Chrysler 2003 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

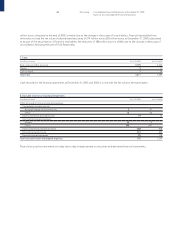

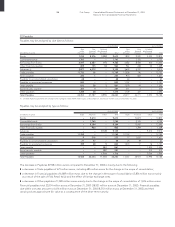

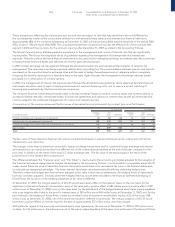

The major bond issues outstanding at December 31, 2003 are the following:

Amount

outstanding

(in millions) Currency Face value Coupon Maturity in euros

Euro Medium Term Notes:

Fiat Fin. North America USD 69 5.020% Oct. 19, 2004 55

Fiat Fin. North America EUR 100 5.125% Feb. 21, 2005 70

Fiat Finance & Trade EUR 155 Indexed July 5, 2005 155

Fiat Finance & Trade EUR 130 Indexed July 5, 2005 130

Fiat Finance & Trade EUR 500 6.125% Aug, 1, 2005 500

Fiat Finance & Trade EUR 300 6.125% Aug, 1, 2005 300

Fiat Finance & Trade GBP 125 7.000% Oct. 19, 2005 170

Fiat Finance & Trade (1) EUR 1,700 5.750% May 25, 2006 1,700

Fiat Finance Canada EUR 100 5.800% July 21, 2006 81

Fiat Finance & Trade (1) EUR 500 5.500% Dec. 13, 2006 500

Fiat Finance & Trade (1) EUR 1,000 6.250% Feb. 24, 2010 1,000

Fiat Finance & Trade (1) EUR 1,300 6.750% May 25, 2011 1,300

Fiat Finance & Trade (1) EUR 617 (2) (2) 617

Others (3) 475

Total Euro Medium Term Notes 7,053

Convertible bonds:

Fiat Fin. Luxembourg (4) USD 2,229 3.250% July 9, 2004 1,765

Total Convertible bonds 1,765

Other bonds:

Fiat Finance & Trade (1) EUR 1,000 3.750% Mar. 31, 2004 936

Fiat Finance & Trade JPY 40,000 1.500% June 27, 2005 296

CASE LLC USD 243 7.250% Aug, 1, 2005 193

CASE CREDIT Corp. USD 127 6.750% Oct. 21, 2007 100

CNH Inc. USD 1,050 9.250% Aug. 1, 2011 831

CASE LLC USD 254 7.250% Jan. 15, 2016 201

Total Other bonds 2,557

Total bonds 11,375

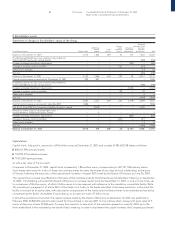

(1) Bonds listed on the “Mercato Obbligazionario Telematico” of the Italian stock exchange (EuroMot). Furthermore, the majority of the bonds issued by the Fiat Group are also listed on

the Luxembourg stock exchange.

(2) “Fiat Step-Up Amortizing 2001-2011” bonds repayable at face value in five equal annual installments each for 20% of the total issued“ (617 million euros) due beginning from the sixth

year (November 7, 2007) by reducing the face value of each bond outstanding by one-fifth. The last installment will be repaid on November 7, 2011. The bonds pay coupon interest

equal to: 4.40% in the first year (Nov. 7, 2002), 4.60% in the second year (Nov. 7, 2003), 4.80% in the third year (Nov. 7, 2004), 5.00% in the fourth year (Nov. 7, 2005), 5.20% in the fifth

year (Nov. 7, 2006), 5.40% in the sixth year (Nov. 7, 2007), 5.90% in the seventh year (Nov. 7, 2008), 6.40% in the eighth year (Nov. 7, 2009), 6.90% in the ninth year (Nov. 7, 2010), 7.40%

in the tenth year (Nov. 7, 2011).

(3) Bonds with amounts outstanding equal to or less than the equivalent of 50 million euros.

(4) Bonds convertible into General Motors Corp. common stock.

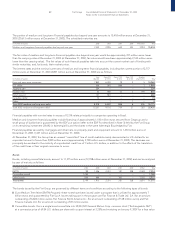

The Fiat Group intends to repay the issued bonds in cash at maturity by utilizing available liquid resources. To this end, available

liquidity (Cash and Other securities in Current assets) at the end of 2003 totals 7 billion euros. The Fiat Group also has available

unused committed credit lines for more than 2 billion euros.

Moreover, the companies in the Fiat Group may from time to time buy back bonds on the market that were issued by the Group also

for purposes of their cancellation. Such buy-backs, if made, will depend upon market conditions, the financial situation of the Group

and other factors which could affect such decisions.

Mandatory Convertible facility

Medium and long-term financial payables also include the 3 billion euros Mandatory Convertible facility stipulated in execution of

the Framework Agreement, dated May 27, 2002, with Capitalia, Banca Intesa, SanPaolo IMI and Unicredito Italiano (Money Lending

Banks) for the purpose of providing the Fiat Group with the financial support it needs to implement its strategic and industrial plans.

The facility was secured on September 24, 2002 from a syndicate of banks, including the Money Lending Banks, in which BNL, Monte

dei Paschi di Siena, ABN Amro, BNP Paribas, Banco di Sicilia and Banca Toscana (hereinafter “the Banks”) also participated. The

main features of the Mandatory Convertible facility are listed in the following paragraphs.