Chrysler 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

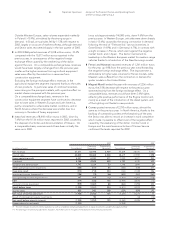

Financial Activities

Financial Activities generated net revenues of 1,870 million

euros in 2003, approximately 19% lower than the 2,305 million

euros generated in 2002.

The reduction in revenues is mainly attributable to lower interest

rates, portfolio selection policies, and the negative effect of the

strengthening of the euro against the dollar. Disposals in the

mobility services segment of the Automobile Sector also had

a negative impact, which was partially offset by consolidation

by the Commercial Vehicles Sector for the entire year of a

company that operates in the field of financing sales outside

Western Europe.

The result before taxes of normal Financial Activities (which

does not include the impact of the result of equity investments

owned by the financial companies in industrial companies)

totaled -22 million euros, compared with +180 million euros

in fiscal 2002.

This decrease is mainly attributable to a lower result from

equity investments, in particular the company Leasys, and

higher net non-operating expenses, which amounted to 119

million euros (positive balance of 35 million euros in 2002)

and derive in particular from revision of the operating and

organizational processes of the rental companies of the

Automobile Sector, and the residual loss caused by the

sale of Fraikin.

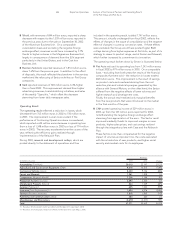

Discontinuing Operations

The net revenues of discontinuing operations totaled 2,949

million euros in 2003 and included the first six months of

2003 for FiatAvio S.p.A. (623 million euros, compared with

1,499 million euros in 2002), the first four months of 2003 for

the Toro Assicurazioni Group (1,654 million euros compared

with 4,916 million euros in 2002), the revenues of the companies

sold to Fidis Retail Italia during the year and the one that is still

to be sold (617 million euros compared with 739 million euros

in 2002), and the first quarter of the Brazilian retail financing

activities of Fiat Auto (55 million euros compared with 349

million euros in 2002). Furthermore, fiscal 2002 included

the revenues of IPI (31 million euros) and Fraikin (517 million euros).

The operating income of discontinuing operations in 2003

totaled 204 million euros, consisting of: six months of FiatAvio

S.p.A. (54 million euros compared with 218 million euros in

2002), the first four months of 2003 for the Toro Assicurazioni

Group (35 million euros compared with 108 million euros in

2002), the operating income of the companies sold to Fidis

Retail Italia during the year and the one that is still to be sold

(108 million euros compared with 142 million euros in 2002),

and the first quarter of the Brazilian retail financing activities

of Fiat Auto (7 million euros against 77 million euros in 2002).

Furthermore, fiscal 2002 included the operating income of

IPI (21 million euros) and Fraikin (20 million euros).

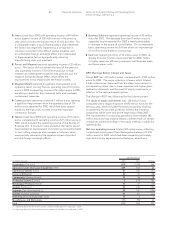

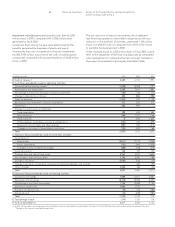

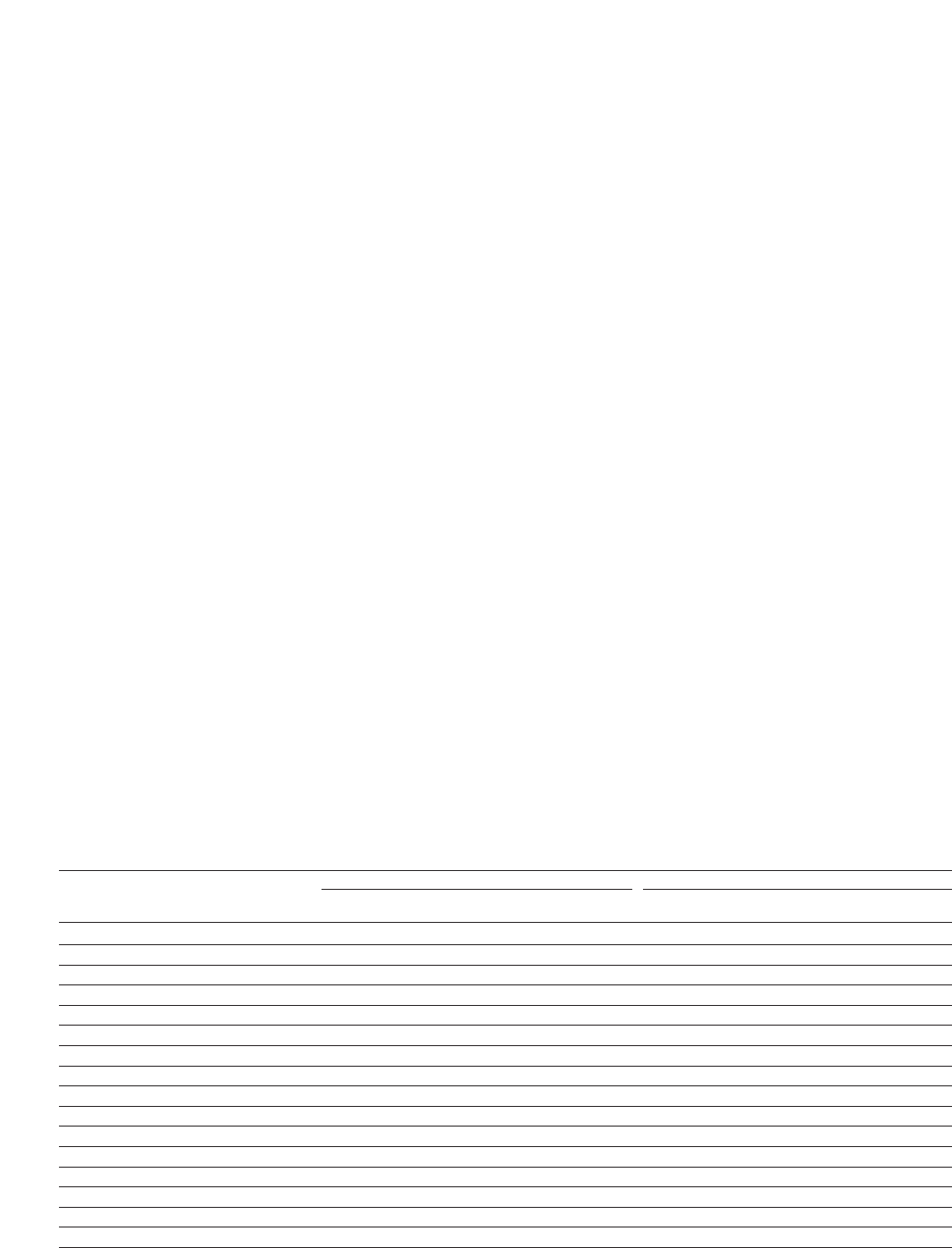

31 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A

2003 2002

Industrial Financial Discontinuing Industrial Financial Discontinuing

(in millions of euros) Consolidated Activities Activities Operations Consolidated Activities Activities Operations

Net revenues 47,271 43,380 1,870 2,949 55,649 46,624 2,305 8,051

Cost of sales 40,830 37,985 1,235 2,538 48,619 41,230 1,622 7,098

Gross operating result 6,441 5,395 635 411 7,030 5,394 683 953

Overhead 4,748 4,186 323 239 5,782 4,778 414 590

Research and development 1,747 1,724 – 23 1,748 1,694 – 54

Other operating income (expenses) (456)(423)(88)55 (262) (507) (32) 277

Operating result (510)(938)224 204 (762) (1,585) 237 586

Investment income (expenses) (*) (156)(16)(63)(46) (690) (282) 3 (360)

Non-operating income (expenses) (**) 347 478 (119)(12) (2,503) (2,302) 35 (236)

EBIT (319)(476)42 146 (3,955) (4,169) 275 (10)

Financial income (expenses) (979)(1,003)(64)88 (862) (999) (95) 232

Result before taxes (1,298)(1,479)(22)234 (4,817) (5,168) 180 222

Income taxes 650 486 55 109 (554) (751) 52 145

Net result of normal operations (1,948)(1,965)(77)125 (4,263) (4,417) 128 77

Result of intersegment investments –13(326)–– 141 (286) (14)

Net result before minority interest (1,948)(1,952)(403)125 (4,263) (4,276) (158) 63

(*) This item includes investment income (expenses) as well as writedowns and upward adjustments in non-intersegment equity investments valued using the equity method.

(**) The 2003 figure for Industrial Activities includes 1,766 million euros in net gains on disposals of assets, while the figure for Financial Activities includes a net loss on disposals

of 24 million euros.