Chrysler 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

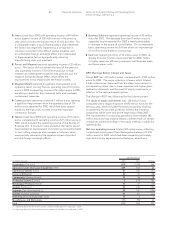

25 Report on Operations Analysis of the Financial Position and Operating Results

of the Fiat Group and Fiat S.p.A

❚Current liabilities include those to be settled in the normal

course of business, liabilities held primarily for trading

purposes, and those due within twelve months of the

year-end or which cannot be renegotiated in that period.

The following analysis provides the information necessary

for correlation with the principal items characteristic of

the industrial activities, such as working capital and net

invested capital.

For a more complete analysis of these items, please see

the Notes to the Consolidated Financial Statements.

Balance Sheet

The financial structure shows items on both the assets

and liabilities side, with a breakdown between current

and non-current assets and liabilities. Specifically:

❚In addition to cash and securities, current assets include

assets held for sale or consumption in the normal course

of business and thus comprise assets generated by financial

services, including assets under financial lease. Current assets

also include amounts which are expected to be received

within twelve months of the year-end.

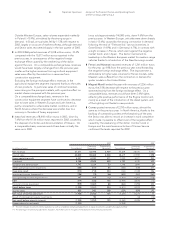

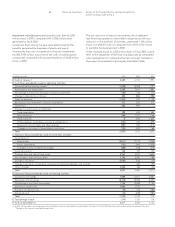

(in millions of euros) At 12.31.2003 At 12.31.2002

❚ASSETS

Intangible fixed assets 3,724 5,200

Intangible fixed assets 1,322 1,600

Goodwill 2,402 3,600

Property, plant and equipment 9,675 12,106

Property, plant and equipment 8,761 10,521

Operating leases 914 1,585

Financial fixed assets 3,950 6,638

Investments on behalf of life insurance policyholders who bear the risk – 6,930

Financial receivables held as fixed assets (*) 29 48

Deferred tax assets 1,879 3,499

Total Non-Current Assets 19,257 34,421

Net inventories (1) 6,912 7,050

Trade receivables 4,553 5,784

Other receivables 3,081 3,351

Financial assets not held as fixed assets 120 6,094

Finance lease contracts receivable (*) 1,797 2,947

Financial receivables from others (*) 10,750 18,411

Securities (*) 3,789 1,507

Cash (*) 3,211 3,489

Total Current Assets 34,213 48,633

Trade accruals and deferrals 407 579

Financial accruals and deferrals (*) 386 661

❚TOTAL ASSETS 54,263 84,294

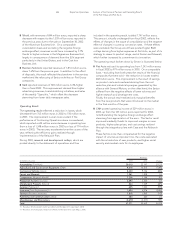

❚LIABILITIES AND STOCKHOLDERS’ EQUITY

Stockholders’ equity 7,494 8,679

Stockholders’ equity of the Group 6,793 7,641

Minority interest 701 1,038

Deferred income tax reserves 211 1,236

Reserves for risks and charges 5,168 15,390

Reserves for employee severance indemnities 1,313 1,609

Policy liabilities and accruals where the investment risk is borne by policyholders – 7,000

Long-term financial payables (*) 15,418 20,613

Total Non-Current Liabilities 22,110 45,848

Trade payables 12,588 13,267

Other payables 3,170 4,771

Short-term financial payables (2) (*) 6,616 8,310

Total Current Liabilities 22,374 26,348

Trade accruals and deferrals 1,329 1,499

Financial accruals and deferrals (*) 956 1,920

❚TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY 54,263 84,294

❚NET FINANCIAL POSITION (*) (3,028) (3,780)

(1) Net of advances received for contract work in progress (8,448 million euros at December 31, 2003 and 8,227 million euros at December 31, 2002).

(2) The item includes the 1,765-million-euro exchangeable bond payable in 2004.