Chrysler 2003 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

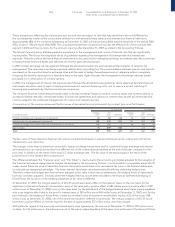

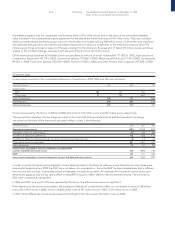

Other financial income of 2,856 million euros in 2003 (4,369 million euros in 2002), when shown net of Interest and other financial

expenses of 3,157 million euros (4,161 million euros in 2002) results in a net negative balance of 301 million euros (a net positive

balance of 208 million euros in 2002). The decrease in the net balance of 509 million euros derives almost entirely from the

deconsolidation of the Toro Assicurazioni Group, FiatAvio S.p.A. and the retail activities of Fiat Auto and Fraikin.

Foreign exchange gains, net, of 47 million euros (foreign exchange losses, net, of 111 million euros in 2002), represent the balance

between foreign exchange gains of 2,519 million euros in 2003 (2,446 million euros in 2002) and foreign exchange losses of 2,472

million euros in 2003 (2,557 million euros in 2002).

The Losses on sale of securities amounts to 8 million euros in 2003 and include losses of 6 million euros on the sale of investments

not held as fixed assets.

Discounts and other expenses includes receivables discounting and securitization expenses of 280 million euros in 2003 (261 million

euros in 2002).

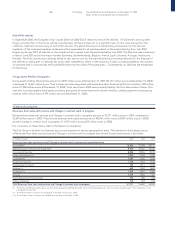

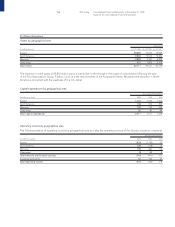

18 Adjustments to financial assets

(in millions of euros) 2003 2002 2001

Revaluations:

Equity investments 91 68 204

Financial fixed assets other than equity investments ––38

Securities held in current assets other than equity investments 14 712

Total Revaluations 105 75 254

Writedowns:

Equity investments 263 809 577

Financial fixed assets other than equity investments 184 128

Securities held in current assets other than equity investments 845 28

Financial receivables 518 15

Total Writedowns 277 956 748

Total Adjustments to financial assets (172) (881) (494)

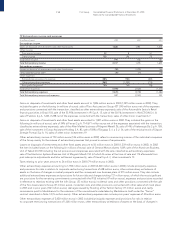

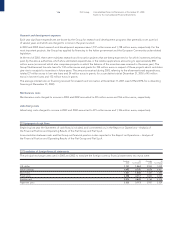

Revaluations and Writedowns of equity investments also include the share of the earnings and losses of companies accounted

for using the equity method.

Revaluations of equity investments of 91 million euros in 2003 include the share of the earnings of the following companies

(in millions of euros): BUC-Banca Unione di Credito 11, other companies of CNH Global N.V. 24, companies in the Automobile

Sector 20, other companies 36.

Revaluations of equity investments of 68 million euros in 2002 included the share of the earnings of the following companies

(in millions of euros): other companies of CNH Global N.V. 33, companies in the Automobile Sector 15, other companies 20.

Writedowns of equity investments of 263 million euros in 2003 (809 million euros in 2002) include the share of the losses of the

companies valued using the equity method and the permanent impairments in value of the companies valued at cost, for the

following (in millions of euros): Italenergia Bis S.p.A. 24 (211 in 2002), Atlanet S.p.A. 56 (31 in 2002), other companies of CNH Global

N.V. 9 (5 in 2002), companies in the Automobile Sector 112 (81 in 2002), companies of the Toro Assicurazioni Group for the first four

months 48 (198 in 2002), other companies 14.

In 2002, Writedowns also referred to Capitalia S.p.A., a Toro Assicurazioni Group holding for 124 million euros, Lingotto S.p.A.

for 30 million euros, Trucks & Bus Company for 17 million euros, other companies for 112 million euros.