Chrysler 2003 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 Fiat Group Consolidated Financial Statements at December 31, 2003

Notes to the Consolidated Financial Statements

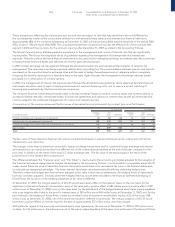

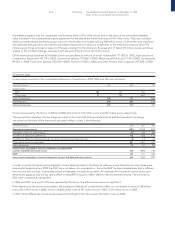

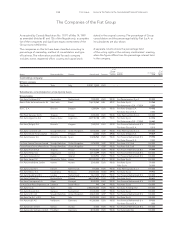

19 Extraordinary income and expenses

(in millions of euros) 2003 2002 2001

Extraordinary income

Gains on disposals of investments and other fixed assets 1,826 1,081 1,515

Other income:

Prior period income 32 851

Other income 159 146 79

Total Other income 191 154 130

Total Extraordinary income 2,017 1,235 1,645

Extraordinary expenses

Losses on disposal of investments and other fixed assets (50) (1,239) (56)

Taxes relating to prior years (26) (79) (18)

Other expenses:

Extraordinary provisions to reserves (585) (980) (483)

Other extraordinary expenses (969) (1,400) (713)

Prior period expenses (40) (40) (16)

Total Other expenses (1,594) (2,420) (1,212)

Total Extraordinary expenses (1,670) (3,738) (1,286)

Total Extraordinary income and expenses 347 (2,503) 359

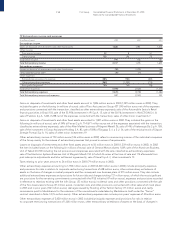

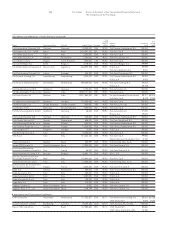

Gains on disposals of investments and other fixed assets amount to 1,826 million euros in 2003 (1,081 million euros in 2002). They

include the gains on the following (in millions of euros): sale of Toro Assicurazioni Group 427 (390 million euros net of the expenses

and provisions connected with the transaction, classified as other extraordinary expenses), sale of the Automobile Sector’s Retail

financing activities in Brazil 103, sale of the 55.95% investment in IPI S.p.A. 15, sale of the 50.1% investment in IN ACTION S.r.l. 8,

sale of FiatAvio S.p.A. 1,266 (1,258 net of the expenses connected with the transaction), sales of other minor investments 7.

Gains on disposals of investments and other fixed assets amounted to 1,081 million euros in 2002. They included the gains on the

following (in millions of euros): sale of 34% di Ferrari S.p.A. 714 (671 million euros net of the expenses associated with the transaction,

classified as extraordinary expenses), sale of the After Market business of Magneti Marelli 26, sale of 14% of Italenergia Bis S.p.A. 189,

sale of the investment in Europ Assistance Holding S.A. 83, sale of 50% of Targasys S.r.l. a S.U. 36, sale of the residual stock of Sinport

Sinergie Portuali S.p.A. 14, sales of other minor investments 19.

Other extraordinary income of 159 million euros (146 million euros in 2002) refers to nonrecurring income of the individual companies

of the Group mainly for the release of extraordinary reserves that proved in excess of requirements.

Losses on disposals of investments and other fixed assets amount to 50 million euros in 2003 (1,239 million euros in 2002). In 2002

the item included losses on the following (in millions of euros): sale of General Motors shares 1,049, sale of the Aluminum Business

Unit of Teksid 24 (100 including the net provisions and expenses associated with the sale, classified as extraordinary expenses),

sale of the Electronic Systems Business Unit of Magneti Marelli 150 (of which 36 arose at the time of sale and 114 afterwards from

post-sales price adjustments and later settlement agreements), sale of Viasat S.p.A. 3, other investments 13.

Taxes relating to prior years amount to 26 million euros in 2003 (79 million euros in 2002).

Other extraordinary expenses amounting to 1,594 million euros in 2003 (2,420 million euros in 2002) include principally expenses

and provisions for risks in relation to corporate restructuring transactions of 658 million euros, other extraordinary writedowns of

assets on the basis of changes in market prospects and the consequent new business plans of 215 million euros. They also include

additional extraordinary expenses and provisions for future risks and charges totaling 721 million euros, of which the most significant

are: provisions for the remaining commitments connected with the IPSE initiative (47 million euros), expenses and provisions recorded

in reference to relations existing with the Ixfin Group (53 million euros), incidental costs and other provisions connected with the sale

of the Toro Assicurazioni Group (37 million euros), incidental costs and other provisions connected with other sales which took place

in 2003 and in prior years (102 million euros), damages caused by flooding at the Termoli factory (71 million euros) and, lastly,

commissions paid to Mediobanca for the extension of the commitments undertaken by Mediobanca itself under the “Ferrari”

contract described in Note 14 (16 million euros). Other extraordinary expenses also include prior years’ expenses of 40 million euros.

Other extraordinary expenses of 2,420 million euros in 2002 included principally expenses and provisions for risks in relation

to corporate restructuring transactions of 1,026 million euros, other extraordinary writedowns of assets on the basis of changes in