Chrysler 2003 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

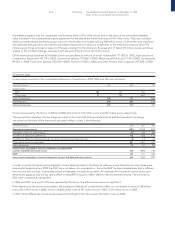

❚Fiat may share, in declining percentages, in any gain realized by Mediobanca and the other members of the consortium in the

event of an IPO.

Ixfin

At the end of 2003 the Fiat Group signed an agreement with the Ixfin group which had previously purchased Magneti Marelli

Sistemi Elettronici from the Mekfin group, to which Fiat had sold that business in 2002. Ixfin Magneti Marelli Sistemi Elettronici is

considered as a strategic supplier of both Fiat Auto and other automotive groups that were formerly customers of Magneti Marelli.

In order that Ixfin Magneti Marelli Sistemi Elettronici could regularly meet the commitments undertaken with its customers and

pursue development strategies for its business, a decision was taken to sign the aforementioned agreement, in the context of

which, besides obtaining a series of guarantees:

❚Magneti Marelli Holding S.p.A. signed a contract for the beneficial interest in the shares of Ixfin Magneti Marelli Sistemi Elettronici,

valid until December 31, 2004, by which it is entitled to the voting rights and all the other administrative rights;

❚Fiat Netherland Holding (at one time a Magneti Marelli Sistemi Elettronici stockholder and therefore a creditor company for

the balance of the sale price) acquired a Call option (transferable) from the Ixfin group that is exercisable at any time up to

December 31, 2004 for the purchase of Ixfin Automotive, the direct parent company of Ixfin Magneti Marelli Sistemi Elettronici,

or, alternatively, Ixfin Magneti Marelli Sistemi Elettronici itself. The purchase price of the opted shares is 45 million euros.

Furthermore, in the event the Call option is exercised, Fiat Netherland Holding will assume the debt that the group of sellers

has with Ixfin Magneti Marelli Sistemi Elettronici and with the other companies that would be acquired for a total of 53 million

euros. The price that would eventually be paid in total if the Call option is exercised would thus be equal to 98 million euros.

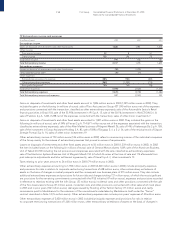

Teksid

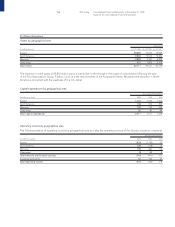

Teksid S.p.A. is the object of a Put and Call contract with the partner Norsk Hydro concerning the subsidiary Meridian Technologies

Inc. (held 51% by the Teksid Group and 49% by the Norsk Hydro Group). In particular, should there be a strategic deadlock in the

management of the company (namely in all those cases in which a unanimous vote in favor is not reached by the directors on the

board as regards certain strategic decisions disciplined by the contract between the stockholders), the following rights would arise:

❚Put Option of Norsk Hydro with Teksid on the 49% holding: the sale price would be commensurate with the initial investment

made in 1998, revalued pro rata temporis, net of dividends paid.

❚Call Option of Teksid with Norsk Hydro on the 49% holding (exercisable whenever Norsk Hydro renounces its right to exercise the

Put Option described above): the sale price would be the higher value between the initial investment made by Norsk Hydro in

1998, calculated according to the criteria expressed previously, and 140% of the Fair Market Value (in this regard, an increase of 2%

per year is established in the event the option is exercised from the start of 2008 until 2013, thus up to 150% of the relative value).

It should be pointed out that so far the conditions that would give rise to the strategic deadlock are considered to be quite remote.

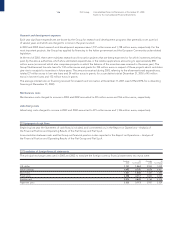

Fiat S.p.A. is subject to a put contract with Renault (in reference to the original investment of 33.5% in Teksid, now 19.52%).

In particular, Renault would acquire the right to exercise a sale option on the treasury stock to Fiat, in the following cases:

❚in the event of nonfulfilment in the application of the protocol of the agreement and admission to receivership or any other

redressment procedure:

❚in the event Renault’s investment in Teksid falls below 15% or Teksid decides to invest in a structural manner outside the foundry

sector:

❚should Fiat be the object of the acquisition of control by another car manufacturer.

The exercise price of the option is established as follows:

❚for 6.5% of the share capital of Teksid, the initial investment price increased pro rata temporis;

❚for the remaining amount of share capital of Teksid, the share of the accounting net equity.