Chrysler 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A

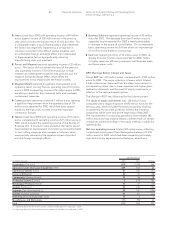

❚Iveco closed fiscal 2003 with operating income of 81 million

euros, against income of 102 million euros in the previous

year, which included the positive result of sold activities. On

a comparable basis, it would have posted a slight decrease:

the Sector was negatively impacted by a contraction in

volumes connected to the difficult market situation, and

an unfavorable foreign exchange effect. Iveco responded

to these negative factors by significantly reducing

manufacturing costs and overhead.

❚Ferrari and Maserati reported operating income of 32 million

euros. The Sector did not achieve the level of the previous

year (operating income of 70 million euros) due to high

research and development costs for new products and the

negative foreign exchange effect, which offset the

improvement in mix realized with the Ferrari models.

❚Magneti Marelli reported a significant improvement in its

operating result, moving from an operating loss of 16 million

euros in 2002 to operating income of 32 million euros in 2003,

benefiting in particular from materials costs and overhead

containment measures.

❚Comau posted operating income of 2 million euros, realizing

a significant improvement from the operating loss of 101

million euros reported for 2002, which had been caused

mainly by the high costs incurred on several important

contracts in Europe.

❚Teksid closed fiscal 2003 with operating income of 12 million

euros, compared with operating income of 27 million euros in

2002, which included the operating income of the Aluminum

Business Unit. If this factor were excluded, the Sector would

have realized an improvement of 2 million euros mainly thanks

to cost cutting measures and increases in volumes, which

were partially reduced by the negative impact of product

mix and foreign exchange effects.

❚Business Solutions reported operating income of 45 million

euros for 2003. The decrease from the 67 million euros in

operating income reported for 2002 is mainly attributable

to changes in the scope of consolidation. On a comparable

basis, operating income would have shown an improvement

of 6 million euros thanks to cost savings.

❚Itedi had operating income of 10 million euros in 2003, up

sharply from the 3 million euros reported for 2002, thanks

to higher revenues, efficiency measures in all business areas,

and lower paper costs.

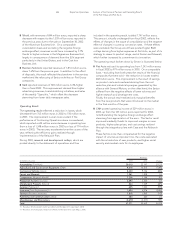

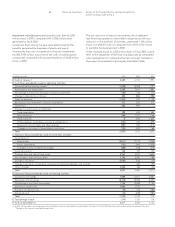

EBIT (Earnings Before Interest and Taxes)

Group EBIT was -319 million euros, compared with -3,955 million

euros for 2002. The major reduction in losses, which totaled

3,636 million euros, stemmed from the sharp improvement in

non-operating items, due to lower expenses and higher gains

realized on disposals, and the result of equity investments, in

addition to the reduced operating loss.

The change in EBIT was influenced by the following items:

The result of equity investments was -156 million euros,

compared with a negative balance of 690 million euros for the

previous year, which included the losses incurred by marking

to market equity securities portfolios held by the insurance

companies, which were sold at the beginning of May 2003.

The improvement in continuing operations alone totaled 182

million euros and was realized thanks to better results of certain

companies valued according to the equity method, in particular

Italenergia Bis.

Net non-operating income totaled 347 million euros, reflecting

a significant improvement from the negative balance of 2,503

million euros for 2002, which had been caused by particularly

high restructuring expenses and writedowns, as well as a

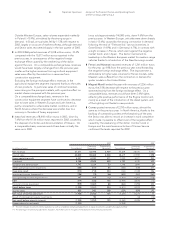

Operating Result

(in millions of euros) 2003 2002 Change

Automobiles (Fiat Auto) (979) (1,343) 364

Agricultural and Construction Equipment (CNH) 229 163 66

Commercial Vehicles (Iveco) 81 102 (21)

Ferrari and Maserati 32 70 (38)

Components (Magneti Marelli) 32 (16) 48

Production Systems (Comau) 2(101) 103

Metallurgical Products (Teksid) 12 27 (15)

Aviation (FiatAvio) (*) 53 210 (157)

Insurance (Toro Assicurazioni) (**) 44 147 (103)

Services (Business Solutions) 45 67 (22)

Publishing and Communications (Itedi) 10 37

Miscellaneous and Eliminations (71) (91) 20

Total (510) (762) 252

(*) Operating Result for the Aviation Sector is shown until the date of its sale (July 1, 2003).

(**) Operating Result for the Insurance Sector is shown until the date of its sale (May 2, 2003).