Chrysler 2003 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

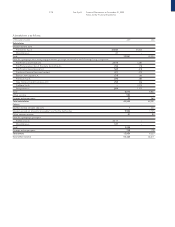

168 Fiat S.p.A. Financial Statements at December 31, 2003

Notes to the Financial Statements

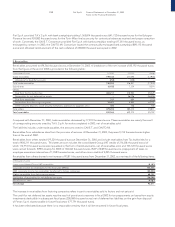

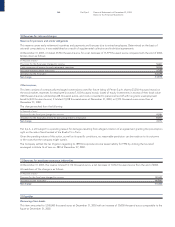

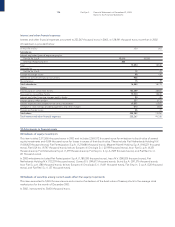

Other unsecured guarantees

This item totaled 13,640,371 thousand euros at December 31, 2003, or 2,361,562 thousand euros less than at the end of 2002.

It includes the following:

❚13,422,685 thousand euros in guarantees provided on behalf of subsidiaries to secure loans (Banco CNH Capital S.A. 568,949

thousand euros, Fiat Automoveis S.A. 101,091 thousand euros, Iveco Fiat Brasil Ltda 26,978 thousand euros, Case LLC 148,389

thousand euros, Iveco Latin America Ltda 6,945 thousand euros, Fiat Partecipazioni S.p.A. (formerly Sicind S.p.A.) 1,130,387

thousand euros in favor of Citigroup), bond issues (Fiat Finance and Trade Ltd. 8,118,721 thousand euros, Fiat Finance North

America Inc. 187,632 thousand euros, Fiat Finance Luxembourg S.A. 1,764,842 thousand euros, Fiat Finance Canada Ltd. 100,000

thousand euros), credit lines (New Holland Credit Company LLC 395,883 thousand euros, Fiat Auto Financial Services Limited

582,577 thousand euros), VAT receivable under the Group consolidation process (57,647 thousand euros), as provided under

Ministerial Decree of 12/13/79 as amended, and sundry guarantees (232,645 thousand euros);

❚128,791 thousand euros for the risk of nonpayment on receivables due from tax authorities;

❚88,895 thousand euros in miscellaneous guarantees.

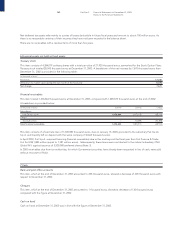

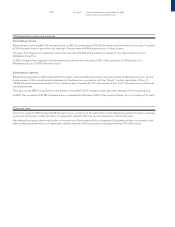

The turnover of receivables sold with recourse in 2003 was 387 million euros (350 million euros in 2002).

Although they are not included in the memorandum accounts, trade receivables and other receivables due after December 31, 2003

were sold without recourse for a total of 396 million euros (341 million euros in 2002 for receivables due after December 31, 2002).

The turnover of receivables sold without recourse totaled 1,471 million euros in 2003 (364 million euros in 2002).

The guarantees issued on behalf of subsidiaries show a net decrease, largely on account of fewer guarantees granted following

the reimbursement of bonds and reduced use of credit facilities.

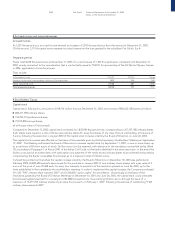

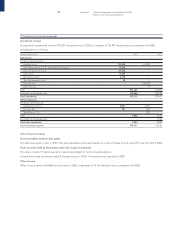

Pursuant to the General Motors Co. stock equity swap agreement between Intermap (Nederland) B.V. (a subsidiary of Fiat

Partecipazioni S.p.A.) and Merrill Lynch International, Fiat S.p.A. granted the latter a guarantee securing the obligations assumed

by Intermap (Nederland) B.V. in connection with its commitment to pay for the eventual difference between the price of the sold

32,053,422 General Motors Co. shares that was fixed at beginning of the contract (December 2002) in the amount of USD 36.11 per

share and the price of the shares upon maturity (March 16, 2007), in the case of unfavorable performance of the shares, plus interest

on the initial value of the agreement (USD 1,157 million), net of the dividends distributed on the shares during the term of the

agreement itself.

At December 31, 2003 the performance of said shares was positive and quantifiable in 439 thousand euros.

Upon sale of its controlling interest in the rolling stock activities, Fiat S.p.A. assumed certain obligations towards the purchaser

Alsthom N.V. in guarantee of any breaches of contract occurring prior to the sale. On the basis of due diligence results, it is believed

that Fiat does not face a reasonable likelihood of loss.

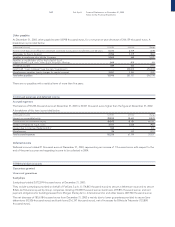

Commitments

Commitments related to supply contracts

This item totaled 8,010,928 thousand euros at December 31, 2003. Of this amount, 3,637,930 thousand euros represent the

commitment (corresponding to the contractual amounts) stemming from the agreement executed on May 7, 1996 and the

supplemental agreements signed by Fiat S.p.A. and Treno Alta Velocità – T. A.V. S.p.A. for the design and construction of the

Bologna-Florence high-speed rail line, and 4,372,998 thousand euros for the commitment undertaken pursuant to the agreement

of February 14, 2002 and subsequent supplement agreements for the design and construction of the Turin-Novara sub-line. The

increase of 293,406 thousand euros compared with December 31, 2002 includes agreements reached during 2003 regarding the

Florence-Bologna line, specifically alterations to the network (28,407 thousand euros), urgent corrective measures (26,311 thousand

euros) and monetary adjustments (46,026 thousand euros) and agreements regarding the Turin-Novara sub-line, specifically

relating to alterations (129,095 thousand euros), and monetary adjustments (63,567 thousand euros).

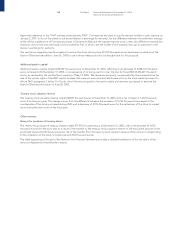

Fiat S.p.A. has subcontracted design and construction to the CAV.E.T. and CAV.TO.MI. Consortia.

Fiat S.p.A. provided T.A.V. S.p.A. with bank suretyships totaling 1,565,814 thousand euros as security for contractual advances

received and proper execution of work. These guarantees are not recorded under the Memorandum Accounts since advances are

included under Liabilities – Advances. Likewise, the CAV.E.T. and CAV.TO.MI Consortia provided Fiat S.p.A. with the contractually

envisaged bank suretyships totaling 617,051 thousand euros and 889,115 thousand euros, respectively.