Chrysler 2003 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

the market prospects and the consequent new business plans of 216 million euros and on the basis of the estimated realizable

value indicated in the subsequently signed agreement for the sale of the Fraikin business of 210 million euros. They also included

additional extraordinary expenses and provisions for future risks and charges totaling 968 million euros, of which the most significant

are: expenses and provisions recorded for permanent impairments in value on investments in the telecommunications sector (95

million euros), those recorded in respect of the sales contract for the Aluminum Business Unit of Teksid (76 million euros), and those

related to the incidental charges associated with the sale of Ferrari S.p.A. (43 million euros).

Other extraordinary expenses by Business Sector are as follows (in millions of euros): Automobile 711 (853 in 2002), Agricultural and

Construction Equipment 142 (18 in 2002), Commercial Vehicles 170 (466 in 2002), Metallurgical Products 67 (149 in 2002), Components

86 (363 in 2002), Production Systems 140 (144 in 2002), Services 31 (202 in 2002) and Other Sectors and Companies 247 (225 in 2002).

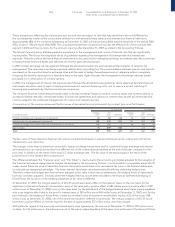

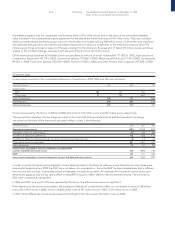

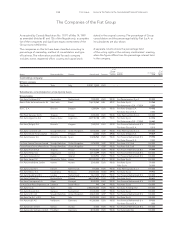

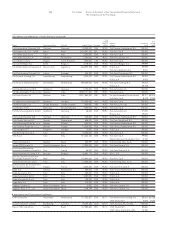

20 Income taxes

Income taxes recorded in the consolidated statement of operations in 2003, 2002 and 2001 are as follows:

(in millions of euros) 2003 2002 2001

Current taxes:

IRAP 125 141 156

Other taxes 31 192 652

Total Current taxes 156 333 808

Deferred taxes 494 (887) (514)

Total Income taxes 650 (554) 294

Income taxes paid by the Group in 2003 and 2002 amounted to 132 million euros and 660 million euros, respectively.

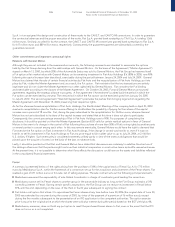

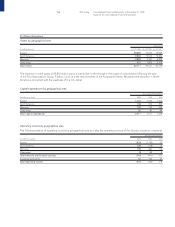

The reconciliation between the tax charge recorded in the consolidated financial statements and the theoretical tax charge,

calculated on the basis of the theoretical tax rates in effect in Italy, is the following:

(in millions of euros) 2003 2002 2001

Theoretical income taxes (441) (1,734) (207)

Utilization of tax loss carryforwards (57) (47) (66)

Tax effect of permanent differences 136 (325) (117)

Tax effect of difference between foreign tax rates and theoretical Italian tax rates (6)1376

Deferred tax assets not provided 881 1,361 544

Other differences 12 37 (92)

Income taxes recorded in financial statements excluding IRAP

(current and deferred income taxes)525 (695) 138

IRAP 125 141 156

Income taxes recorded in financial statements (current and deferred income taxes)650 (554) 294

In order to render the reconciliation between income taxes recorded in the financial statements and theoretical income taxes more

meaningful, beginning from 2002 the IRAP tax is not taken into consideration. Since the IRAP tax has a taxable basis that is different

from income before taxes, it generates distortions between one year and another. Accordingly, the theoretical income taxes were

determined applying only the tax rate in effect in Italy (IRPEG equal to 34% in 2003) to the income before taxes. The amounts for

2001 were consequently reclassified.

In 2003 and 2002, as a result of the loss reported by the Group, the effective tax rate is not significant.

With reference to the above reconciliation, the permanent differences include the tax effect on non-taxable income of 148 million

euros (356 million euros in 2002) and on nondeductible costs of 341 million euros in 2003 (1,276 million euros in 2002).

In 2003, Other differences include unrecovered withholdings for 20 million euros (34 million euros in 2002).