Chrysler 2003 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

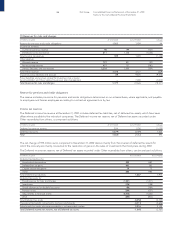

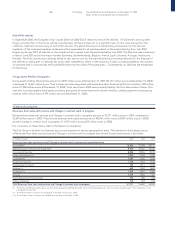

shares and which was put into place to hedge the risk, implicit in the Exchangeable bonds described previously, of an increase in

the General Motors share price above the conversion price (Note 12). It also comprises the equity swaps stipulated to hedge the risk

of an increase in the Fiat share price above the exercise price of the stock options assigned to Mr. Giuseppe Morchio as described in

the following paragraphs.

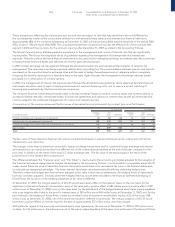

With regard to the equity swaps on General Motors shares, in fact, the Exchangeable bonds issued at the start of 2002 are

convertible into the same number of General Motors shares as once held by the Fiat Group (32,053,422 shares). The option exercise

price implicit in the bonds coincides with the pre-sale unit carrying value, in U.S. dollars, of the General Motors shares in the

consolidated financial statements of Fiat, prior to the sale made in 2002, of 69.54 U.S. dollars per share. Accordingly, at the time the

bonds were issued the risk of an increase in the General Motors share price above 69.54 U.S. dollars per share was covered by the

shares held by Fiat. At the time of the sale of the General Motors shares by Fiat in December 2002, in order to hedge the above-

mentioned risk implicit in the Exchangeable bonds, Fiat contemporaneously stipulated with the bank acquiring the shares a “Total

Return Equity Swap” derivative contract (hereinafter “Equity Swaps”) relating to the same number of General Motors shares and

having the following main characteristics:

❚In line with the expiry of the Exchangeable bonds, at maturity, Fiat will settle with the counterparty bank the price variances

between the initial General Motors share price (36.11 U.S. dollars per share) and the final share price, cashing in on a positive share

price performance or paying for a negative performance.

❚Throughout the duration of the bonds, Fiat will pay the counterparty variable interest applied on the notional value of the contract

(equal to the sale price of 1,157 million U.S. dollars).

❚Any dividends distributed by General Motors on the sold shares will be repaid to Fiat by the counterparty.

❚As a guarantee for the payment of the above-mentioned variance, if negative, Fiat deposited a remunerated amount in an account

with the bank. Such collateral will be adjusted in relation to the relative exposure of the two parties and at December 31, 2003

amounts to 183 million euros (221 million euros at December 31, 2002).

❚At the closing of the Equity Swaps, Fiat will not possess any rights to repurchase the sold shares.

❚The Equity Swaps can be settled at an earlier date, in whole or in part, at any time.

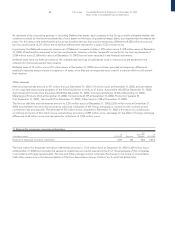

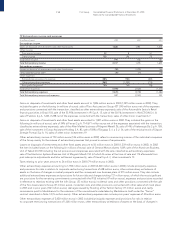

In accordance with accounting principles, the aforementioned Equity Swaps, despite being entered into for hedging purposes,

cannot be treated in hedge accounting and accordingly is defined as a trading derivative financial instrument. It follows that, in

accordance with the principle of prudence, if during the period of the contract General Motors shares perform positively, the positive

fair value of the instrument is not recorded in the statement of operations; if, instead, the performance is negative, the negative fair

value of the instrument is recorded immediately as a cost within financial expenses. At December 31, 2003, the Equity Swaps have

a positive fair value of 439 million euros (23 million euros at December 31, 2002), that has not been recorded in the financial

statements.

As regards the Equity Swaps on Fiat shares, the Board of Directors resolved in 2003 to assign options to Mr. Giuseppe Morchio, as

the only variable component of his compensation for the post of CEO, for the purchase of 13,338,076 Fiat ordinary shares at a price

of euro 5.623 per share, which can be exercised from March 27, 2004 to March 27, 2010. The right to purchase a maximum amount of

20% of the total matures in each of the first five years. Two-thirds of the options that will mature from March 27, 2005 to 2008 can be

exercised only upon reaching preestablished profit objectives during the period of reference. The risk of a significant increase in the

Fiat share price above the exercise price of these options is covered, with reference to 3,338,076 shares, by treasury stock in portfolio,

whereas with reference to the remaining 10,000,000 shares, the aforementioned “Total Return Equity Swap” agreement was put into

place with a reference price of 6.173 euro per share and expiring on August 31, 2004. In accordance with accounting principles, the

aforementioned Equity Swaps, despite being entered into for hedging purposes, cannot be treated in hedge accounting and

accordingly is defined as a trading derivative financial instrument. It follows that, in accordance with the principle of prudence, if

during the period of the contract the Fiat shares perform positively, the positive fair value of the instrument is not recorded in the

statement of operations; if, instead, the performance is negative, the negative fair value of the instrument is recorded immediately

as a cost within financial expenses. At December 31, 2003, the Equity Swaps have a negative fair value of 1 million euros that has

therefore been recorded in the financial statements.

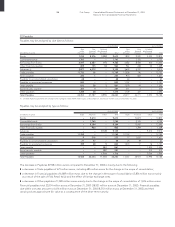

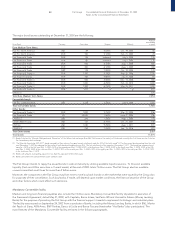

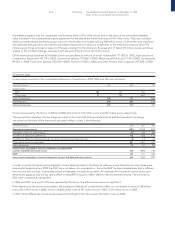

Other commitments amounted to 10,350 million euros at December 31, 2003 (9,884 million euros at December 31, 2002) and include

commitments for the execution of works in the amount of 8,011 million euros (7,718 million euros at December 31, 2002) under the

contracts between Fiat S.p.A., as General Contractor, and Treno Alta Velocità T.A.V. S.p.A. for the design and construction of a high-

speed railway lines between Bologna - Florence and Turin - Milan. The increase of 293 million euros compared to December 31, 2002

relates principally to the agreements reached during 2003 regarding the Florence-Bologna section, concerning alterations to the

network (28 million euros), urgent improvement work (26 million euros) and monetary adjustments (46 million euros) and agreements

relating to the Turin-Novara sub-line, concerning alterations (129 million euros) and monetary adjustments (64 million euros). Fiat