Chrysler 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A

Cash and cash equivalents collected by the centralized cash

management during its activity have been recorded in the item

Financial payables net of intersegment activities in the Industrial

Activities column. However, funds that were transferred to other

Activities, and in particular Financial Activities, were posted net

of the relative intersegment relationships, as shown in the table

below.

During 2003, the Group strengthened its financial structure

by reducing net indebtedness (financial payables net of

intersegment activities, cash and marketable securities)

from 24,594 million euros to 15,542 million euros.

Cash and marketable securities increased by a total of 2,004

million euros. At December 31, 2002 the balance included

cash and marketable securities of companies that have been

sold (the Toro Assicurazioni Group in particular). If cash

and marketable securities of Industrial Activities alone are

considered (as stated previously, Industrial Activities include

companies that operate centralized cash management activities

for the Group), the increase amounted to 3,659 million euros

(from 3,132 million euros at December 31, 2002 to 6,791

million euros at December 31, 2003).

When the changes in the Group’s financial structure over

the year are analyzed, it must be remembered that:

❚deconsolidation of the sold companies (Discontinuing

Operations) caused a reduction in net indebtedness of

approximately 4.4 billion euros with respect to December

31, 2002;

❚Industrial Activities show a net indebtedness of

approximately 5.1 billion euros, down from the 7.4 billion

euros in the previous year in consequence of the proceeds

from disposals and the capital increase at Fiat S.p.A., net

of operating requirements during the period;

❚Financial Activities show a reduction in the financed portfolio

and corresponding indebtedness. This reduction is partially

due to the effects of conversion of the portfolios denominated

in currencies other than the euro and partially reflects an

actual reduction in the outstanding balance of financing,

in consequence of lower levels of activity.

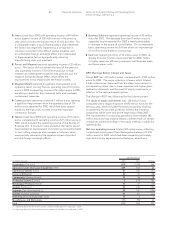

At 12.31.2003 At 12.31.2002

Industrial Financial Discontinuing Industrial Financial Discontinuing

(in millions of euros) Consolidated Activities Activities Operations Consolidated Activities Activities Operations

Financial payables net of intersegment activities (22,034)(11,531)(9,909)(594) (28,923) (10,050) (12,630) (6,243)

Accrued financial expenses (593)(416)(171)(6) (785) (555) (108) (122)

Prepaid financial expenses 85 68 17 – 118 63 19 36

Cash 3,211 3,121 77 13 3,489 2,746 153 590

Securities 3,789 3,670 119 – 1,507 386 338 783

Net Indebtedness (15,542)(5,088)(9,867)(587) (24,594) (7,410) (12,228) (4,956)

Financial receivables and lease contracts receivable 12,576 2,114 9,715 747 21,406 2,502 10,942 7,962

Accrued financial income 301 298 3 – 543 351 32 160

Deferred financial income (363)(65)(195)(103) (1,135) (70) (211) (854)

Net Financial Position (3,028)(2,741)(344)57 (3,780) (4,627) (1,465) 2,312

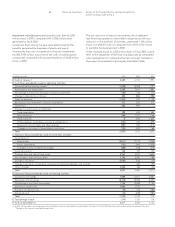

At 12.31.2003 At 12.31.2002

Industrial Financial Discontinuing Industrial Financial Discontinuing

(in millions of euros) Consolidated Activities Activities Operations Consolidated Activities Activities Operations

Short-term financial payables to others 6,616 5,150 1,187 279 8,310 4,220 1,954 2,136

Long-term financial payables to others 15,418 14,480 634 304 20,613 17,378 1,216 2,019

(Intersegment financial receivables) –(8,459)(355)(5) – (12,547) (489) (514)

Intersegment financial payables – 360 8,443 16 – 999 9,949 2,602

Financial payables net of

intersegment activities 22,034 11,531 9,909 594 28,923 10,050 12,630 6,243

Breakdown of net indebtedness and net financial position by Activity Segment