Chrysler 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A

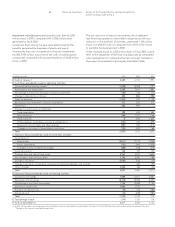

FINANCIAL POSITION AND OPERATING PERFORMANCE

OF FIAT S.P.A.

Statement of Operations

The net loss of the Parent Company for the fiscal year as resulting

from the Statement of Operations was 2,359 million euros,

compared with a net loss of 2,053 million euros in fiscal 2002.

The following table contains a breakdown of this result:

(in millions of euros) 2003 2002

Investment income 400 278

Adjustments (2,379) (2,866)

Net financial expenses (169) (26)

Cost of personnel and services, less revenues (130) (126)

Non-operating income (expenses) (20) 632

Income taxes (61)55

Net result (2,359) (2,053)

Net investment income totaled 400 million euros. It consists of

dividends, including the respective tax credits, paid by subsidiaries

and associated companies.

A breakdown of the dividends received in 2003 and 2002 is

provided in the Notes to the Financial Statements of Fiat S.p.A.

Adjustments totaled 2,379 million euros in 2003 and principally

reflect the writedowns in the book value of the subsidiaries Fiat

Partecipazioni S.p.A. (formerly Sicind S.p.A.) due to the negative

performance of the Automobile Sector (1,210 million euros), Fiat

Netherlands Holding N.V. due to losses at the subsidiaries Iveco

and CNH (1,000 million euros), and Magneti Marelli Holding S.p.A.

(144 million euros).

In 2002, the adjustments were mainly accounted for by Fiat

Partecipazioni S.p.A. (1,189 million euros), Fiat Netherlands

Holding N.V. (732 million euros), Comau B.V. (350 million euros),

Sicind S.p.A. (291 million euros), and Iveco N.V. (280 million euros).

Net financial expenses totaled 169 million euros, against 26

million euros in 2002, representing an increase of 143 million

euros, mainly due to the increase in average indebtedness

caused by investments in equity interests.

The cost of personnel and services, less revenues, totaled 130

million euros (126 million euros in 2002). In particular, the cost

of personnel and services totaled 243 million euros, compared

with 221 million euros in 2002. The 22-million-euro increase stems

mainly from higher costs related to personnel who left the

Company. The average number of employees was 167 (including

15 seconded to the principal companies of the Group),

compared with 210 employees in 2002 (including 16 seconded

employees). Revenues totaled 113 million euros, or an increase

of 18 million euros over the previous fiscal year. They included

royalties from the right to use the Fiat trademark, computed as

a percentage of the sales of the individual Group companies,

and fees for services rendered by management personnel.

Net non-operating expenses totaled 20 million euros and

largely comprised commissions paid to Mediobanca for the

postponement of the commitments undertaken by Mediobanca

itself in the framework of the Ferrari contract mentioned in Note

14 of the Financial Statements of Fiat S.p.A. (16 million euros).

In 2002, net non-operating income was represented for 630

million euros by the net gain realized on the sale of 34% of

Ferrari S.p.A. to Mediobanca S.p.A.

Income taxes totaled 61 million euros, resulting from cancellation

of the net deferred tax assets set aside in previous years, as

there is no reasonable certainty that they will be recovered

in subsequent fiscal years.

For the same reason, tax prepayments on the tax loss for

the fiscal year were not counted.

Income taxes in 2002 were represented by 55 million euros

in prepaid income taxes to be recovered.

Balance Sheet

The following table illustrates highlights of the Balance Sheet

of the Parent Company:

(in millions of euros) At 12/31/2003 At 12/31/2002

Fixed assets 7,404 8,144

Working capital 77 (169)

Total net invested capital 7,481 7,975

Stockholders’ equity 5,415 5,934

Net Financial Position (2,066) (2,041)

Fixed assets consist mainly of investments in the Group’s

principal companies. The total value at December 31, 2003 was

7,282 million euros, for a net decrease of 768 million euros since

December 31, 2002.

The principal increases involved the subscription of capital

increases at Fiat Partecipazioni S.p.A. (formerly Sicind S.p.A.)

(100 million euros), Comau B.V. (100 million euros) and CNH

(“preference shares”) subsequently contributed to Fiat

Netherlands Holding N.V. (1,382 million euros).

The decreases mainly stem from a total of 2,374 million euros

in writedowns of the subsidiaries Fiat Partecipazioni S.p.A., Fiat

Netherlands Holding N.V. and Magneti Marelli Holding S.p.A.

Working capital consists of receivables from and payables to Tax

Authorities, trade receivables and payables, and receivables

from and payables to employees for 49 million euros, and ordinary

treasury stock for 28 million euros (4,384,019 shares). It shows an

increase of 246 million euros with respect to December 31, 2002,

primarily in consequence of reimbursement of the 250 million

euros in cash collateral paid in 2002 by the CAV.TO.MI. consortium

as security for the issuance of contractually agreed suretyships.

Stockholders’ equity totaled 5,415 million euros at December

31, 2003, for a decrease of 519 million euros since the end of

2002. The changes are the net result of the capital increase

resolved by the Board of Directors on June 26, 2003 (1,836

million euros) and the net loss for the year (2,359 million euros).

Net financial position at the end of 2003 was negative by 2,066

million euros, against 2,041 million euros in the previous year.

It includes the Convertible Facility of 3 billion euros granted by

a pool of banks which expires in September 2005, as described

in detail in the specific section of the Notes to the Financial

Statements of Fiat S.p.A. The worsening stems mainly from the

previously described investments in equity holdings, which were

partially offset by the amounts collected for the capital increase.

An analysis of cash flows is provided at the end of the Notes to

the Financial Statements of S.p.A.