Chrysler 2003 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

The balance sheets of foreign subsidiaries are translated into

euros by applying the exchange rates in effect at year end. The

statements of operations of foreign subsidiaries are translated

using the average exchange rates for the year. In the financial

statements of subsidiaries operating in high-inflation countries

(cumulative inflation in excess of 100% in three years),

accounting principles for hyperinflationary economies are used.

Exchange differences resulting from the translation of opening

stockholders’ equity at current exchange rates and at the

exchange rates used at the end of the previous year, as well as

differences between net income expressed at average exchange

rates and expressed at current exchange rates, are reflected in

the stockholders’ equity caption “Cumulative translation

adjustments”.

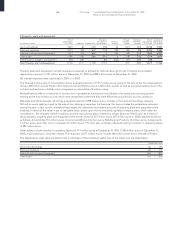

The exchange rates used are summarized in Note 23.

OTHER INFORMATION

The following information is presented in the Report on

Operations:

❚Significant events occurring since the end of the fiscal

year and business outlook;

❚Transactions among Group Companies and with related

parties;

❚Statement of cash flows;

❚Transition to International Accounting Standards.

Accounting principles

Balance sheet

Fixed assets

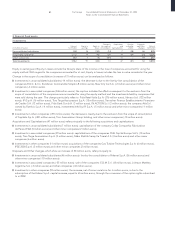

Intangible fixed assets

Intangible assets and deferred charges expected to benefit

future periods are recorded at cost, adjusted by amortization

calculated on a straight-line basis over the period to be

benefited. In particular, goodwill and differences on

consolidation are amortized over a period of no more than

20 years, taking into account their expected period of recovery.

In general, the Group periodically reviews that the carrying value

of such assets is not higher than the estimated recovery value,

in relation to their use or realization, as determined by reference

to the most recent corporate plans. In cases in which there is a

permanent impairment in the estimated recovery value that is

lower than carrying value, appropriate writedowns are recorded.

The costs of researching and developing new products and/or

processes are mainly included in the results of operations in the

period in which such costs are incurred in line with the principle

of prudence and with international practice in the Automotive

industry.

Goodwill is recorded as an asset when acquired for

consideration.

Property, plant and equipment

Property, plant and equipment are recorded at purchase or

construction cost. These values are adjusted where specific laws

of the country in which the assets are located allow or require

revaluation, in order to reflect, even if only partially, changes

in the purchasing power of the currency. Cost also includes

financing expenses incurred during the construction period

for specific loans, where significant.

Depreciation is provided on a straight-line basis at rates that

reflect the estimated useful life of the related assets.

When, at the balance sheet date, property, plant and equipment

show a permanent impairment in value below their carrying

value, such assets are written down to the lower value,

according to the method indicated above for intangible assets.

Ordinary repairs and maintenance expenses related to property,

plant and equipment are charged to the statement of

operations in the year in which they are incurred, while

maintenance expenses which increase the value of property,

plant and equipment are capitalized and depreciated over

the estimated useful lives of the assets.

Capital investment grants related to investments in property,

plant and equipment are recorded as deferred income when

collection becomes certain and credited to income over the

useful life of the related asset.

Properties held by insurance companies to cover policy liabilities

and accruals are stated at acquisition cost and adjusted by the

compulsory law on revaluations imposed on Italian companies;

however, the carrying amounts do not exceed market value.

Depreciation is determined based on the useful life and

expected recovery value.

The revaluation of assets allowed by Law No. 342/2000, which

effected only a very few Italian companies of the Group, was

reversed in the consolidated financial statements, for purposes

of giving preference to the uniformity and comparability of the

accounting principles.

Financial fixed assets

Financial fixed assets include investments in unconsolidated

subsidiaries, associated companies and other companies,

financial receivables held for investment purposes, treasury

stock and other securities.

Investments in unconsolidated subsidiaries, in companies

in which Fiat exercises joint control with other partners and

in associated companies (those in which Fiat exercises, directly

or indirectly, a significant influence) are normally accounted for

using the equity method. This method is not used in cases in

which the investor no longer exercises significant influence over

the investee, in which case the cost is considered to be the

value of the investment taken from the prior year’s financial

statements.

Investments in other companies are valued at cost. In the event

of a permanent impairment in value, a specific allowance is

provided as a direct reduction of the asset account.