Chrysler 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A

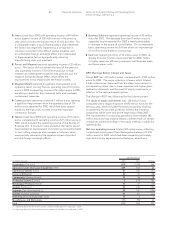

Intangible Fixed Assets

Intangible fixed assets (start-up and expansion costs, goodwill,

construction in progress and others) amount to 3,724 million

euros, 1,476 million euros less than the 5,200 million euros

reported at the end of 2002. Over half of the decrease is

attributable to the disposals of activities carried out during

2003, as well as to the reduction in value of goodwill due to

changes in foreign exchange rates.

The investments made during the fiscal year, for a total of

527 million euros (603 million euros in 2002), were almost totally

offset by amortization for the period, which totaled 519 million

euros (595 million euros in 2002).

Property, Plant and Equipment

Property, plant and equipment totaled 9,675 million euros

(12,106 million euros at December 31, 2002). The decrease

(-2,431 million euros) largely reflects the changes in the scope

of consolidation (sale of Fraikin, FiatAvio S.p.A., and the Toro

Assicurazioni Group), variations in foreign exchange rates and

writedowns during the year.

Overall investments in fixed assets totaled 2,011 million euros

(2,771 million euros in 2002), including those in long-term leases

which declined by 486 million euros, from 844 million euros in

2002 to 358 million euros in 2003. This reduction is mainly

attributable to the disposal of Fraikin, while investments net

of long term leases were impacted by the deconsolidation of

FiatAvio S.p.A., the Toro Assicurazioni Group, and the Teksid

Aluminum Business Unit.

In 2003 depreciation of property, plant and equipment totaled

1,750 million euros (2,019 million euros in 2002).

At December 31, 2003, accumulated depreciation and

writedowns totaled 17,366 million euros, corresponding to

64% of gross fixed assets, compared with approximately 60%

at the end of 2002.

Financial Fixed Assets

Financial fixed assets totaled 3,950 million euros, compared

with 6,638 million euros at December 31, 2002. The significant

reduction of 2,688 million euros is mainly due to the effect of the

deconsolidation of the Toro Assicurazioni Group, which was only

partially offset by the increase mainly stemming from the equity

investments in Fidis Retail Italia (49% held by the Automobile

Sector following the sale of 51% of the stake) and Naveco (which

was consolidated according to the proportional method until

2002).

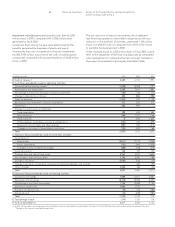

Financial Assets not held as Fixed Assets

Financial assets not held as fixed assets totaled 120 million

euros, 5,974 million euros less than the 6,094 million euros at the

end of 2002, following disposal of the Toro Assicurazioni Group

and consequent deconsolidation of its activities.

Net Deferred Tax Assets

Net deferred tax assets (deferred tax assets net of deferred

tax reserve) totaled 1,668 million euros at December 31, 2003,

compared with 2,263 million euros at the end of 2002. The

decrease with respect to 2002 amounted to 595 million euros,

mainly attributable to the utilization of tax prepayments whose

recovery was primarily connected to the realization of capital

gains on the disposal of equity investments, which occurred

in 2003.

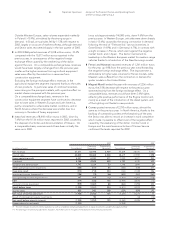

Working Capital

The Group’s working capital increased by 639 million euros

to a negative 2,134 million euros, up from the negative 2,773

million euros reported at the end of 2002. On a comparable

basis the increase would have been 872 million euros.

The following table illustrates the composition of working

capital in the two fiscal years:

(in millions of euros) At 12.31.2003 At 12.31.2002 Change

Net inventories 6,912 7,050 (138)

Trade receivables 4,553 5,784 (1,231)

Trade payables (12,588) (13,267) 679

Other receivables / (payables) (1,011) (2,340) 1,329

Working capital (2,134) (2,773) 639

An analysis of the changes affecting the main components

of working capital is provided below.

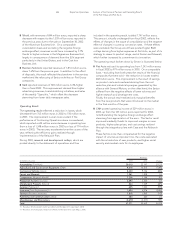

Net inventories (raw materials, finished products, and work

in progress), net of advances received for contract work in

progress, totaled 6,912 million euros, against 7,050 million euros

at December 31, 2002. The decrease is mainly attributable to

changes in the scope of consolidation during the fiscal year

(principally the sale of FiatAvio S.p.A.). On a comparable basis,

inventories were 389 million euros higher due to the increase in

Fiat Auto stock connected with the introduction of new models.

Trade receivables totaled 4,553 million euros, 1,231 million

euros less than the 5,784 million euros reported at the end of

2002. The change in the scope of consolidation entailed a

reduction of 1,106 million euros.

Trade payables totaled 12,588 million euros compared with the

13,267 million euros at December 31, 2002. The decrease of 679

million euros is entirely attributable to changes in the scope of

consolidation.

The negative balance of other receivables/(payables), which

also includes trade accruals and deferrals, improved from -2,340

million euros at December 31, 2002 to -1,011 million euros. The

lower negative balance by 1,329 million euros includes 715

million euros stemming from changes in the scope of

consolidation.