Chrysler 2003 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

152 Fiat S.p.A. Financial Statements at December 31, 2003

Notes to the Financial Statements

Receivables and payables denominated in currencies of non-

EMU countries are converted into euros using the exchange

rate prevailing at the time when booked. These receivables

and payables are adjusted at year-end exchange rates only in

the case where balances translated at year-end exchange rates

produce a material net exchange loss.

Accruals and deferrals

Accruals and deferrals are determined by the accrual method,

in accordance with the general principle of assigning revenues

and expenses to the accounting period in which they are earned

or incurred.

Reserves for risks and charges

Reserves for risks and charges are established to cover costs

or liabilities that have already been incurred or the occurrence

of which was probable or definite at the end of the fiscal year,

but were undetermined either as to amount or time of probable

occurrence.

Reserve for employee severance indemnities

The reserve for employee severance indemnities represents the

actual liability toward employees accrued as of the end of the

fiscal year and is adjusted each year in accordance with current

laws and collective bargaining agreements.

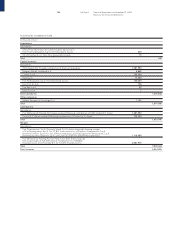

❚MEMORANDUM ACCOUNTS

Suretyships and other unsecured guarantees

The suretyships and other unsecured guarantees granted

on behalf of subsidiaries and others are posted under

memorandum accounts.

The suretyships granted against payment of the leases

of subsidiaries are posted in the amount of the provided

guarantee; the suretyships for the Sava Notes are posted in

the amount of the outstanding notes; the suretyships and other

unsecured guarantees granted for financing, bonds, credit

facilities, and commercial paper of subsidiaries and others are

posted for the value of these notes at December 31.

The Other unsecured guarantees include the amount of

the risk of withdrawal on sales of receivables with recourse.

The receivables sold with recourse are eliminated from

the balance sheet; the risk of withdrawal is reported under

memorandum accounts and described in the notes to the

financial statements.

The suretyships granted by others for enterprise debts, in

particular those granted by the Consortia participating in the

High-Speed Railway Project to guarantee the successful conclusion

of work and the advances posted on the balance sheet under

“Advances,” are not reported under memorandum accounts

but described instead in the notes to the financial statements.

Commitments

The Group’s commitments are posted under memorandum

accounts in their amount at December 31. In particular, the

supply commitments for the High-Speed Railway Project include

the amount of supply commitments envisaged in the original

agreements made with Treno Alta Velocità – T.A.V. S.p.A., the

amounts envisaged in agreements for alterations during

construction, and relative monetary adjustments.

If the amount of a commitment cannot be quantified,

the commitment is not posted under memorandum

accounts but described instead in the notes to the financial

statements.

Derivative financial instruments

Derivative financial instruments are recorded at inception in

the memorandum accounts at their notional contract amount.

More specifically, derivative financial instruments classified

as trading instruments insofar as they do not satisfy the

requirements for hedge accounting treatment (e.g. equity

swaps), are valued at their market value and the differential,

if negative compared to the contractual value, is recorded in

the statement of operations, in Financial income and expenses

in accordance with the principle of prudence.

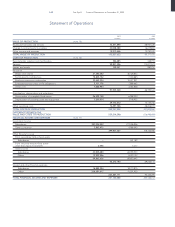

❚STATEMENT OF OPERATIONS

Dividends

Dividends are recorded in the year when declared by the

disbursing companies.

The respective tax credits are booked when the dividends

are collected.

Financial income and expenses

Financial income and expenses are recorded on the accrual

basis.

Costs relating to the sale of receivables of any type (with and

without recourse) and nature (trade, financial, other) are charged

to the statement of operations on an accrual basis.

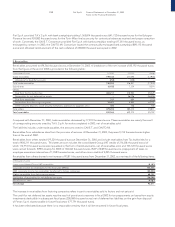

Income taxes

Liability for corporate income taxes due for the fiscal year

is determined in accordance with the current legislation.

Deferred tax assets and liabilities are determined on the basis

of the temporary differences that arise between asset and

liability items and the corresponding tax items.

In particular, deferred tax assets are recognized only when it

is reasonably certain that they will be recovered. Conversely,

deferred tax liabilities are not recognized if it is unlikely that

the corresponding obligations will in fact arise.