Chrysler 2003 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

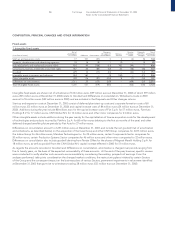

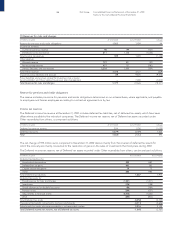

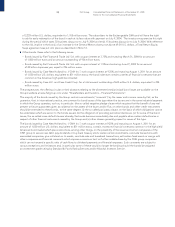

An analysis of receivables by type is as follows:

At 12/31/2003 At 12/31/2002

(in millions of euros) Trade Other Total Trade Other Total

Trade receivables 3,758 – 3,758 5,308 – 5,308

Receivables from unconsolidated subsidiaries 53 23 76 54 – 54

Receivables from associated companies 742 22 764 422 50 472

Other receivables from:

Employees –3535 –3939

Tax authorities – 1,550 1,550 – 1,785 1,785

Social security agencies –1414 –2222

Other – 3,316 3,316 – 4,954 4,954

Total Other receivables – 4,915 4,915 – 6,800 6,800

Total Receivables 4,553 4,960 9,513 5,784 6,850 12,634

of which:

Receivables included in working capital 4,553 3,081 7,634 5,784 3,351 9,135

Deferred tax assets – 1,879 1,879 – 3,499 3,499

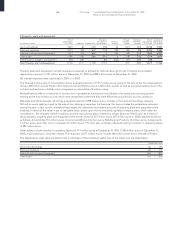

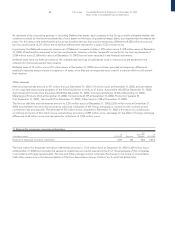

Trade receivables decreased by 1,231 million euros resulting from reductions of 1,106 million euros due to changes in the scope

of consolidation and 125 million euros due to current operations.

Trade receivables are shown net of allowances for doubtful accounts of 476 million euros at December 31, 2003 (549 million euros

at December 31, 2002). Movements in the allowance accounts during the year are as follows:

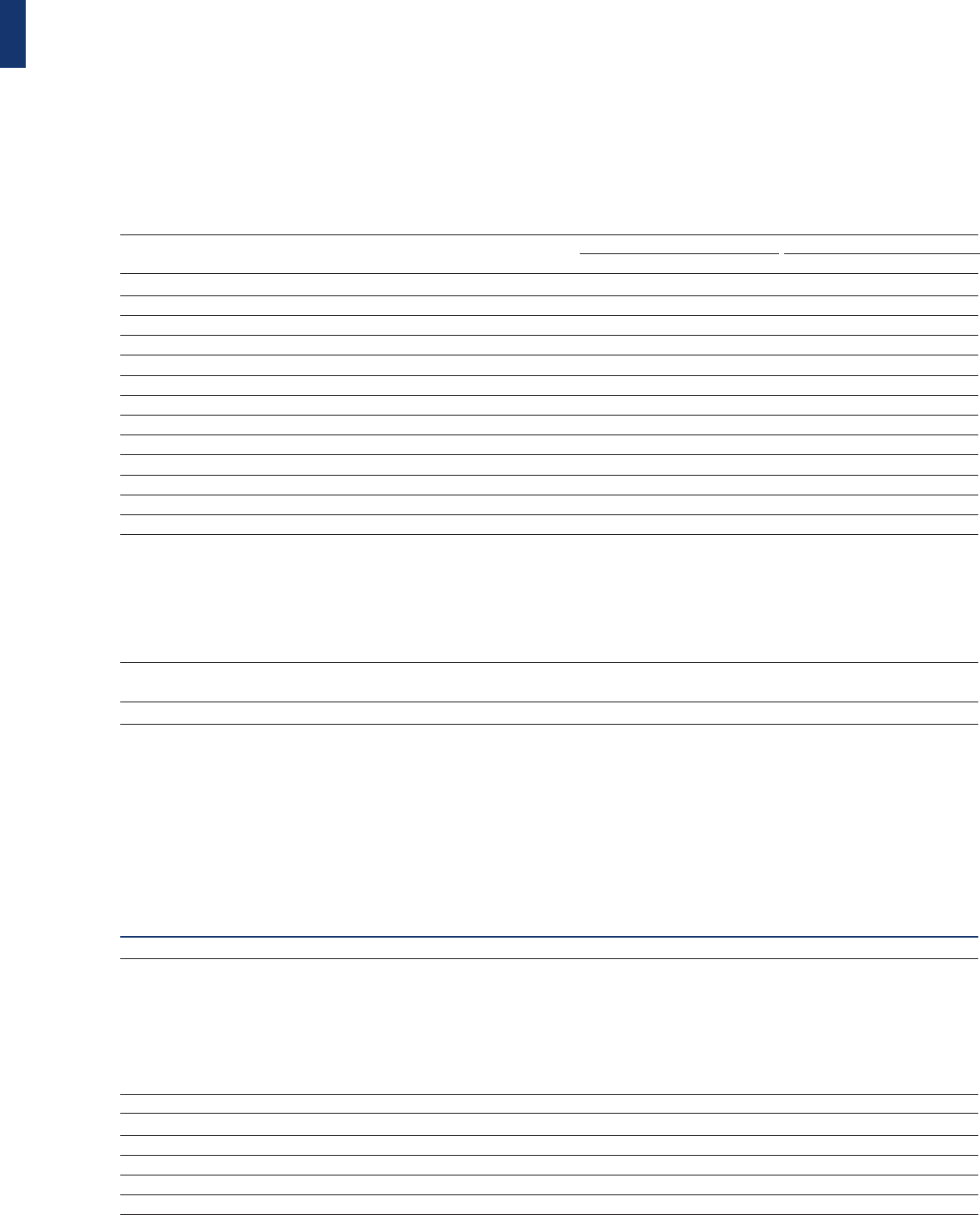

Use and Change in

At other the scope of At

(in millions of euros) 12/31/2002 Provisions changes consolidation 12/31/2003

Allowances for doubtful accounts 549 86 (109) (50) 476

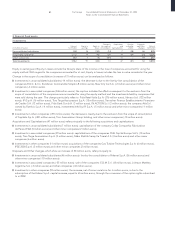

Receivables from tax authorities principally refer to VAT and income taxes receivable from the Italian tax authorities and include

the tax credit relating to the advance payments of income tax on employee severance indemnities paid by Italian companies.

The portion of interest accrued on that receivable relating to the current year is recorded in Financial income and expenses.

“Other receivables from others” include deferred tax assets of 1,879 million euros (3,499 million euros at December 31, 2002),

accounted for in accordance with the accounting policies described previously. Additional information on these assets is provided

in Note 10 - Reserves for risks and charges, under Deferred income tax reserve.

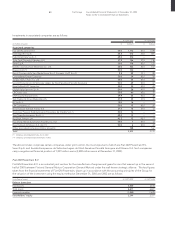

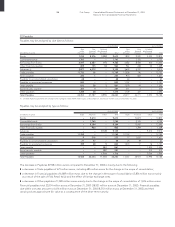

6 Financial assets not held as fixed assets

Investments

Investments in other companies amount to 32 million euros at December 31, 2003 (810 million euros at December 31, 2002) and show

a decrease of 778 million euros, mainly due to the sale of the Toro Assicurazioni Group.

Other securities

(in millions of euros) At 12/31/2003 At 12/31/2002 Change

Italian government securities 55 2,968 (2,913)

Other securities 3,790 3,801 (11)

Total Other securities 3,845 6,769 (2,924)

of which:

held by insurance companies 186 6,102 (5,916)

Italian government securities also include securities issued by other public entities and guaranteed by the Italian government.