Chrysler 2003 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

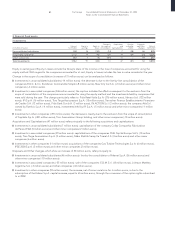

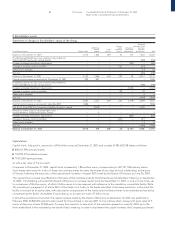

Fidis Retail Italia (FRI)

With reference to the associated company Fidis Retail Italia S.p.A. (“FRI”), this company was set up to take over the European

activities of the Automobile Sector in the area of consumer financing for retail automobile purchases. To this end, those activities,

performed by the various companies operating in the different countries in Europe, were gradually sold to FRI, after obtaining the

necessary authorizations from the local regulatory agencies. As envisaged by the Framework Agreement signed on May 27, 2002 by

Fiat and the “Money Lending Banks” (Capitalia, Banca Intesa, SanPaolo IMI and later Unicredito Italiano), on May 27, 2003, the Fiat

Group sold 51% of FRI’s shares and, as a result, the relative control, to Synesis Finanziaria S.p.A. an Italian company held equally by

the four Banks, at the price of 370 million euros. This transaction led to a loss of 15 million euros that had already been set aside in a

specific reserve for risks in the consolidated financial statements at December 31, 2002, based upon the binding agreements signed

by the parties at that time. The sale contract calls for Put and Call options that can be summarized as follows:

❚Call Option by Fiat to purchase 51% of Fidis Retail Italia, held by Synesis Finanziaria, exercisable twice a year (in January and July)

up to January 31, 2006 at a price increased prorata temporis over the sales price plus additional payments less any distributions.

❚Synesis Finanziaria’s right to ask Fiat to exercise the above purchase option on 51% of Fidis Retail Italia in the event of which,

by January 31, 2006, there is a change in control of Fiat or Fiat Auto (also through the sale of a substantial part of the companies

owned by Fiat Auto or one of its brands Fiat, Alfa and Lancia) as set forth in the relative stockholders agreement between Fiat,

Synesis Finanziaria and the four money lending banks.

❚So-called “tag along” option on behalf of Synesis Finanziaria if the same events referred to in the preceding point occur after

January 31, 2006.

❚So-called “drag along” option on behalf of Fiat Auto in the event of the sale of the investment after January 31, 2006.

As a result of the transaction, FRI was deconsolidated and has repaid all the loans it previously obtained from the centralized treasury

department of the Group.

Lastly, it should be mentioned that previous to the negotiations with the four Money Lending Banks, the control of FRI had been

offered to General Motors, which, as established by the Master Agreement, had the “Right of First Refusal”.

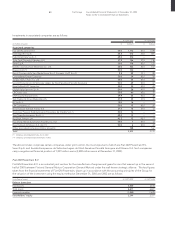

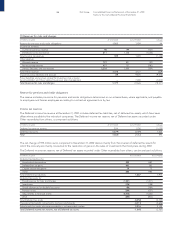

Investments in other companies are as follows:

(in millions of euros) At 12/31/2003 At 12/31/2002

Other companies:

Other listed companies 158 581

Other unlisted companies 99 101

Total 257 682

Other listed companies principally comprise shares of Mediobanca S.p.A. for 93 million euros (93 million euros in 2002) and Edison

S.p.A. for 65 million euros.

Had the portfolio of the major listed stocks at December 31, 2003 been valued at fair value based on market prices, it would have

been approximately 59 million euros higher than the carrying value in the financial statements (approximately 286 million euros lower

than the carrying value at December 31, 2002).

No fair values have been determined for the Other unlisted companies as this type of calculation would require a significant effort

which would outweigh the benefits of obtaining such information.