Chrysler 2003 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

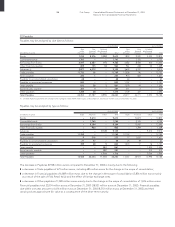

89 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

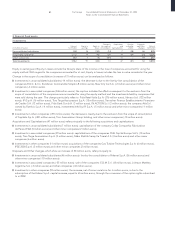

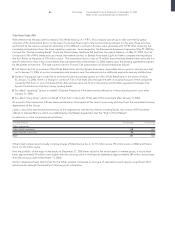

At December 31, 2003, Other securities include short-term bonds and commercial paper (1,480 million euros) and highly rated

liquidity funds of leading international banks (2,365 million euros) in which mainly the treasury management companies of the

Group had made temporary and highly liquid investments of available cash resources that arose mainly as a result of the significant

divestitures by the Group. Additional liquidity in the form of bank accounts and cash is included in Cash (3,211 million euros-Note 7).

At December 31, 2002, Other securities comprised securities with a broad market issued by debtors with a high credit rating

and mainly held by the insurance companies to cover, for the most part, policy liabilities and accruals.

The securities portfolio of 3,845 million euros at December 31, 2003 (6,769 million euros at December 31, 2002) approximates

fair value.

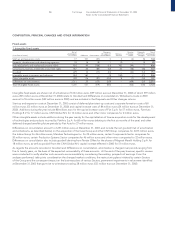

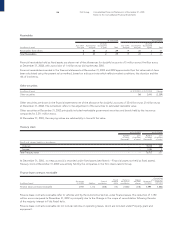

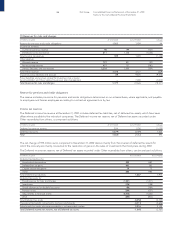

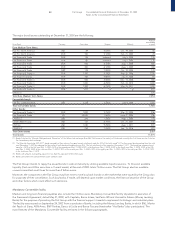

Treasury stock

At 12/31/2003 At 12/31/2002

Number Cost Number Cost

of shares (in millions of shares (in millions

(thousands) of euros) (thousands) of euros)

Fiat S.p.A. shares held by Fiat S.p.A. and subsidiaries:

Ordinary 4,969 32 2,530 22

Total Treasury stock 4,969 32 2,530 22

Treasury stock consists of 4,969,034 Fiat ordinary shares held by Fiat S.p.A. and Fiat Ge.Va. S.p.A. and amounts to 32 million euros,

net of writedowns recorded during the year totaling 5 million euros.

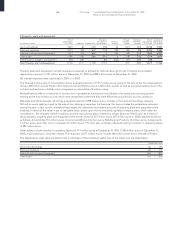

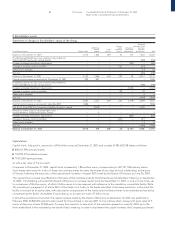

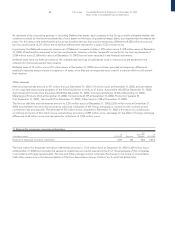

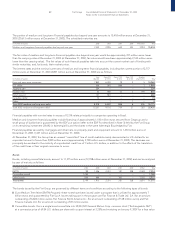

Financial receivables

At 12/31/2003 At 12/31/2002

Due Due Of which Due Due Of which

within beyond due beyond within beyond due beyond

(in millions of euros) one year one year 5 years Total one year one year 5 years Total

Receivables from unconsolidated subsidiaries 475 46 – 521 348 163 – 511

Receivables from associated companies 413 231 – 644 912 401 – 1,313

Receivables from others 6,488 3,097 422 9,585 9,216 7,371 935 16,587

Total Financial receivables 7,376 3,374 422 10,750 10,476 7,935 935 18,411

Financial receivables amounting to 10,750 million euros at December 31, 2003 (18,411 million euros at December 31, 2002), net

of allowances for doubtful accounts of 316 million euros (523 million euros at December 31, 2002), decreased by 7,661 million euros

compared to the end of the prior year. Such reduction is mainly due to the change in the scope of consolidation (6,183 million euros)

particularly as a result of the sale of the retail financing activities of the Automobile Sector.

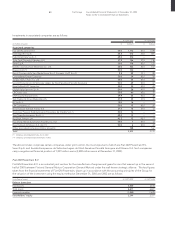

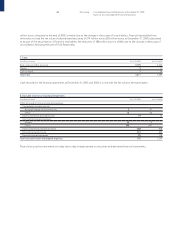

Movements in the allowance accounts during the year are as follows:

Use and Change in

At Other the scope of At

(in millions of euros) 12/31/2002 Provisions changes consolidation 12/31/2003

Allowances for doubtful accounts 523 188 (115) (280) 316

The fair value of Financial receivables would be approximately 10,800 million euros at December 31, 2003 (18,454 million euros at

December 31, 2002). The fair value of financial receivables was determined in accordance with the method indicated in Note 3 -

Financial fixed assets – Receivables.

Receivables from associated companies of 644 million euros at December 31, 2003 (1,313 million euros at December 31, 2002)

decreased by 669 million euros due to loan repayments.

Financial receivables from others amount to 9,585 million euros at December 31, 2003 (16,587 million euros at December 31, 2002),

of which 7,914 million euros at December 31, 2003 (15,615 million euros at December 31, 2002) consist of financing granted to retail

customers as well as dealer networks and suppliers. As regards the receivables from the dealer networks, reference can be made to

the information provided in the Report on operations – Analysis of the Financial Position and Operating Results of the Fiat Group

and Fiat S.p.A., with regard to the note on the Net Financial Position. The reduction in Financial receivables from others of 7,002