Chrysler 2003 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

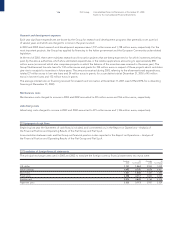

Investment income includes income from associated companies of 1 million euros (1 million euros in 2002) and from other companies

of 21 million euros (151 million euros in 2002), with a reduction of 130 million euros compared to 2002 due to the change in the scope

of consolidation owing to the sale of the Toro Assicurazioni Group (56 million euros).

Dividends were mainly received from minority investments valued at cost. This item included 68 million euros in 2002 for dividends

received on General Motors shares.

The Gains on sale of investments held in current assets decreased by 26 million mainly on account of the change in the scope

of consolidation due to the sale of the Toro Assicurazioni Group.

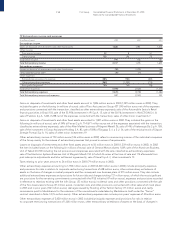

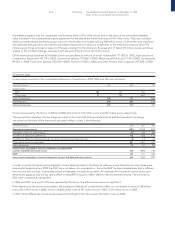

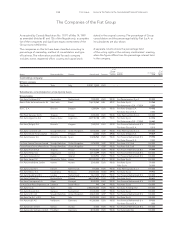

Other financial income

The following analysis of “Other financial income” and “Interest and other financial expenses” present the amounts shown in the

related captions on the statement of operations and also the amounts of income and expenses of the Group’s financial companies

presented in the captions on the statement of operations under “Revenues from sales and services” and “Interest and other

expenses of financial services companies”, respectively. The last line in the table shows “Other financial income” and “Interest

and other financial expenses” as presented on the statement of operations, excluding the financial activities.

(in millions of euros) 2003 2002 2001

Other financial income from:

receivables held as fixed assets from others 322

securities held as fixed assets other than equity investments –156 253

securities held as current assets other than equity investments 119 147 301

Other income from:

unconsolidated subsidiaries 825 11

associated companies 34 38 22

others:

bank and other interest 266 264 302

customer interest and lease income 1,166 2,010 2,154

discounts and other income 81 124 284

income from derivative financial instruments 1,132 1,603 1,075

foreign exchange gains, net 47 ––

Total from others 2,692 4,001 3,815

Total Other income 2,734 4,064 3,848

Total Other financial income 2,856 4,369 4,404

of which:

Other financial income, excluding financial services companies 1,504 2,219 2,188

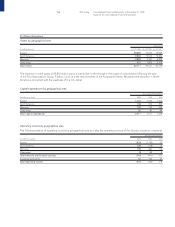

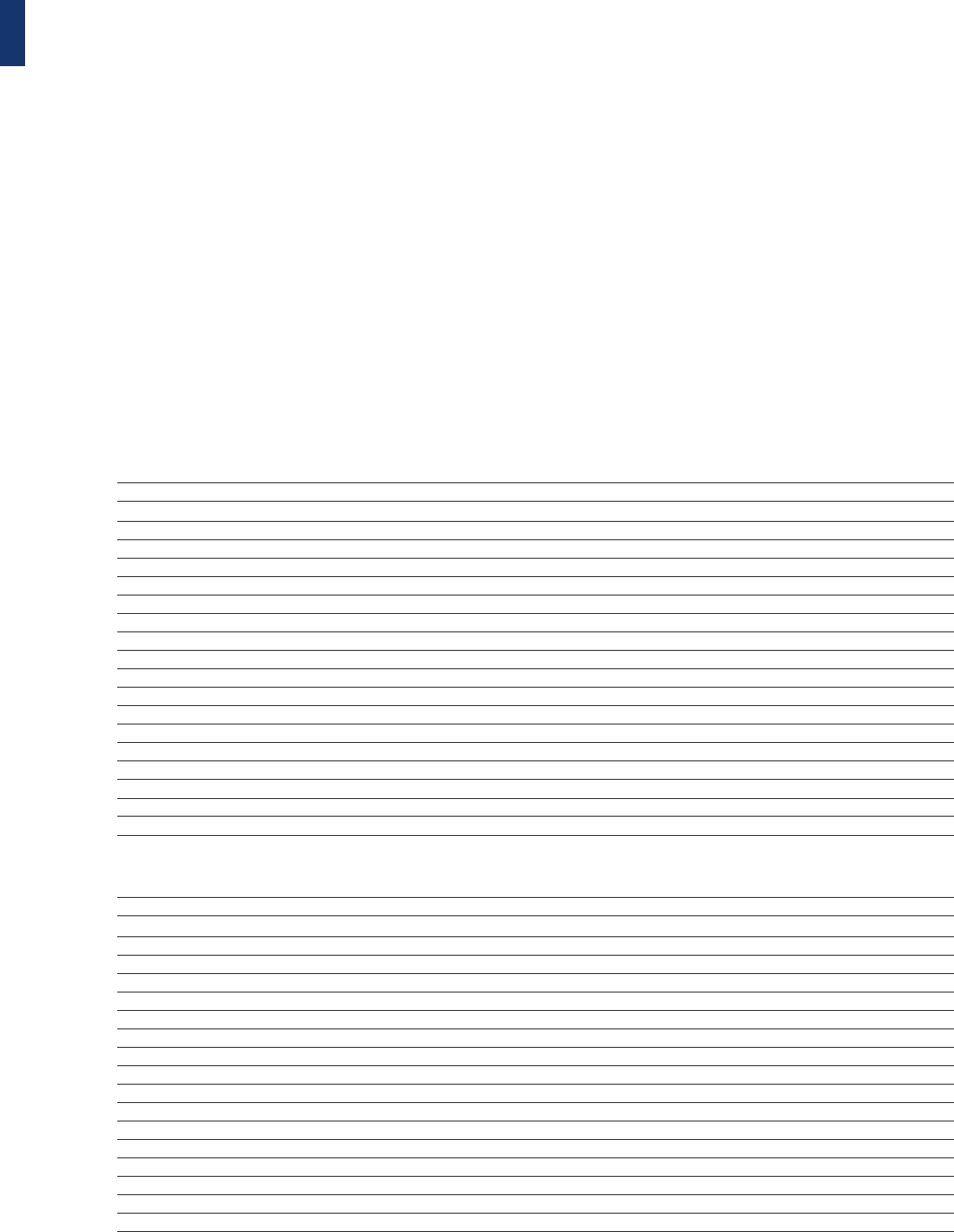

Interest and other financial expenses

(in millions of euros) 2003 2002 2001

Interest and other financial expenses from:

unconsolidated subsidiaries 323

associated companies 6210

others:

bond interest 681 769 625

bank interest 558 656 799

interest on trade and other payables 18 71 63

interest on notes payable 49 106 202

interest on other financial payables 185 273 343

discounts and other expenses 534 635 511

expenses from derivative financial instruments 1,115 1,492 1,255

losses on sale of securities 844 78

foreign exchange losses, net –111 147

Total Interest and other financial expenses - others 3,148 4,157 4,023

Total Interest and other financial expenses 3,157 4,161 4,036

of which:

Interest and other financial expenses, excluding financial services companies 2,489 3,046 3,132