Chrysler 2003 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

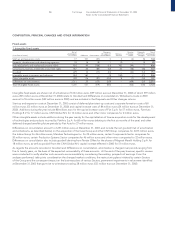

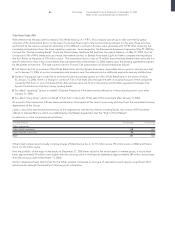

Investments held at December 31, 2003, by type of consolidation method, are analyzed as follows:

(in millions of euros) At 12/31/2003 At 12/31/2002

Investments accounted for using the equity method 3,539 3,161

Investments valued on a cost basis:

listed companies 158 581

unlisted companies 197 220

Total Investments valued at cost 355 801

Total Investments 3,894 3,962

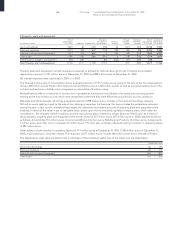

Investments accounted for using the equity method: the increase (378 million euros) is due to the equity method of valuation for the

companies Fidis Retail Italia S.p.A. (372 million euros) and Naveco Ltd. (102 million euros), the foreign exchange effect (-87 million

euros) and other minor changes (-9 million euros).

Investments valued on a cost basis: the decrease (423 million euros) in listed companies is mainly due to the exit of Capitalia S.p.A.

(-481 million euros), a Toro Assicurazioni Group holding, the inclusion of Edison S.p.A. shares (65 million euros) and other minor

changes (-7 million euros). The reduction in unlisted companies valued at cost (-23 million euros) is the result of the sale of the

investment in Johnson Matthey Argentina S.A. (-3 million euros), the exclusion of Atla S.r.l., a company held by FiatAvio S.p.A.

(-4 million euros), certain Toro Assicurazioni Group companies (-3 million euros) and other companies (-13 million euros).

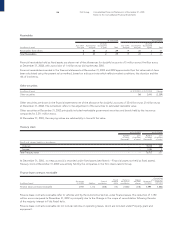

The principal investments in unconsolidated subsidiaries are the following:

At 12/31/2003 At 12/31/2002

(in millions of euros) % Amount % Amount

Unconsolidated subsidiaries:

BUC-Banca Unione di Credito 100.0 340 100.0 361

Leasys S.p.A. 51.0 36 51.0 112

Other unconsolidated subsidiaries (minor amounts) 59 85

Total 435 558

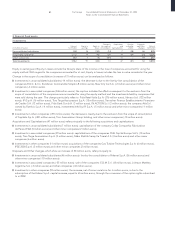

As allowed by law, the above companies have not been consolidated either because their operations are so dissimilar (BUC – Banca

Unione di Credito) or because it would not have been possible to obtain the necessary information for their consolidation on a timely

basis without disproportionate expense or because their operations are not significant. Such companies show a negative net financial

position of 297 million euros (164 million euros at December 31, 2002).

As regards the investment in Leasys S.p.A., this company is subject to joint control with the other partner, even though the Fiat Group

holds 51% of capital stock; like the other principal jointly controlled companies, the investment is accounted for using the equity

method.