Chrysler 2003 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

These transactions, reflecting the notional principal amount, are not subject to risks that may derive from the non-fulfillment by

the counterparties insofar as the contracts are entered into with several primary national and international financial institutions.

Approximately 48% of the contracts outstanding at December 31, 2003 will expire during 2004 and the remainder in the period 2005-

2022, of which 13% will expire after 2008. The consolidated statement of operations includes the effects both of the contracts that

expired in 2003 and the provisions for the contracts expiring after December 31, 2003, as stated in the Accounting Policies.

The Group’s financial policy attaches particular importance to the management and control of financial risks that can significantly

impact profits. The Group has adopted a series of guidelines regarding the management of exchange rate and interest rate

exposure. The policy allows derivative financial instruments to be used only for managing exchange and interest rate risks connected

to balance sheet flows and assets and liabilities, and not for speculative purposes.

In 2003, foreign exchange risk management followed the aforementioned policy and maintained the character of selective risk

management. The reduction in exchange exposure, substantially originating from the positive balance between exports and imports,

was based on the expected trend in exchange rates and the need to hedge the exchange levels of reference without completely

foregoing the benefits deriving from a favorable trend in the rates. Again this year, the management of exchange risks was based

principally on a combination of currency options.

In 2003, the management of interest rate exposure also followed the aforementioned guidelines which state that derivative financial

instruments should be used to reach a fixed exposure level and minimize financing costs, and to ensure a correct matching of

financing and investments by the financial services companies.

The derivative financial instruments principally relate to foreign exchange forward contracts, currency swaps and currency options or,

as regards interest rate risks, interest rate swaps, forward rate agreements and options on interest rates, as well as interest rate and

currency swaps for the combined management of currency and interest rate risks.

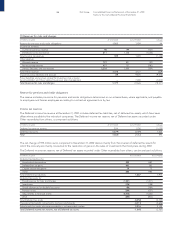

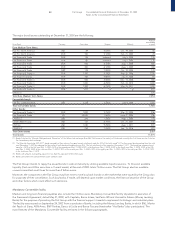

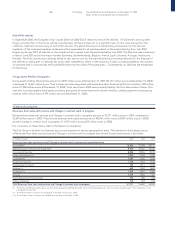

A comparison of the carrying values and the fair values of derivative financial instruments by contract type is set forth below:

At 12/31/2003 At 12/31/2002

Carrying Fair Carrying Fair

(in millions of euros) value value Difference value value Difference

Foreign exchange risk management instruments (3)59 62 75 118 43

Interest rate risk management instruments 138 319 181 107 343 236

Foreign exchange and interest rate risk management instruments 174 176 2 99 84 (15)

Equity swaps (1)439 440 –2323

Total 308 993 685 281 568 287

The fair value of these derivative financial instruments was estimated based on year-end market prices for instruments with similar

characteristics and maturities.

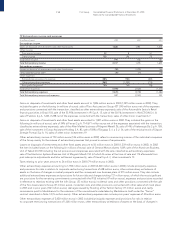

The changes in the financial statement amounts for foreign exchange transactions and for combined foreign exchange and interest

rate transactions can mainly be ascribed to a different mix of the outstanding transactions at the end of the year compared to the

prior year, in addition to the trend of the euro/U.S. dollar exchange rate. The fair value of the equity swaps is the result of the

positive trend in the General Motors share price.

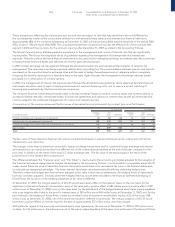

The difference between the “Carrying value” and “Fair Value” is mainly due to the accounting principles adopted for the valuation of

the financial instruments designated as hedges. As disclosed in the Accounting Policies, it is not possible to completely adopt IAS 39

under current Italian law since all derivative financial instruments would have to be recorded at fair value in the financial statements,

including those designated as hedges. The latter, instead, have been valued symmetrically with the underlying hedged item.

Therefore, where the hedged item has not been adjusted to fair value in the financial statements, the hedging financial instruments

have also not been adjusted. Similarly, where the hedged item has not yet been recorded in the financial statements (hedging of

future flows), the valuation of the hedging instrument at fair value is deferred.

At December 31, 2003, the integral adoption of IAS 39 would have had an effect on the balance sheet, on the one hand, for the

adjustment of derivative financial instruments to arrive at fair value with a positive effect of 685 million euros (a positive effect of 287

million euros at December 31, 2002), and, on the other hand, for the adjustment of the hedged balance sheet items (mainly payables)

with a net negative effect (due to the trend in interest rates) of 262 million euros (405 million euros at December 31, 2002) and, for the

part relating to the hedging of future flows, a lower accumulated value of reserves in stockholders’ equity of 22 million euros (188

million euros at December 31, 2002), net of the amount set aside for deferred income taxes. The integral adoption of IAS 39 would

have led to positive effects on the net result for the year of approximately 272 million euros, net of tax charges.

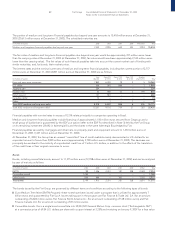

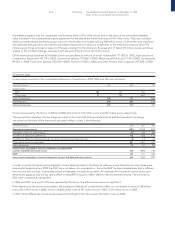

With particular regard to the previously mentioned equity swap agreements, the amount at December 31, 2003 of 978 million euros

includes, for 916 million euros, the notional amount of the equity swaps stipulated at the same time as the sale of the General Motors