Chrysler 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 Report on Operations

INTRODUCTION

The Industrial and Financial Relaunch Plan based on refocusing

the Fiat Group on automotive industrial activities was approved

in June 2003.

Significant measures were taken to restore balance to the

financial structure of the Group, among which are the capital

increase carried out in July 2003 at Fiat S.p.A., subscription of

which generated an influx of new stockholders’ equity of

1,836 million euros, and the sale of activities not considered

strategic.

Consistently with this strategy, the most important transactions

modifying the scope of consolidation are reviewed below:

❚In the first quarter of 2003, Iveco sold the activities of Fraikin

to Eurazeo. The operations of Fraikin, which specializes in the

long-term vehicle leasing business, were deconsolidated as

of the beginning of 2003.

❚In the first quarter of 2003, Business Solutions sold

approximately 56% of IPI S.p.A. to the Zunino Group. IPI

S.p.A., which was deconsolidated as of January 1, 2003,

operates in the field of large property improvement,

management, and sales.

❚Fiat Auto Holdings’ retail financing activities in Brazil were

sold to the Itaù banking group at the end of March 2003

and deconsolidated from that date.

❚The agreement to sell the Toro Assicurazioni Group to

the DeAgostini Group was signed on May 2, 2003 and the

relevant operations were deconsolidated as of the same date.

❚On May 27, 2003, as part of the agreement signed by Fiat

and Capitalia, Banca Intesa, Sanpaolo IMI and Unicredito on

March 11, 2003, and following approval by the competent

authorities, the first part of the transaction for the sale by Fiat

to the Banks of a majority interest (51%) of Fidis Retail Italia

was concluded. Fidis Retail Italia is the company that controls

the European activities of Fiat Auto Holdings in the field of

retail consumer financing for automobile purchases.

The sale to Fidis Retail Italia of the equity investments in

the other financial companies covered by the agreement

was finalized in October 2003, with the sole exception of

the company active in the United Kingdom.

❚In execution of the contract signed on July 1, 2003 and

after having met the conditions precedent, the sale of the

aerospace activities of FiatAvio S.p.A. to Avio Holding S.p.A.,

a company 70% owned by The Carlyle Group and 30% by

Finmeccanica S.p.A., was finalized. Said activities were

deconsolidated effective from the date of the agreement.

Please note that Iveco has valued the activities of Naveco, the

50-50 joint venture with the Yueijin Group, according to the

equity method since January 1, 2003. This investment was

previously consolidated using the proportional method.

To provide clearer information on the Group’s operating

performance, the financial figures are illustrated and

commented in the following chapter, “Financial Position

and Operating Results by Activity Segment” broken

down according to Industrial Activities, Financial Activities,

and Discontinuing Operations.

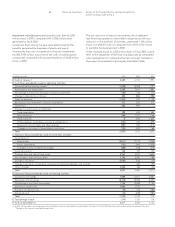

FINANCIAL POSITION AND OPERATING RESULTS

OF THE FIAT GROUP

Operating Performance

Although it continued to operate in a difficult environment

characterized by market stagnation and appreciation of the

euro, the Group improved its own economic indicators in line

with the targets set in the Relaunch Plan. Losses decreased

significantly, particularly in terms of the performance of

continuing operations – those activities that are destined to

remain within the scope of consolidation. The results achieved

by the Group reflected the major cost savings deriving from the

measures envisaged in the Relaunch Plan and the gains realized

upon disposal of activities, although it had to face the negative

effect of restructuring expenses and writedowns, as well as other

non-operating expenses and provisions.

Highlights of Group operating performance are illustrated

below. For a more detailed analysis, see the section

“Operating Performance – Sectors of Activity”.

Net Revenues

Fiat Group net revenues, including changes in contract work

in progress, totaled 47,271 million euros, reflecting a 15.1%

decrease from the previous year, largely due to the disposal

of activities. If continuing operations alone are considered –

excluding the revenues of businesses sold in 2003 from the

values for both fiscal years – the reduction would have been

7.3%. The negative foreign exchange effect caused by

appreciation of the euro against other currencies and

contraction in the volumes of Fiat Auto were the principal

causes of this change.

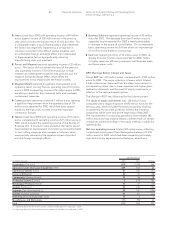

Revenues broken down by Sector are illustrated below:

❚Fiat Auto reported revenues of 20,010 million euros for 2003,

9.6% less than the 22,147 million euros reported in 2002 due

to the contraction in sales volumes and disposal of retail

financing activities (decrease of approximately 8% on a

comparable basis). Fiat Auto sold a total of approximately

1,700,000 automobiles and light commercial vehicles, down

8.8% from 2002.

In Western Europe, where 1,179,000 units were sold, the

decrease was 9.4% with respect to the previous year. The

main causes for this downturn were persistent softness on

its principal markets, growing competitive pressures, and

anticipation leading up to the introduction of new products.

The new models came onto the market only at the end of

2003 and thus the benefits deriving from their sale were

only marginal. On the major Western European markets,

decreases were reported in France (-16.3%) and in Italy

(-11.5%), in contrast with the positive performance of

sales in Great Britain and especially Spain (+14.8%).

Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A