Chrysler 2003 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

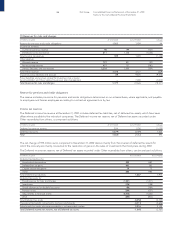

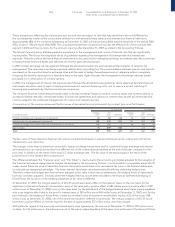

As disclosed in the accounting policies, in recording Deferred tax assets, each company in the Group critically evaluated whether the

conditions existed for the future recoverability of such assets on the basis of updated strategic plans, accompanied by the related tax

plans. For this reason, the total theoretical future tax benefits deriving from positive temporary differences (4,258 million euros) and

tax loss carryforwards (4,313 million euros) have prudently been reduced for a total of 5,216 million euros.

In particular, the Deferred income tax reserve net of Deferred tax assets includes 1,259 million euros (1,478 million euros at December

31, 2002) of tax benefits connected to tax loss carryforwards. However, a further tax benefit connected to tax loss carryforwards of

3,054 million euros (2,168 million euros at December 31, 2002) has not been recorded in the financial statements.

Deferred taxes have not been provided on the undistributed earnings of subsidiaries since no transactions are expected to be

entered into that would warrant their taxation.

Deferred taxes of 72 million euros (127 million euros at December 31, 2002) have not been provided on temporary differences

relating to reserves and provisions in suspension of taxes, since they are not expected to be used in a manner which would warrant

their taxation.

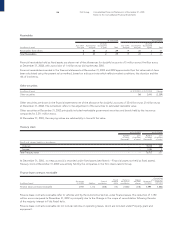

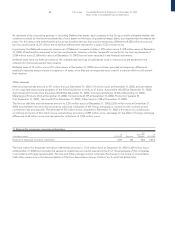

Other reserves

Restructuring reserves amount to 471 million euros at December 31, 2003 (731 million euros at December 31, 2002) and are related

to the corporate restructuring programs of the following Sectors (in millions of euros): Automobile 160 (320 at December 31, 2002),

Agricultural and Construction Equipment 83 (218 at December 31, 2002), Commercial Vehicles 75 (83 at December 31, 2002),

Metallurgical Products 24 (2 at December 31, 2002), Components 64 (59 at December 31, 2002), Production Systems 54

(2 at December 31, 2002), Services 8 (19 at December 31, 2002), Other Sectors 3 (28 at December 31, 2002).

The Various liabilities and risk reserves amount to 2,216 million euros at December 31, 2003 (2,555 million euros at December 31,

2002) and represent the amounts set aside by individual companies of the Group principally in connection with contractual and

commercial risks and disputes. The decrease of 339 million euros compared to December 31, 2002 is the result of a combination

of ordinary provisions of 661 million euros, extraordinary provisions of 289 million euros, decreases for the effect of foreign exchange

differences of 64 million euros and decreases for utilizations of 1,225 million euros.

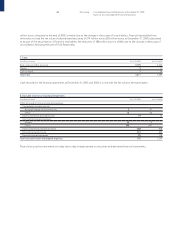

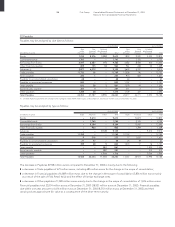

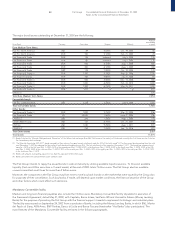

11 Reserve for employee severance indemnities

Use

At and Other At

(in millions of euros) 12/31/2002 Provisions changes 12/31/2003

Reserve for employee severance indemnities 1,609 244 (540) 1,313

The total reserve for employee severance indemnities amounts to 1,313 million euros at December 31, 2003 (1,609 million euros

at December 31, 2002) and includes the severance indemnities accrued at year-end in favor of the employees of the companies

in accordance with legal requirements. The Use and Other changes column comprises the change in the scope of consolidation

(160 million euros) due to the deconsolidation of the Toro Assicurazioni Group, FiatAvio S.p.A. and Fidis Retail Italia.