Chrysler 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

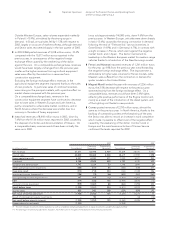

The principal applications of funds during the year consisted of:

❚2,011 million euros in fixed assets (2,771 million euros in

2002), including investments in vehicles to be leased on a long-

term basis for 358 million euros (844 million euros in 2002). A

significant portion of the decrease is attributable to the sale of

Fraikin (long-term vehicle leasing business) and FiatAvio S.p.A.

❚488 million euros in intangible fixed assets (518 million euros

in 2002).

❚A total increase of 3,065 million euros in securities subscribed

to as a temporary and immediately disposable investment

for the cash generated by the sale of assets made in 2003.

Financing activities absorbed 1,228 million euros, compared

with 1,793 million euros absorbed in 2002.

In 2003, the absorption of cash flows was mainly attributable

to the net reimbursement of loans totaling 4,189 million euros –

which also includes reclassification under payables due within

the year of the exchangeable bond of 1,765 million euros

(generation of 2,655 million euros in resources in 2002) – which

was offset by the increase of 1,134 million euros in short-term

payables, although this was due to the previously mentioned

reclassification (absorption of 5,358 million euros in resources in

2002), and the capital increases for a total of 1,860 million euros,

including the capital increase of 1,836 million euros at Fiat S.p.A.

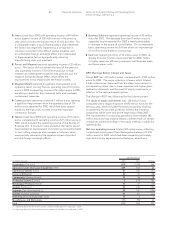

Financial Position and Operating Results by Activity Segment

The following analyses of the statement of operations and

the balance sheet illustrate the contribution made to the

consolidated results by the Group’s continuing operations,

broken down by “Industrial Activities” and “Financial Activities,”

(which include the Fiat Auto, CNH and Iveco companies that

operate retail financing, leasing and rental businesses) and the

activities that were sold or whose sale was pending in 2003

(discontinuing operations).

The figures for discontinuing operations were classified in

accordance with the provisions of Paragraph 3, Article 39 of

Legislative Decree no. 127/91, in view of the significance of

the changes in the composition of the Group that occurred

in 2003 or are pending.

Principles of Analysis

The classification between Industrial and Financial Activities

(for continuing operations only) was realized by defining

specific sub-consolidated financial statements according to

the normal business performed by each Group company.

The equity investments held by companies belonging to an

activity segment in companies included in another segment

were valued according to the equity method.

To avoid skewing the operating result of normal operations

to be represented here, the effect of this valuation on the

statement of operations is illustrated under the item “Result

of intersegment equity investments.”

The holding companies (Fiat S.p.A., IHF-International Holding

Fiat S.A., Fiat Partecipazioni S.p.A., Fiat Netherlands Holding

N.V.) were classified under Industrial Activities.

The sub-consolidated financial statements of the Industrial

Activity segment also includes companies that operate

centralized cash management activities, i.e. that raise financial

resources on the market and finance Group companies, without

providing financial services to others.

When the sub-consolidated figures for the various activities

were identified, the relative goodwill was allocated to the

activities themselves.

The transactions relating to the sale of receivables executed

at market conditions between the industrial and financial

companies of the Group are posted as financial receivables and

payables under Financial Activities. The portion of these items

that, according to the last contractual relationship established

with others, is still of a commercial nature, insofar as it does not

yield interest, was reclassified directly in the sub-consolidated

results of Financial Activities under trade receivables and

payables.

The discontinuing operations include the activities that were

deconsolidated following the sales concluded during fiscal

2003 (Toro Assicurazioni Group, Fraikin, IPI, FiatAvio S.p.A.,

Fidis Retail Italia, and the Brazilian retail financing activities),

and the remaining financial company which is active in the

United Kingdom and is still to be sold to Fidis Retail Italia.

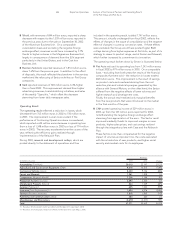

Operating Performance by Activity Segment

Industrial Activities

The net revenues for Industrial Activities, including changes in

contract work in progress, totaled 43,380 million euros, for a

decrease of 7% with respect to the previous year. This decrease

was caused in particular by the negative foreign exchange

effect, the lower volumes of Fiat Auto, and the reduction in

Teksid revenues, which in 2002 included the revenues of the

Aluminum Business Unit until its disposal in September 2002.

The operating result for Industrial Activities in 2003 was a

loss of 938 million euros, reflecting a significant improvement

from the operating loss of 1,585 million euros reported in the

previous year, thanks to a lower operating loss at Fiat Auto

and improved results at CNH, Magneti Marelli, and Comau.

In 2003 EBIT for Industrial Activities was -476 million euros,

compared with -4,169 million euros in 2002.

The change reflected a better operating result, the improved

results of equity investments and, in particular, the positive

balance of non-operating items due to gains realized on

disposals, which were partially reduced by expenses and

provisions to reserves for restructuring, writedowns and

other non-operating expenses and provisions, compared

with an extremely negative balance in fiscal 2002.

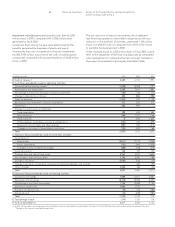

30 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A