Chrysler 2003 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

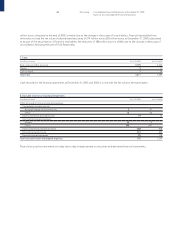

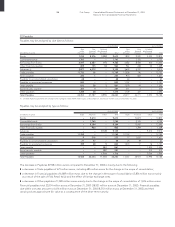

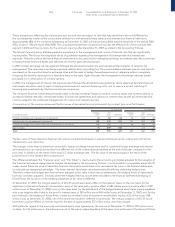

The portion of medium and long-term Financial payables due beyond one year amounts to 15,418 million euros at December 31,

2003 (20,613 million euros at December 31, 2002). The scheduled maturities are:

(in millions of euros) 2005 2006 2007 2008 Thereafter Total

Medium and long-term financial payables due beyond one year 7,443 2,955 643 424 3,953 15,418

The fair value of medium and long-term Financial payables due beyond one year would be approximately 397 million euros lower

than the carrying value at December 31, 2003 (at December 31, 2002, fair value would have been approximately 2,169 million euros

lower than the carrying value). The fair values of such financial payables take into account the current market cost of funding with

similar maturities, and, for bonds, their market prices.

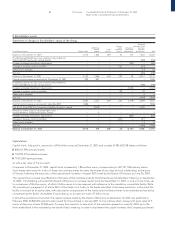

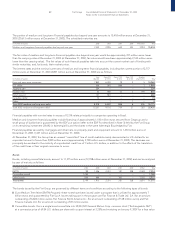

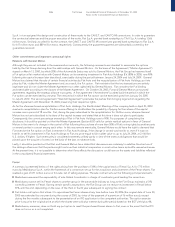

The interest rates and the nominal currencies of medium and long-term financial payables, including the current portion of 2,757

million euros at December 31, 2003 (4,807 million euros at December 31, 2002) are as follows:

Less From 5% From 7.5% From 10% Greater

(in millions of euros) than 5% to 7.5% to 10% to 12.5% than 12.5% Total

Euro and euro-zone currencies 7,853 6,330 78 3 5 14,269

U.S. dollar 554 591 848 – 1 1,994

Japanese yen 304 – – – – 304

Brazilian real 32 580 42 2 194 850

British pound 101 581 – – – 682

Canadian dollar 74––––74

Other –1–1–2

Total 2003 medium and long-term debt 8,918 8,083 968 6 200 18,175

Total 2002 medium and long-term debt 15,257 9,116 754 31 262 25,420

Financial payables with nominal rates in excess of 12.5% relate principally to companies operating in Brazil.

Medium and long-term financial payables include financing of approximately 1,150 million euros secured from Citigroup and a

small group of banks that is guaranteed by the EDF put option (refer to the EDF Put described in Note 3) held by the Fiat Group

on its remaining investment (24.6%) in Italenergia Bis and the shares in the same Italenergia Bis pledged by Fiat.

Financial payables secured by mortgages and other liens on property, plant and equipment amount to 1,234 million euros at

December 31, 2003 (1,447 million euros at December 31, 2002).

At December 31, 2003, the Group has an unused “committed” line of credit available mainly denominated in U.S. dollars for an

equivalent amount of more than 2,000 million euros (approximately 3,700 million euros at December 31, 2002). The decrease can

principally be ascribed to the maturity of a syndicated credit line of 1 billion U.S. dollars, in addition to the effects of the translation

of the credit lines in their original currencies to euros.

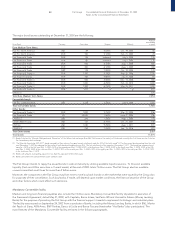

Bonds

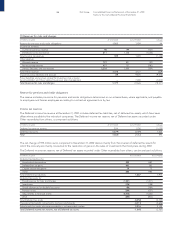

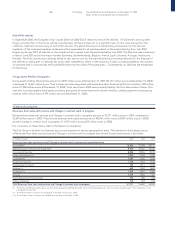

Bonds, including convertible bonds, amount to 11,375 million euros (12,998 million euros at December 31, 2002) and can be analyzed

by year of maturity as follows:

(in millions of euros) 2004 2005 2006 2007 2008 Other Total

EMTN 98 1,426 2,351 181 228 2,769 7,053

Convertible bonds 1,765 –––– – 1,765

Other bonds 936 489 – 100 – 1,032 2,557

Total bonds 2,799 1,915 2,351 281 228 3,801 11,375

The bonds issued by the Fiat Group are governed by different terms and conditions according to the following types of bonds:

❚Euro Medium Term Note (EMTN Program): these notes have been issued under a program that is utilized for approximately 7

billion euros and guaranteed by Fiat S.p.A. Issuers taking part in the program are Fiat Finance & Trade Ltd. S.A. (for an amount

outstanding of 6,824 million euros), Fiat Finance North America Inc. (for an amount outstanding of 148 million euros) and Fiat

Finance Canada Ltd. (for an amount outstanding of 81 million euros).

❚Convertible bonds: this is a single bond convertible into 32,053,322 General Motors Corp. common stock (“Exchangeable GM”)

at a conversion price of 69.54 U.S. dollars per share with coupon interest at 3.25% and maturing on January 9, 2007 for a face value