Chrysler 2003 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

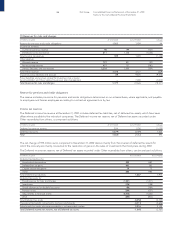

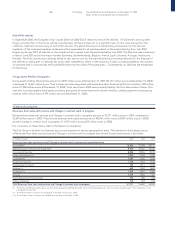

At December 31, 2003, Guarantees granted by the Group total 6,430 million euros (5,642 million euros at December 31, 2002),

detailed as follows:

❚suretyships total 3,060 million euros (1,638 million euros at December 31, 2002. The increase of 1,422 million euros mainly refers

to guarantees that are still being provided to third parties which had previously been granted for the debt of companies in the

Fiat Group that are now controlled by Fidis Retail Italia, which was deconsolidated.

❚Other unsecured guarantees of 3,075 million euros (3,373 million euros at December 31, 2002) include commitments for receivables

and bills discounted with recourse in the amount of 2,203 million euros (2,518 million euros at December 31, 2002). The receivables

and bills discounted with recourse refer to trade receivables and other receivables for 2,144 million euros (2,505 million euros at

December 31, 2002) and financial receivables for 59 million euros (13 million euros at December 31, 2002). The volume of

receivables discounted with recourse in 2003 was 15,341 million euros (20,743 million euros in 2002).

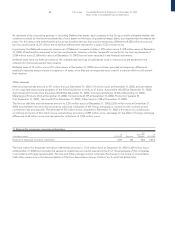

Although not included in the memorandum accounts, receivables and bills discounted by the Group without recourse having due

dates beyond December 31, 2003 amount to 9,852 million euros (in 2002, 13,794 million euros with due dates beyond December 31,

2002). Receivables and bills discounted without recourse refer to trade receivables and other receivables for 4,638 million euros (4,537

million euros at December 31, 2002) and financial receivables for 5,214 million euros (9,257 million euros at December 31, 2002). The

discounting of financial receivables principally refers to securitization transactions involving accounts receivables from the final (retail)

customers of the financial services companies. The accounting treatment for securitization transactions is disclosed in the Accounting

Principles. The volume of receivables and bills discounted without recourse in 2003 was 33,298 million euros (30,502 million euros in

2002).

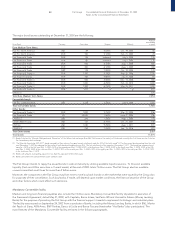

In summary, the discounted receivables and bills at December 31, 2003 are as follows:

At 12/31/2003 At 12/31/2002

Trade Trade

Receivables Receivables

and Other Financial and Other Financial

(in millions of euros) Receivables Receivables Total Receivables Receivables Total

With recourse 2,144 59 2,203 2,505 13 2,518

Without recourse 4,638 5,214 9,852 4,537 9,257 13,794

The Parent Company and certain of its subsidiaries are involved in various legal actions and disputes. However, the settlement of

such actions and disputes should not give rise to significant losses or liabilities which have not already been set aside in specific risk

reserves.

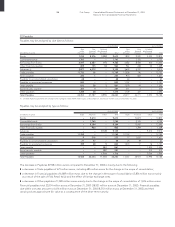

Commitments

(in millions of euros) At 12/31/2003 At 12/31/2002

Commitments related to derivative financial instruments 20,798 38,535

Commitments to purchase property, plant and equipment 329 494

Other commitments 10,350 9,884

Total Commitments 31,477 48,913

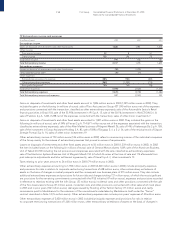

Commitments amount to 31,477 million euros at December 31, 2003 (48,913 million euros at December 31, 2002) and include

derivative financial instruments of 20,798 million euros at December 31, 2003 (38,535 million euros at December 31, 2002).

In particular, the following transactions exist at December 31, 2003:

❚contracts to hedge foreign exchange risks of 4,830 million euros (7,590 million euros at December 31, 2002);

❚contracts to hedge interest rate exposure of 14,142 million euros (27,361 million euros at December 31, 2002);

❚contracts for combined hedging of foreign exchange and interest rate risks of 848 million euros (2,480 million euros at December

31, 2002).

❚equity swaps for 978 million euros (1,104 million at December 31, 2002).

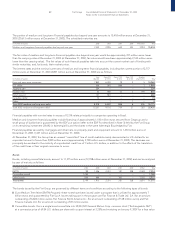

The decrease in the nominal amounts of the above derivative financial contracts compared to December 31, 2002 is largely due

to extraordinary transactions during the period which led to the deconsolidation of outstanding positions and the early closing

of certain loans and the relative hedges.