Chrysler 2003 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

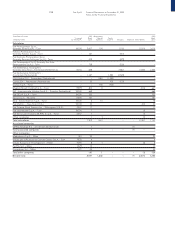

162 Fiat S.p.A. Financial Statements at December 31, 2003

Notes to the Financial Statements

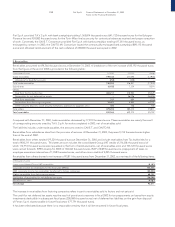

Again with reference to the “FIAT ordinary share warrants 2007”, Fiat reserved the right to pay the warrant holders in cash, starting on

January 2, 2007, in lieu of the shares to be issued (shares in exchange for warrants), for the difference between the arithmetic average

of the official market price of Fiat ordinary shares in December 2006 and the warrant exercise price, unless this difference exceeds the

maximum amount set and previously communicated by Fiat, in which case the holder of the warrants may opt to subscribe to the

shares in exchange for warrants.

The resolutions regarding capital increases to service the stock option plans (27,530 thousand euros) have been revoked since the

Board of Directors decided on June 26, 2003 to use ordinary treasury stock to be bought back for this purpose.

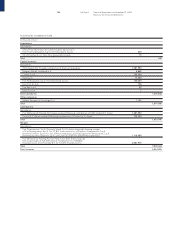

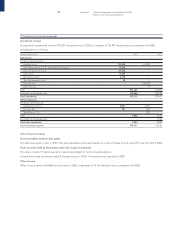

Additional paid-in capital

Additional paid-in capital totaled 278,962 thousand euros at December 31, 2003, reflecting a net decrease of 2,048,157 thousand

euros compared with December 31, 2002, in consequence of its being used to cover the loss for fiscal 2002 (2,052,621 thousand

euros), as resolved by the stockholders’ meeting of May 13, 2003. The decrease was partly compensated by the proceeds from the

sale of the option rights of the 2003 capital increase that were not exercised and which were sold on the stock market pursuant to

Article 2441, paragraph 3 Italian Civil Code, net of the amount paid for the option rights and warrants purchased to execute the

Board of Directors resolution of June 26, 2003.

Treasury stock valuation reserve

The treasury stock valuation reserve totaled 28,045 thousand euros at December 31, 2003, with a net increase of 7,670 thousand

euros from the prior year. The change comes from the difference between the increase of 12,746 thousand euros equal to the

countervalue of the stock purchased during 2003 and a decrease of 5,076 thousand euros for the writedown of the stock to market

value during the last month of the fiscal year.

Other reserves

Reserve for purchase of treasury shares

The reserve for purchase of treasury shares totaled 971,955 thousand euros at December 31, 2003, with a net decrease of 7,670

thousand euros from the prior year as a result of the transfer to the treasury stock valuation reserve of the equivalent amount of the

purchased shares (12,746 thousand euros), net of the transfer from the treasury stock valuation reserve of the amount corresponding

to the writedown of the stock to market value (5,076 thousand euros).

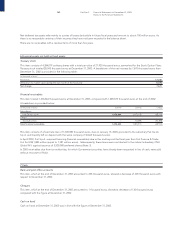

The table appearing at the end of the Notes to the Financial Statements provides a detailed breakdown of the tax status of the

various components of stockholders’ equity.