the accounting valuation

criteria, but also of the format of the financial statements and

the contents of the related notes.

As regards the principles of recognition and measurement of

financial statement components, the most significant changes

relate to the following:

❚replacement of the principle of the transfer of risks and benefits

in respect of the recording and reversal of certain transactions

at the time of transfer of ownership, giving prevalence to the

substance of the transaction over its legal form;

❚use of alternative valuation criteria to historical cost (where

expressly requested), such as fair value (particularly for financial

instruments) and present value (for medium-long term reserves).

Capitalization of development costs

Development costs which meet the conditions set out in IAS 38

must be capitalized, whereas at present they are for the most

part recognized in the statement of operations when they are

incurred; other research and development costs will continue

to be recorded in the statement of operations, when they are

incurred.

Other intangible fixed assets

In contrast to current Italian laws, under IAS 38 the majority

of start-up and expansion costs are recorded in the statement

of operations when they are incurred. Start-up and expansion

costs related to increases in capital stock, financing transactions

and similar transactions are recorded as a reduction of either

the related reserves in stockholders’ equity or of the financing

issued.

Changes to the present IAS 38 introduce the concept of

intangible fixed assets with an indefinite useful life which,

accordingly, will no longer be subject to amortization; this

principle also extends to goodwill deriving from business

combinations. These intangible fixed assets should be subject

to annual impairment tests on the smallest group of assets that

generates cash inflows which are largely independent of other

cash inflows (cash generating unit), comparing the carrying

amount to the related market value or “value in use”.

Writedown of assets

If not stated otherwise in individual applicable accounting

standards, IAS/IFRS require assessment of whether assets are

impaired in the presence of indications which lead to the

belief that this problem may exist.

The methods provided for determining recoverability of

the carrying amount are more specific than those currently in

force in Italy, where, however, only the concept of permanent

impairment in value is observed. On the contrary, under IAS the

impairment in value (not necessarily permanent) is determined

by comparing the carrying amount to the higher of the net

selling price and the value in use of the asset (or a group of

assets – or cash generating units).

Revenue recognition

In relation to the new general principles set out above (transfer

of risks and benefits), various examples of contracts which set

out the recognition of revenue were analyzed. The most

significant difference relates to revenues deriving from vehicle

sales with a buyback option, which are currently recognized in

full at the time of formal transfer of ownership of the vehicle.

In accordance with IAS, these sales should be recorded as

operating leases.

Financial instruments

IAS 32 and 39 provide that companies classify financial

instruments, as a function of their destination, in different

categories than that provided by the laws in force in Italy. The

basis of recognition, measurement and valuation of financial

Process of Transition to International Accounting

Standards (IAS/IFRS)