Chrysler 2003 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

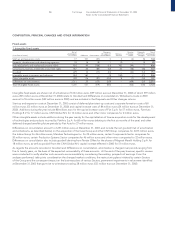

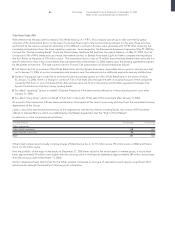

2 Property, plant and equipment

Net of Change in Foreign Disposals Net of

Accumulated

depreciation the scope of Reclassi- exchange and Other depreciation depreciation

(in millions of euros) 12/31/2002 Additions Depreciation consolidation fications effects changes 12/31/2003 12/31/2003

Land and buildings 3,801 60 (150) (730) 36 (121) (160) 2,736 1,903

Plant and machinery 3,721 305 (613) (118) 288 (92) (98) 3,393 7,492

Industrial and commercial equipment 1,511 475 (623) 3 306 (49) (119) 1,504 6,297

Other assets 2,095 480 (364) (507) 6 (78) (318) 1,314 1,674

Construction in progress and advances 978 691 – (65) (636) (37) (203) 728 –

Total Property, plant and equipment 12,106 2,011 (1,750) (1,417) – (377) (898) 9,675 17,366

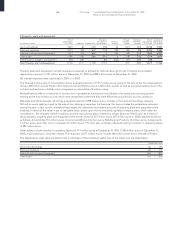

Property, plant and equipment include revaluations required or allowed by national laws, which, net of related accumulated

depreciation, amount to 231 million euros at December 31, 2003 and 288 million euros at December 31, 2002.

No interest expenses were capitalized in 2003 or in 2002.

The Change in the scope of consolidation shows a negative amount of 1,417 million euros owing to the sale of the Toro Assicurazioni

Group (-582 million euros), Fraikin (-514 million euros) and FiatAvio S.p.A. (-326 million euros), as well as a positive balance due to the

inclusion and exclusion of other minor companies in consolidation (5 million euros).

Reclassifications refer to a reduction in construction in progress and advances on purchases of property, plant and equipment

existing at the end of the prior year which were reclassified at the time they were effectively acquired and put into operation.

Disposals and Other changes, which has a negative balance of 898 million euros, include, in the Land and buildings category,

160 million euros relating in part to the sale of non-strategic properties. Furthermore, this item includes the writedowns recorded

during the year. In fact, as with intangible fixed assets, the estimated recoverable amounts of property, plant and equipment were

analyzed, in terms of the value in use or realizable value, based upon the most recently updated company plans, which take into

consideration the changed market conditions and the restructuring plans initiated by certain Sectors of the Group. As a result of

those analyses, property, plant and equipment were written down by 351 million euros (227 million euros in 2002), detailed by Sector

as follows: Automobiles 312 million euros, Commercial Vehicles 6 million euros, Metallurgical Products 16 million euros, Components

7 million euros, and other minor companies 10 million euros. This item also comprises disposals relating to assets on operating leases

of 289 million euros.

Other assets include vehicles on operating leases for 914 million euros at December 31, 2003 (1,585 million euros at December 31,

2002), mainly relating to long-term leases. The reduction of 671 million euros includes 466 million euros due to the sale of Fraikin.

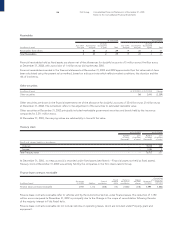

The depreciation rates used are determined on the basis of the estimated useful lives of the assets and are listed below:

Depreciation rates

Land and and buildings 3% – 9%

Plant and machinery 8% – 21%

Industrial and commercial equipment 16% – 28%

Other assets 11% – 25%