Chrysler 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A

On a comparable consolidation basis, the change of 614 million

euros is mainly attributable to higher receivables from Tax

Authorities and to the payment made in favor of the CAV.TO.MI

Consortium for reimbursement of the cash collateral of 250

million euros that the Consortium had paid to Fiat S.p.A. in 2002

while waiting for the issuance of the contractual suretyships,

which were subsequently issued.

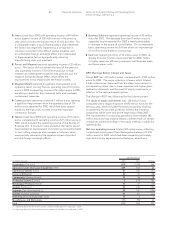

Reserves

Reserves totaled 6,481 million euros, compared with 16,999

million euros at December 31, 2002. The net reduction stems

from the disposals carried out during the year, particularly the

deconsolidation of insurance policy liabilities and accruals (9,508

million euros) and of the reserve for employee severance

indemnities of companies that were sold in 2003. The decrease

of this reserve is also attributable to the utilization connected to

staff reductions resulting from restructuring plans.

At December 31, 2003, the reserves mainly included: income tax

reserves (98 million euros), warranty reserves (791 million euros),

restructuring reserves (471 million euros), reserves for pensions

(1,503 million euros), reserves for employee severance

indemnities (1,313 million euros), and reserves for other risks and

charges (2.216 million euros).

Net Invested Capital

Net invested capital totaled 10,522 million euros, compared

with 12,459 million euros at December 31, 2002. About half of

the 1,937-million-euro decrease was due to the previously

mentioned disposals of lines of business. On a comparable

basis, the reduction is mainly attributable to a decrease in fixed

assets (foreign exchange effect and writedowns) which was

partially offset by the abovementioned increase in working

capital.

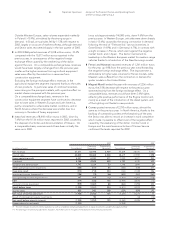

The following table illustrates the composition of net invested

capital at the end of 2003 and 2002:

(in millions of euros) At 12.31.2003 At 12.31.2002 Change

Intangible fixed assets 3,724 5,200 (1,476)

Property, plant and equipment 9,675 12,106 (2,431)

Financial fixed assets 3,950 6,638 (2,688)

Investments on behalf of life insurance

policyholders who bear the risk –6,930 (6,930)

Financial assets not held as fixed assets 120 6,094 (5,974)

Deferred tax assets 1,879 3,499 (1,620)

Reserves (6,692) (18,235) 11,543

Policy liabilities and accruals where the

investment risk is borne by policyholders –(7,000) 7,000

Working capital (2,134) (2,773) 639

Net invested capital 10,522 12,459 (1,937)

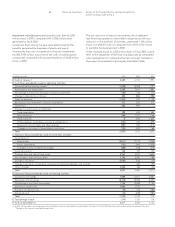

Stockholders’ Equity

Consolidated stockholders’ equity totaled 7,494 million euros

(8,679 million euros at December 31, 2002). The reduction

reflects the net loss for the period (1,948 million euros),

distributed dividends (15 million euros), and the decrease

caused by changes in foreign exchange rates (decrease of

862 million euros), which were only partially offset by the capital

increases carried out (1,860 million euros). The remaining

decrease of 220 million euros was mainly due to the sale of

IPI and the Toro Assicurazioni Group corresponding to the

minority interest.

The stockholders’ equity of the Group was 6,793 million euros,

against 7,641 million euros at December 31, 2002.

Net Financial Position

The net financial position, i.e. net indebtedness (financial

payables and related accruals and deferrals, net of cash and

securities) minus financial receivables, totaled -3,028 million

euros at December 31, 2003, reflecting an improvement of 752

million euros compared with the negative net financial position

of 3,780 million euros at December 31, 2002.

During the fiscal year, the net resources generated by disposals

and the capital increase concluded in August more than offset

the financial and operating requirements (loss for the fiscal year

and increase in working capital).

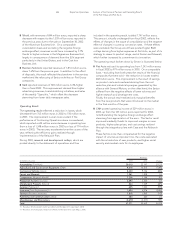

(in millions of euros) At 12.31.2003 At 12.31.2002 Change

Financial payables (22,034) (28,923) 6,889

Accrued financial expenses (593) (785) 192

Prepaid financial expenses 85 118 (33)

Cash 3,211 3,489 (278)

Securities 3,789 1,507 2,282

Net Indebtedness (15,542) (24,594) 9,052

Financial receivables and lease

contracts receivable 12,576 21,406 (8,830)

Accrued financial income 301 543 (242)

Deferred financial income (363) (1,135) 772

Net Financial Position (3,028) (3,780) 752

At December 31, 2003 the financial payables included:

❚bonds for 9,610 million euros;

❚the five-year-bond issued at the beginning of 2002 and

exchangeable for 32,053,422 General Motors shares ($2,229

million – equal to 1,765 million euros). It should be noted,

however, that each bondholder has the right to request early

reimbursement, with payment on July 9, 2004, of all or part

of his bonds pursuant to the terms and conditions envisaged

in the issue prospectus.