Chrysler 2003 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

167 Fiat S.p.A. Financial Statements at December 31, 2003

Notes to the Financial Statements

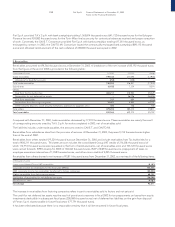

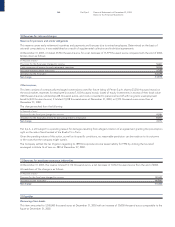

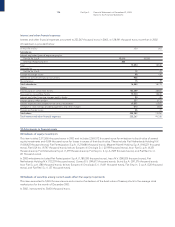

Other payables

At December 31, 2003, other payables were 18,998 thousand euros, for a net year-on-year decrease of 246,159 thousand euros. A

breakdown is provided below:

(in thousands of euros) 12/31/03 12/31/02 Change

Former Chief Executive Officer for retirement incentives to be paid in installments over 20 years 6,310 6,549 (239)

Employees for fees to be paid 2,356 3,219 (863)

Payables to employees who left the Company 5,963 568 5,395

Payables to stockholders of Toro Assicurazioni S.p.A.,

Magneti Marelli S.p.A. and Comau S.p.A. for public offerings 869 909 (40)

Dividends payable 449 560 (111)

CAV.TO.MI. “Cash Collateral” (see the item “Inventories”) –250,000 (250,000)

Miscellaneous payables (mainly charges for capital increase) 3,051 3,352 (301)

Total other payables 18,998 265,157 (246,159)

There are no payables with a residual term of more than five years.

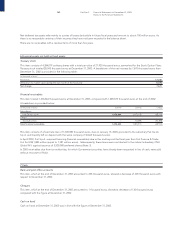

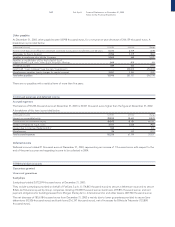

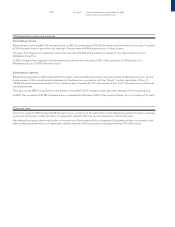

13 Accrued expenses and deferred income

Accrued expenses

The balance of 92,256 thousand euros at December 31, 2003 is 30,507 thousand euros higher than the figure at December 31, 2002.

A breakdown of this item is provided below:

(in thousands of euros) 12/31/03 12/31/02 Change

Interest on convertible facility 29,833 38,653 (8,820)

Commissions on convertible facility 58,952 18,785 40,167

Interest on Fiat Ge.Va. S.p.A. loans 3,101 4,068 (967)

Interest due to Intermap (Nederland) B.V. 344 – 344

Miscellaneous 26 243 (217)

Total accrued expenses 92,256 61,749 30,507

Deferred income

Deferred income totaled 21 thousand euros at December 31, 2003, representing an increase of 1 thousand euros with respect to the

end of the previous year and regarding income to be collected in 2004.

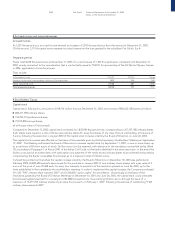

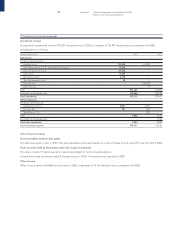

14 Memorandum accounts

Guarantees granted

Unsecured guarantees

Suretyships

Suretyships totaled 2,072,599 thousand euros at December 31, 2003.

They include suretyships provided on behalf of FiatSava S.p.A. (1,174,843 thousand euros) to secure a debenture issue and to secure

Billets de Trésorerie issued by Group companies (totaling 210,000 thousand euros), bank loans (279,816 thousand euros), and rent

payment obligations for buildings leased from Morgan Stanley & Co. International Ltd. and other lessors (407,940 thousand euros).

The net decrease of 185,618 thousand euros from December 31, 2002 is mainly due to lower guarantees provided to secure Sava

debentures (93,926 thousand euros) and bank loans (216,347 thousand euros), net of increases for Billets de Trésorerie (133,800

thousand euros).