Chrysler 2003 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

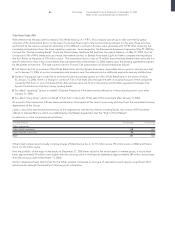

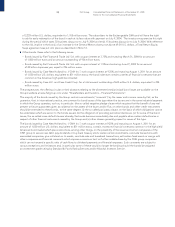

311,432 “FIAT warrants on ordinary shares 2007” and 2,100,000 “option rights” for cancellation. Accordingly, on the basis of the

resolutions passed by the Board of Directors Meetings on December 10, 2001 and June 26, 2003, the capital stock could ultimately

be increased against payment for a maximum of 82 million euros, thus reaching 5 billion euros, through the issue of a maximum of

16,377,292 ordinary shares of par value 5 euros each, on February 1, 2007, following the exercise of outstanding “FIAT warrants on

ordinary shares 2007”.

Again with reference to the “FIAT warrants on ordinary shares 2007”, Fiat reserved the right to pay the warrant holders in cash,

starting on January 2, 2007, in lieu of the shares to be issued (shares in exchange for warrants), for the difference between the

arithmetic average of the official market price of Fiat ordinary shares in December 2006 and the warrant exercise price, unless

this difference exceeds the maximum amount set and previously communicated by Fiat, in which case the holder of the warrants

may opt to subscribe to the shares in exchange for warrants.

The resolutions regarding the capital increase to service the stock option plans (28 million euros) have been revoked since the

Board of Directors decided on June 26, 2003 to use ordinary treasury stock to be bought back for this purpose.

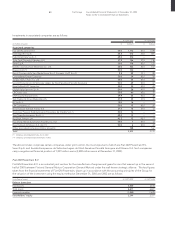

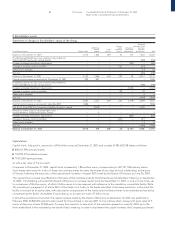

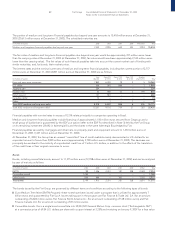

Additional paid-in capital

Additional paid-in capital at December 31, 2003 amounts to 279 million euros, with a reduction of 2,048 million euros compared to

December 31, 2002 following its utilization to cover the loss for fiscal 2002 (2,053 million euros) as voted by the Stockholders’ Meeting

held May 13, 2003. The reduction was partly compensated by the proceeds from the sale of the option rights on the 2003 capital

increase that were not exercised and which were sold on the market as set forth in art. 2441, paragraph 3 of the Italian Civil Code,

net of the amount paid for the option rights and the warrants purchased to execute the board resolution passed on June 26, 2003.

Legal reserve

The legal reserve amounts to 659 million euros at December 31, 2003 and did not change in respect of December 31, 2002.

At December 31, 2003, the legal reserve exceeds one-fifth of capital stock.

Cumulative translation adjustments

Cumulative translation adjustments show a negative change of 802 million euros compared to December 31, 2002 mainly due

to the effect of the weakness of the U.S. dollar and the Polish zloty against the euro.

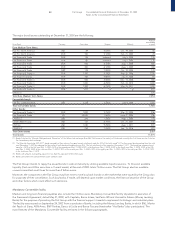

Retained earnings and Other reserves

Retained earnings and Other reserves include, in addition to the undistributed earnings of the consolidated companies,

also monetary revaluation reserves and other reserves in suspension of taxes.