Chrysler 2003 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

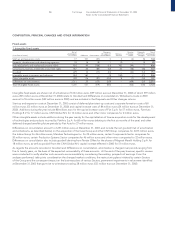

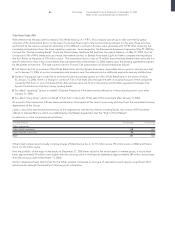

3 Financial fixed assets

Investments

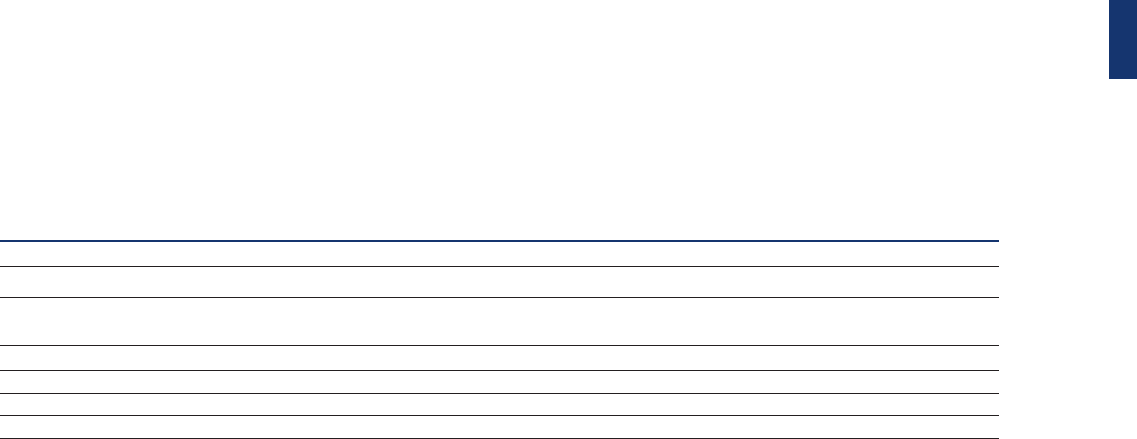

Change in Acquisitions Foreign Disposals

Value at Equity in Equity in the scope of and exchange and Other Value at

(in millions of euros) 12/31/2002 earnings losses consolidation Capitalizations effects changes 12/31/2003

Unconsolidated subsidiaries 558 16 (150) (14) 7 (28) 46 435

Associated companies 2,722 74 (45) 536 29 (59) (55) 3,202

Other companies 682 1 (5) (491) 11 – 59 257

Total Investments 3,962 91 (200) 31 47 (87) 50 3,894

Equity in earnings and Equity in losses include the Group’s share of the income or the loss of companies accounted for using the

equity method. With regard to the companies accounted for at cost, Equity in losses includes the loss in value recorded in the year.

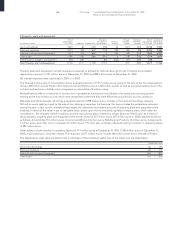

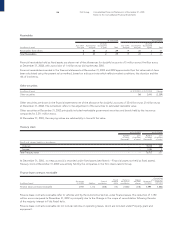

Change in the scope of consolidation (increase of 31 million euros) can be analyzed as follows:

❚Investments in unconsolidated subsidiaries (-14 million euros): the decrease is due to the line-by-line consolidation of the

companies B.D.C. & Co. Société en Commandite Simple (-8 million euros), New City Car S.A. (-2 million euros) and other minor

companies (-4 million euros).

❚Investments in associated companies (536 million euros): the caption includes the effects consequent to the exclusion from the

scope of consolidation of the companies now accounted for using the equity method and the investments held by companies that

were sold during the year. The change particularly refers to: Fidis Retail Italia S.p.A. (376 million euros), Naveco Ltd. (122 million

euros), IPI S.p.A. (16 million euros), Toro Targa Assicurazioni S.p.A. (15 million euros), Transolver Finance Establecimiento Financiero

de Credito S.A. (12 million euros), Fidis Bank G.m.b.H. (3 million euros), IN ACTION S.r.l. (2 million euros), the company Atla S.r.l.

owned by FiatAvio S.p.A. (-4 million euros), investments held by IPI S.p.A. (-5 million euros) and other minor companies (-1 million

euros).

❚Investments in other companies (-491 million euros): the decrease is mainly due to the exclusion from the scope of consolidation

of Capitalia S.p.A. (-481 million euros), Toro Assicurazioni Group holding, and other minor companies (-10 million euros).

Acquisitions and Capitalizations (47 million euros) refer principally to the following acquisitions and capitalizations:

❚Investments in unconsolidated subsidiaries (7 million euros): capitalization of the company Cofap Companhia Fabricadora

de Pecas LTDA (5 million euros) and other minor companies (2 million euros).

❚Investments in associated companies (29 million euros): capitalizations of the companies CNH Capital Europe S.A.S. (10 million

euros), Toro Targa Assicurazioni S.p.A. (9 million euros), Mako Elektrik Sanay Ve Ticaret A.S. (4 million euros) and other minor

companies (6 million euros).

❚Investments in other companies (11 million euros): acquisitions of the companies Gas Turbine Technologies S.p.A. (6 million euros),

IPSE 2000 S.p.A. (3 million euros) and other minor companies (2 million euros).

Disposals and Other changes, which show an increase of 50 million euros, refer principally to:

❚Investments in unconsolidated subsidiaries (46 million euros): line-by-line consolidation of Atlanet S.p.A. (56 million euros) and

other minor companies (-10 million euros).

❚Investments in associated companies (-55 million euros): sale of the companies: E.D.M. S.r.l. (-8 million euros), Johnson Matthey

Argentina S.A. (-3 million euros) and other companies (-44 million euros).

❚Investments in other companies (59 million euros): the increase, net of minor variations for -6 million euros, is due to the

subscription of the Edison S.p.A. capital increase, equal to 65 million euros, through the conversion of the option rights subscribed

to in 2002.